UAE Real Estate Market News

Insights & Snapshots

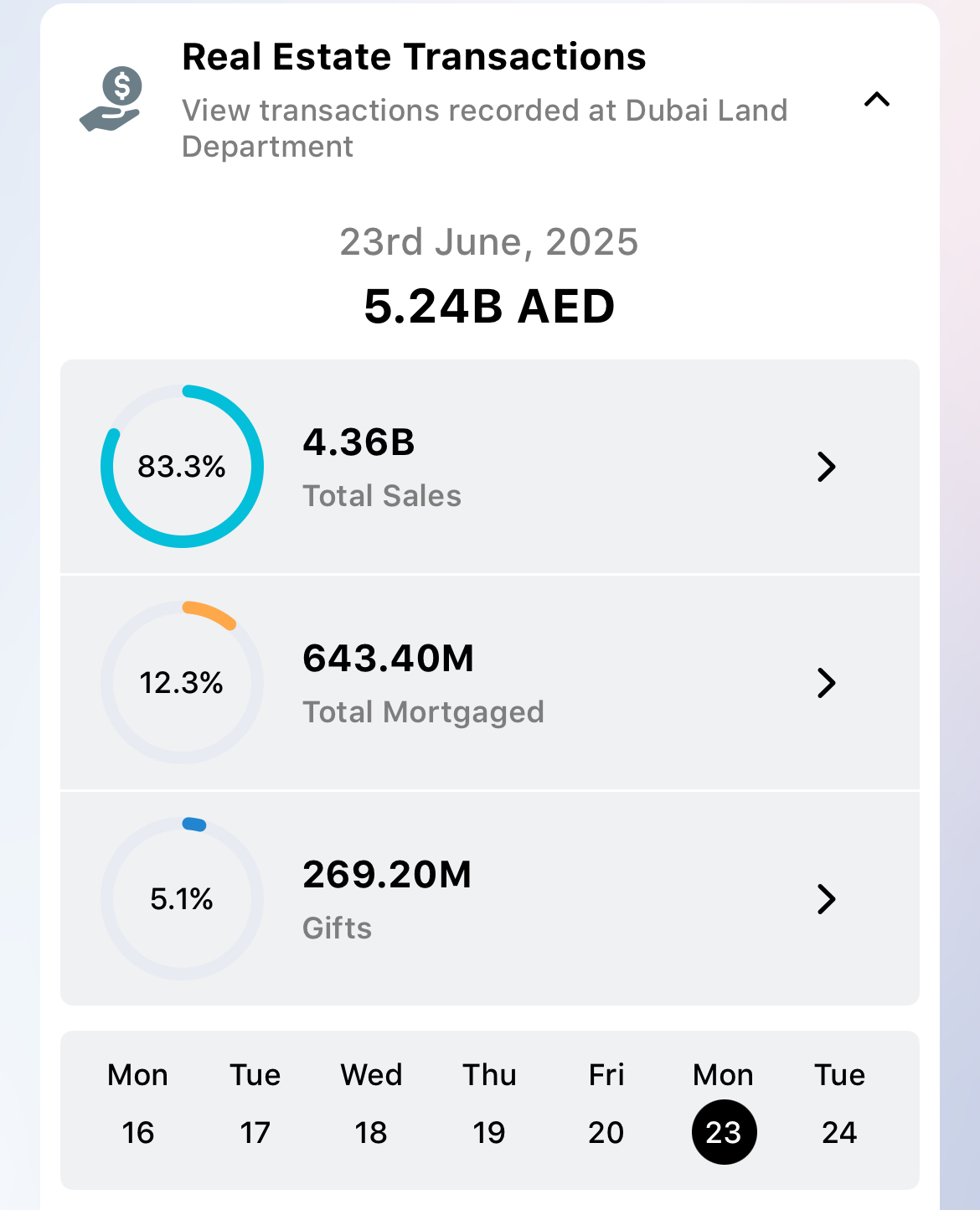

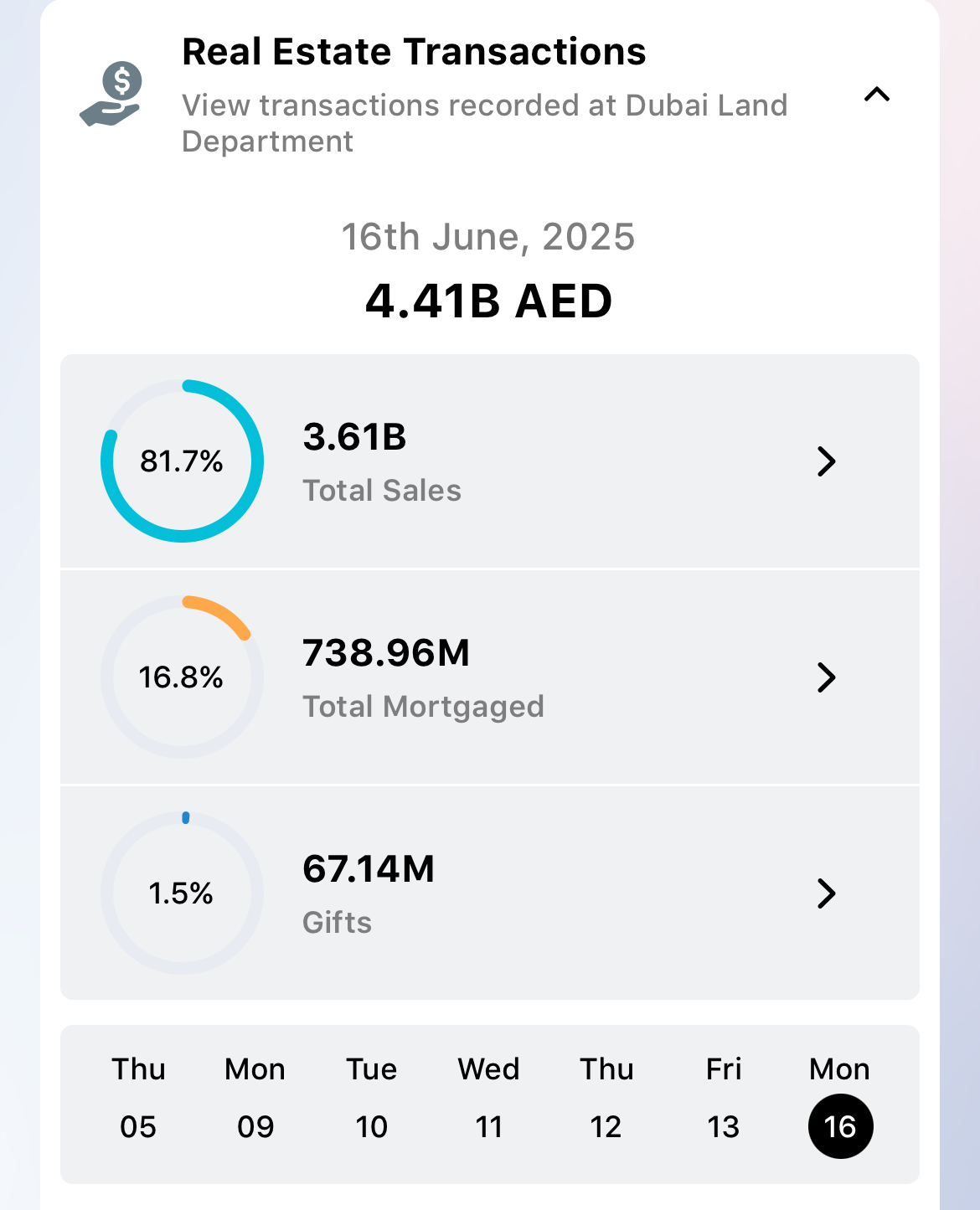

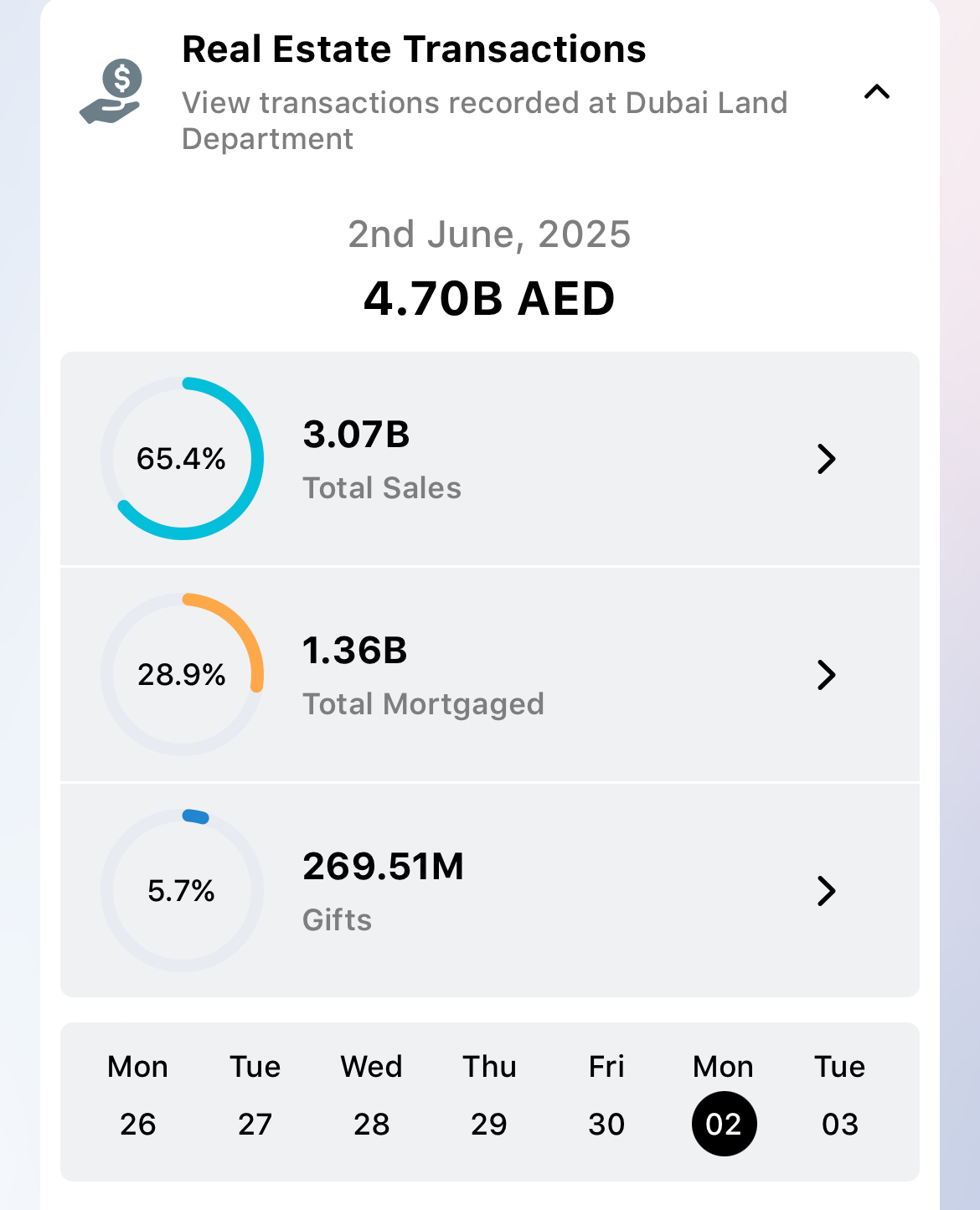

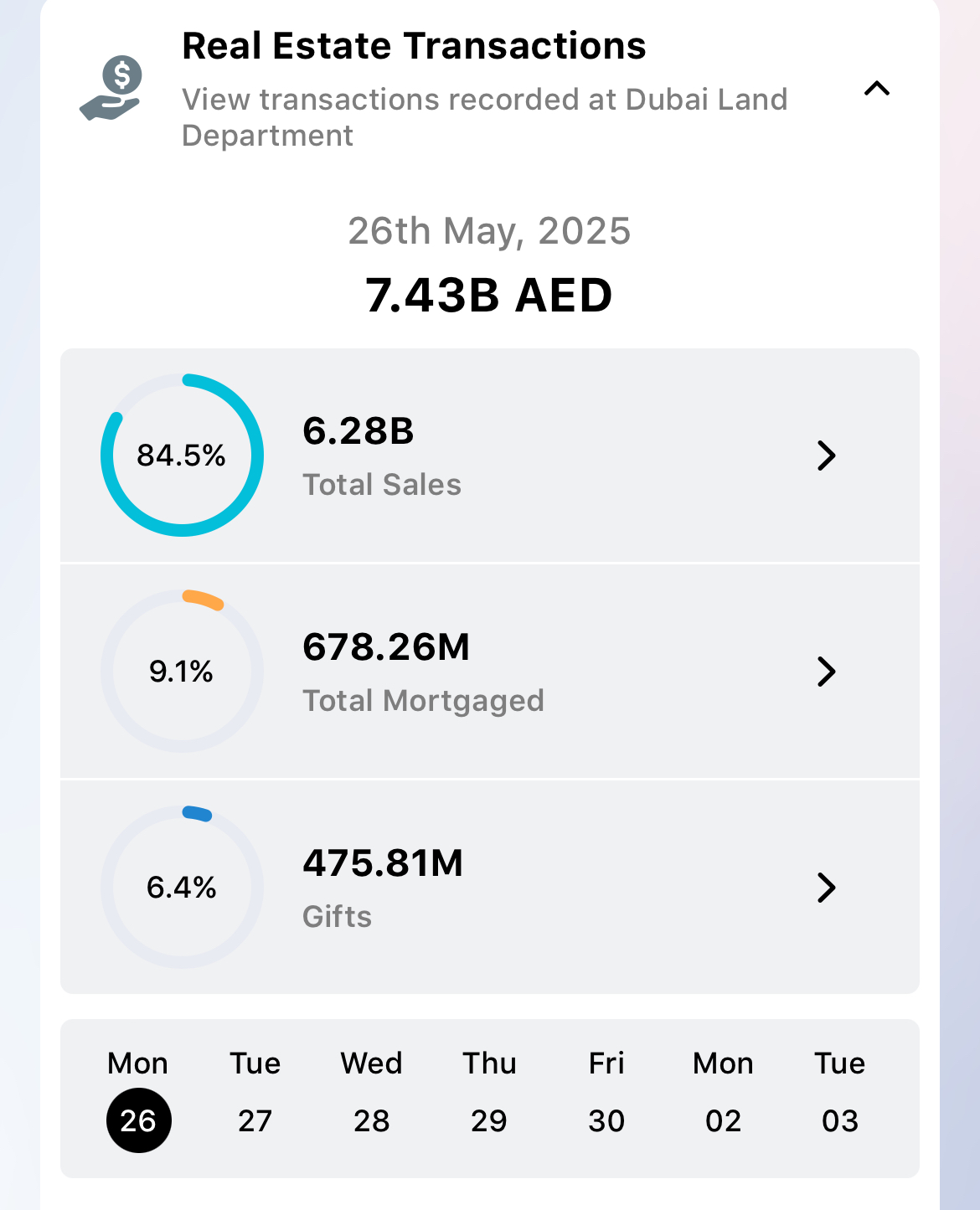

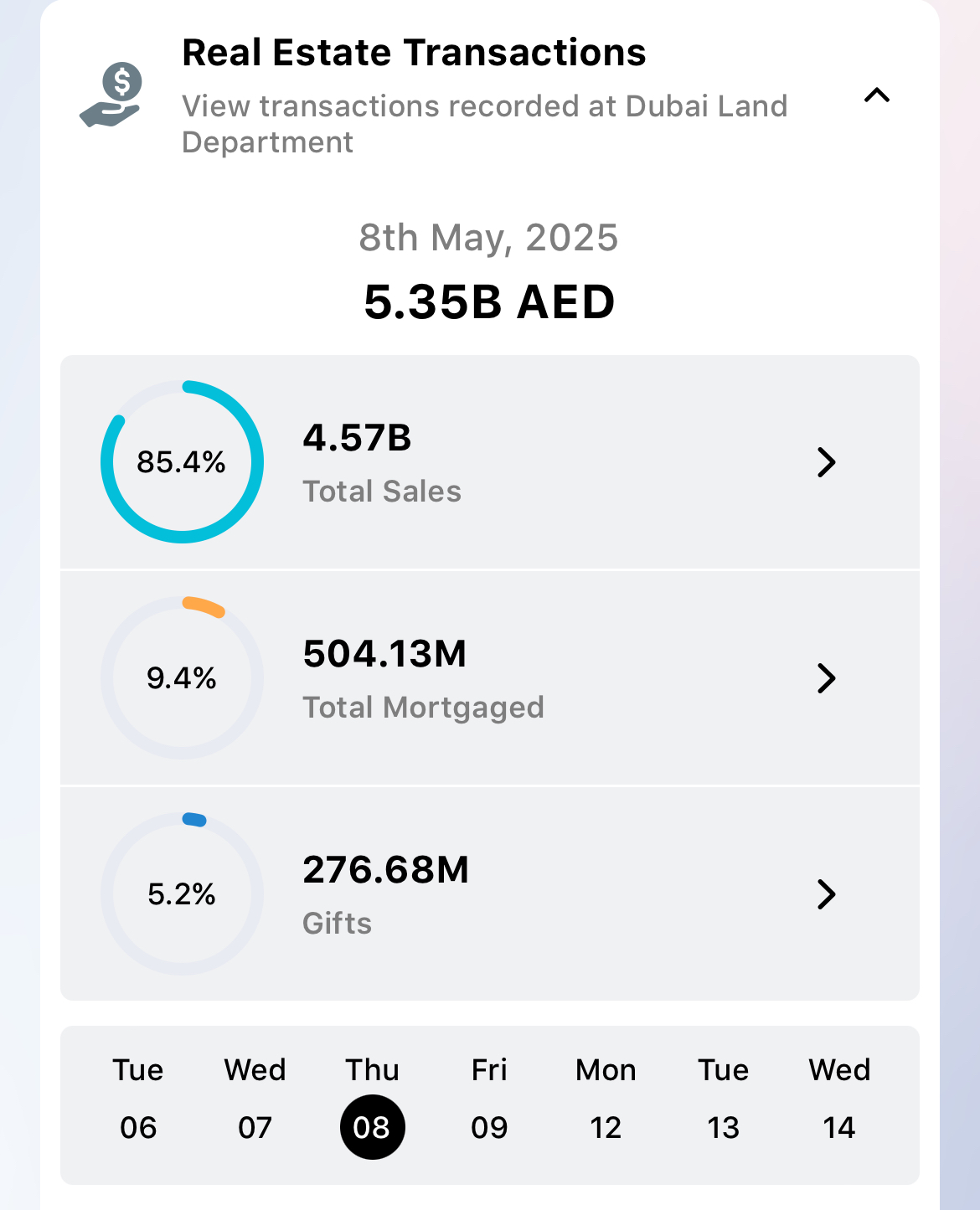

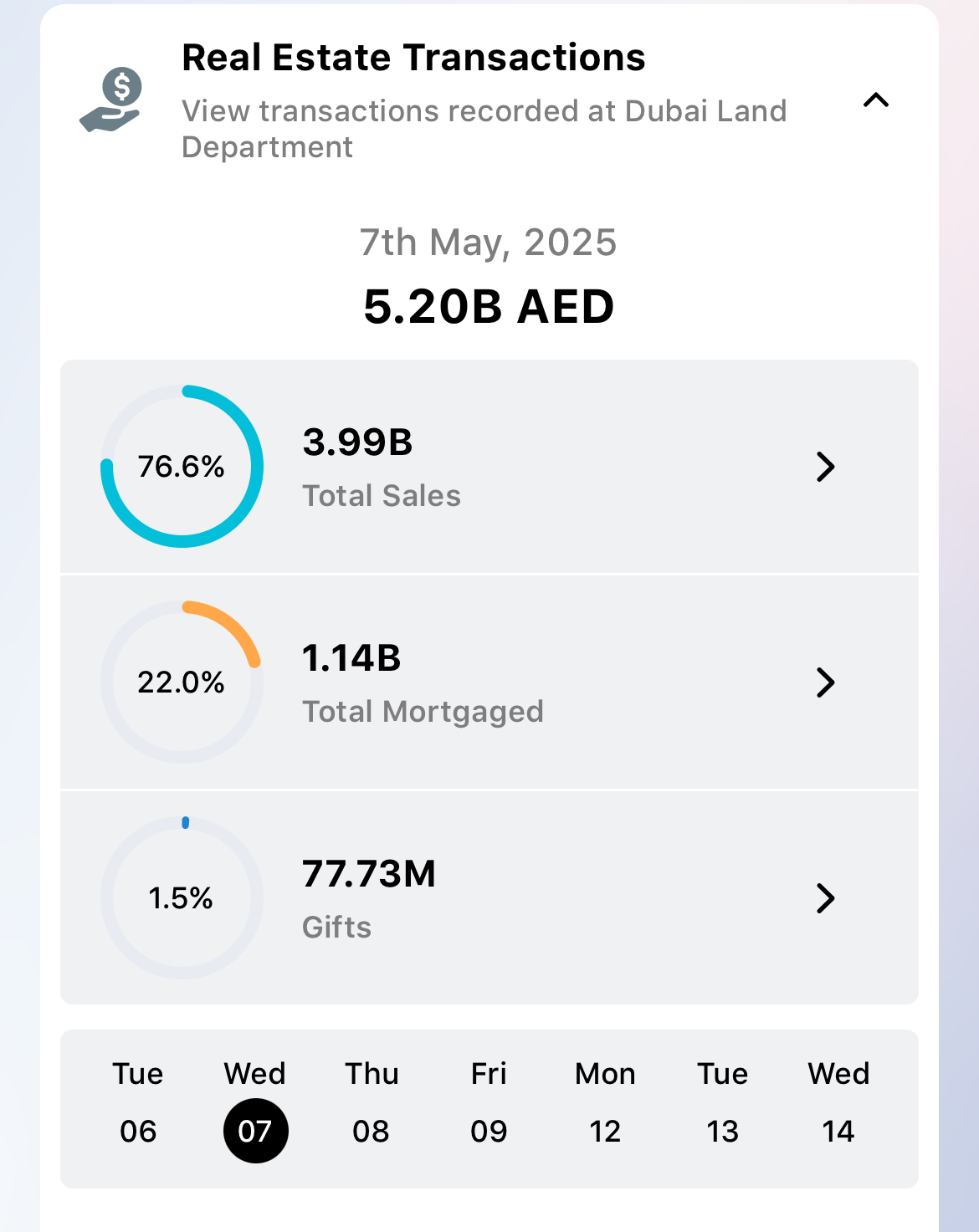

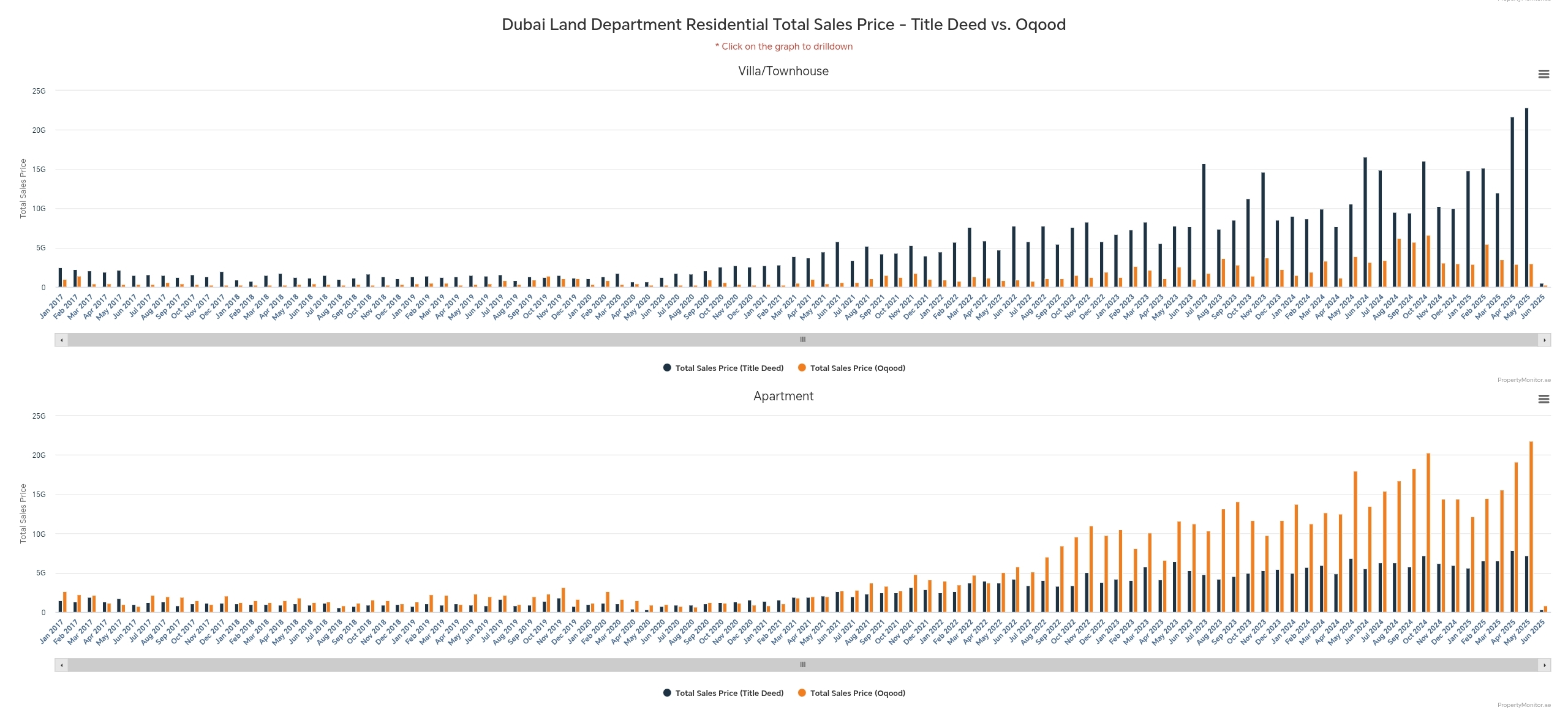

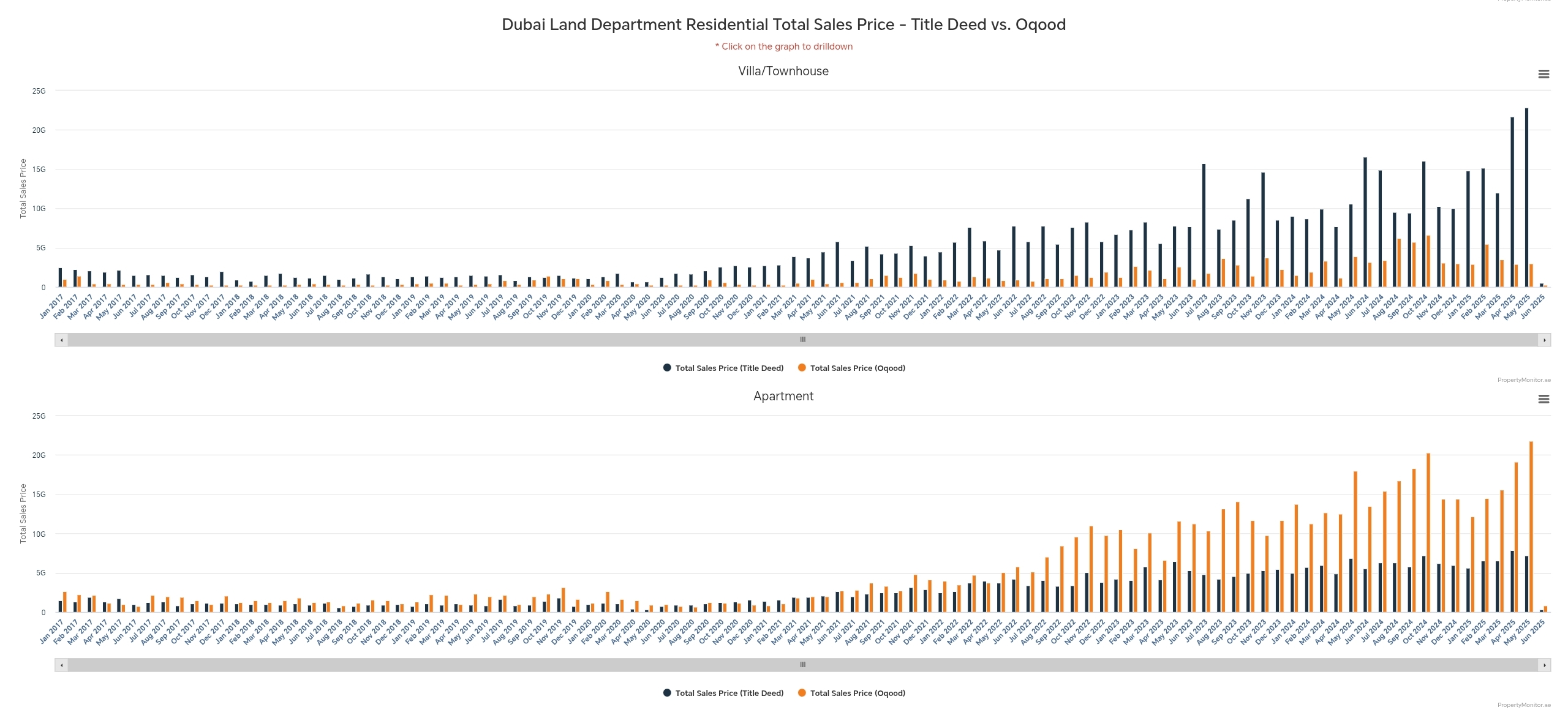

CURRENT MARKET TRANSACTIONS

Last Days & Weeks

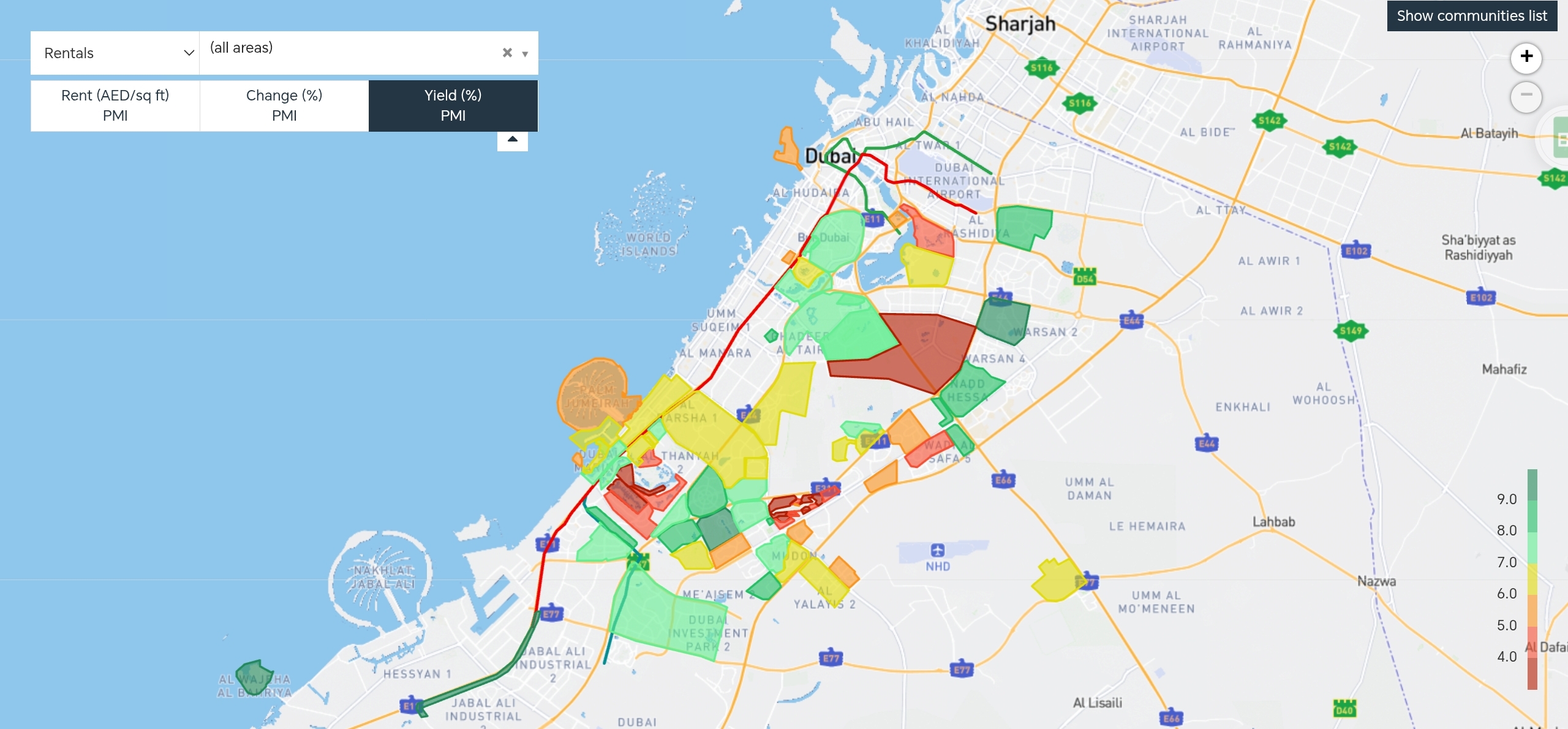

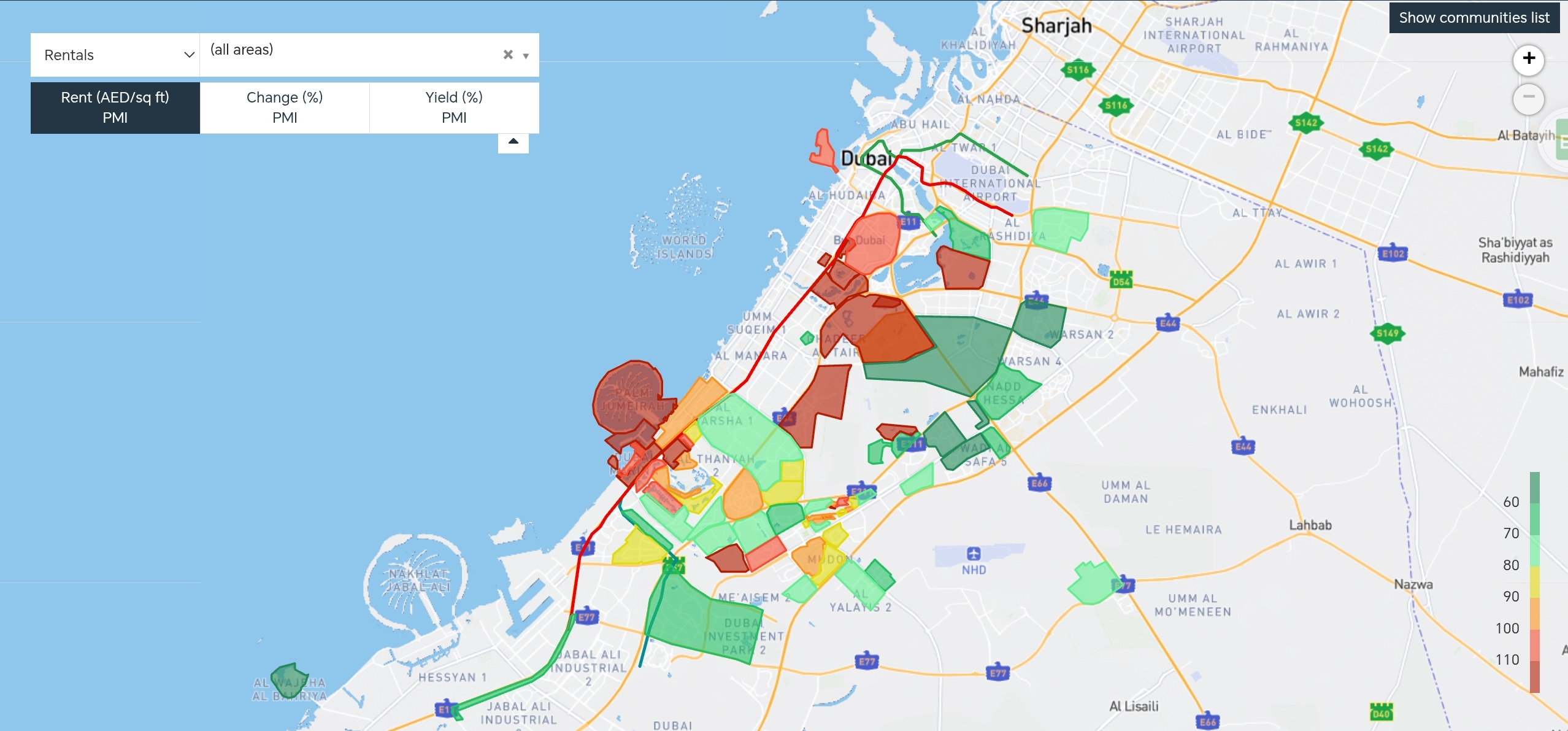

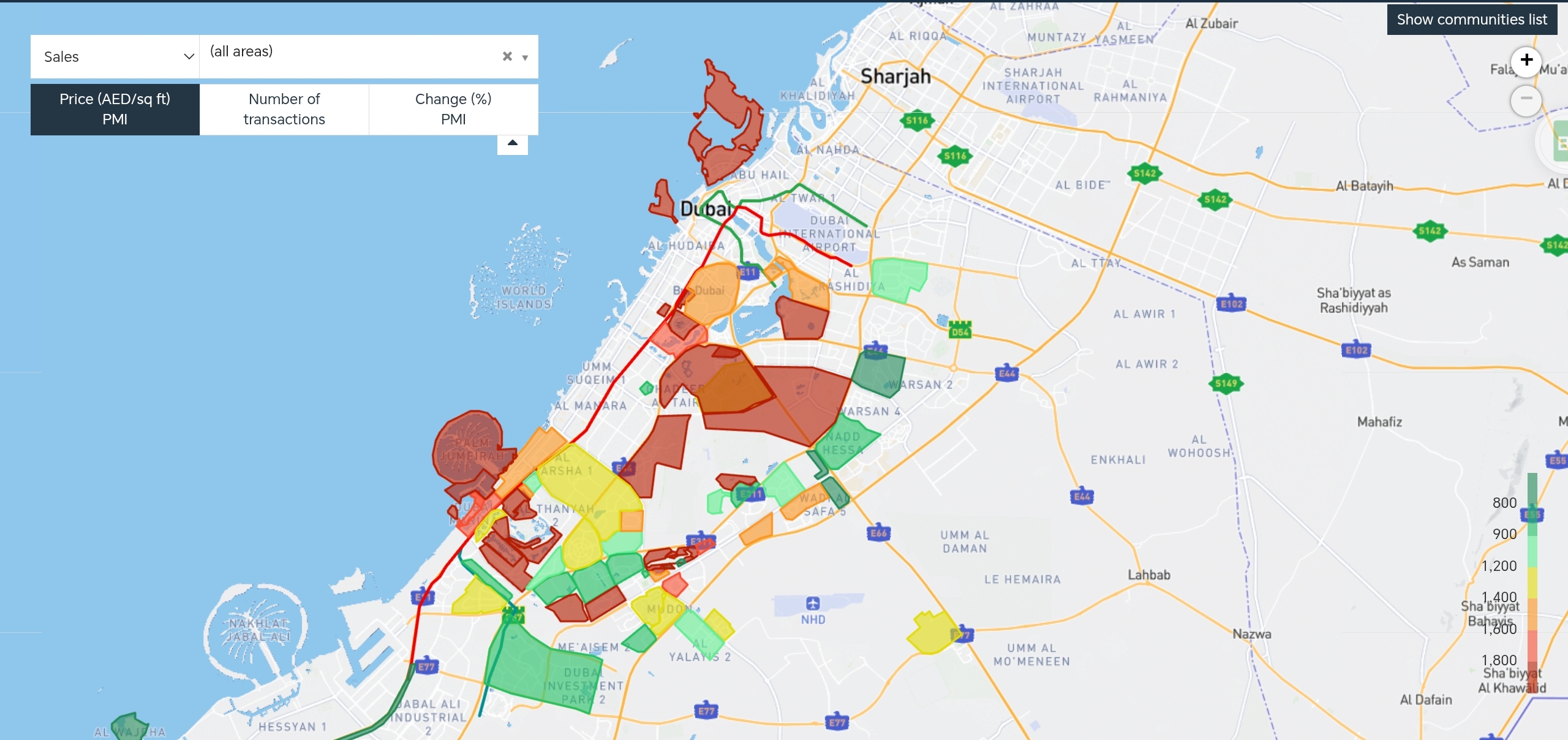

HEAT MAP

DUBAI

2025 Q1

CURRENT MARKET STATISTICS

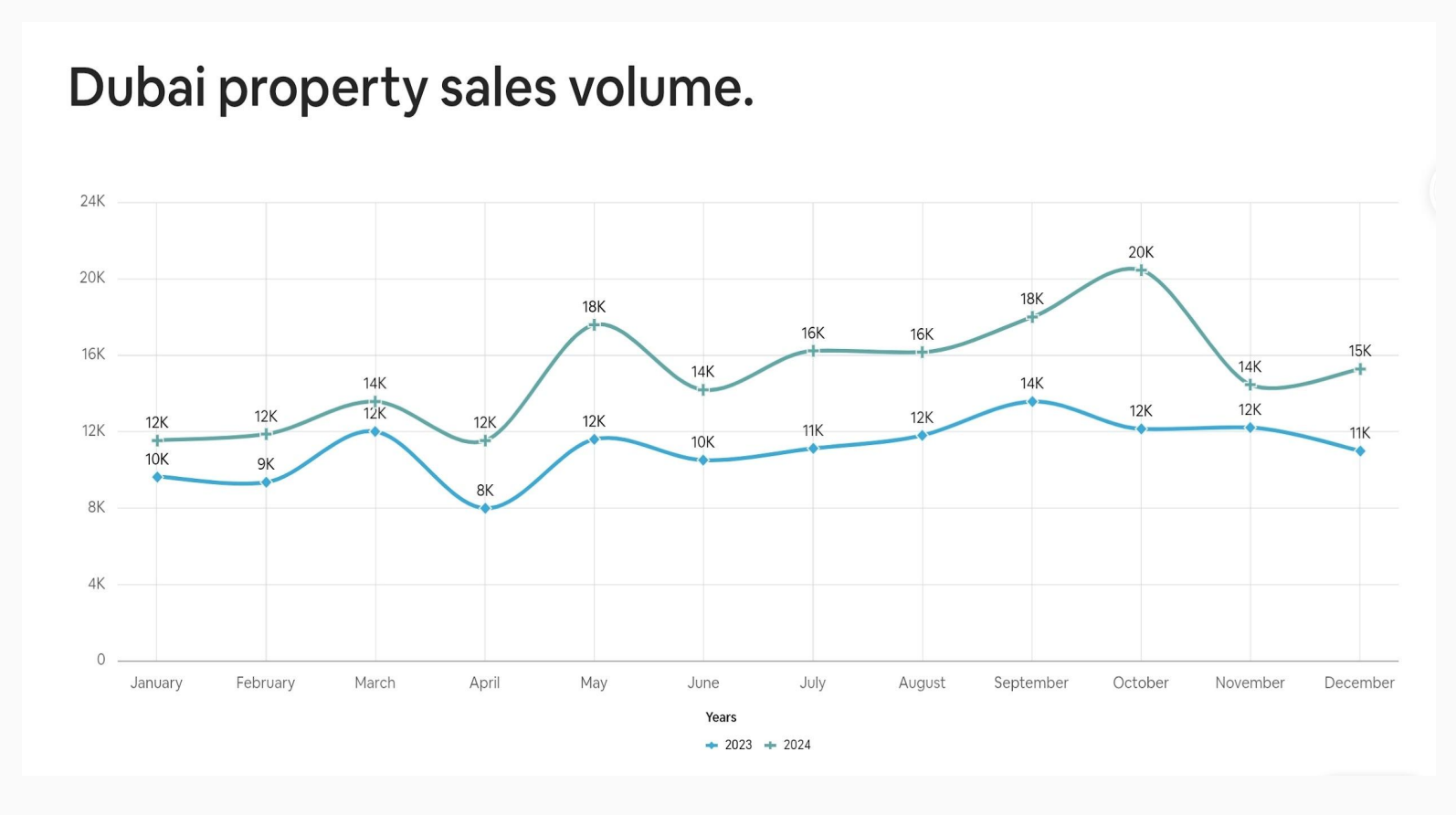

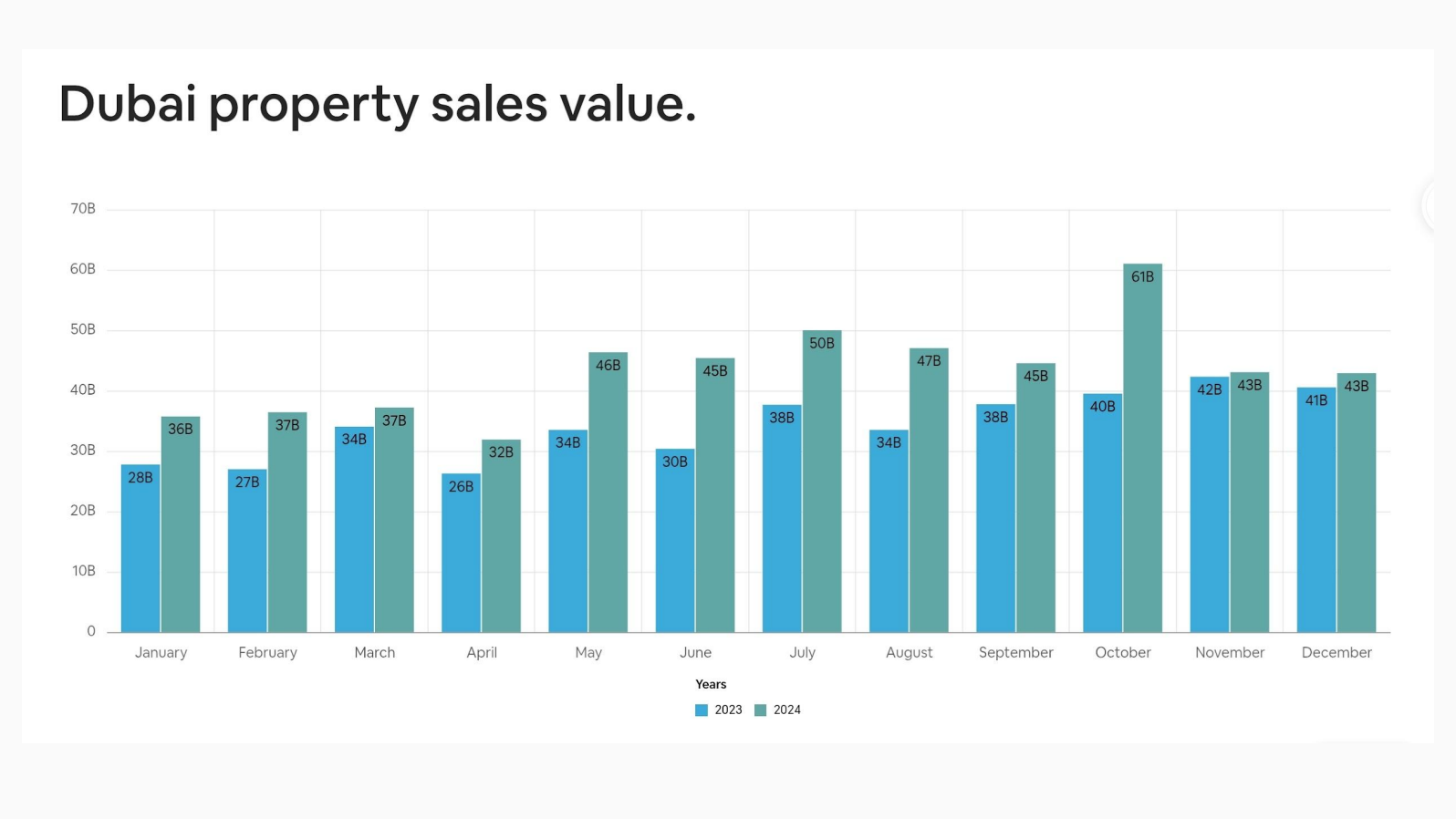

2024 - 2023

PAST YEARS MARKET STATISTICS

Past Decade

PAST YEARS MARKET STATISTICS

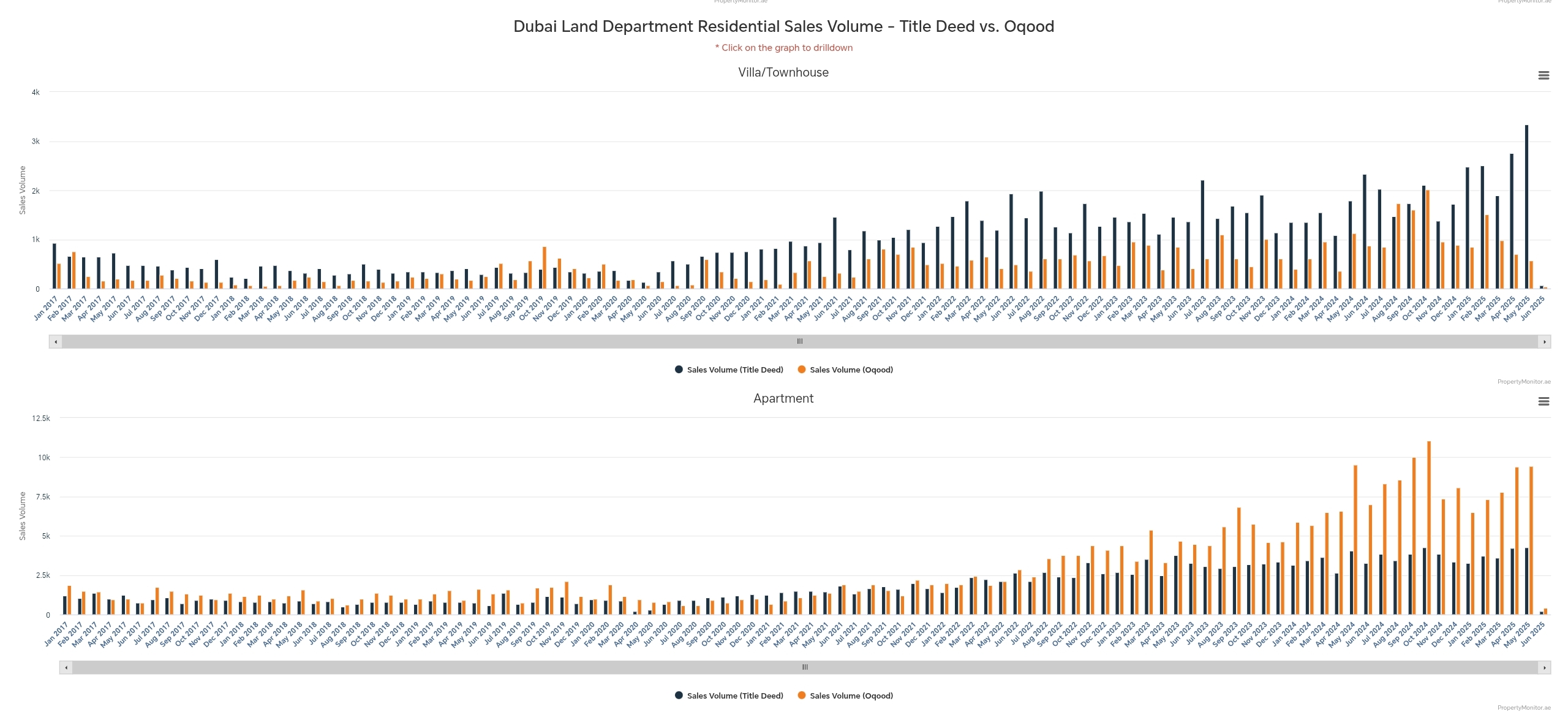

- Transaction Volume: Dubai recorded approximately 42,273 residential property transactions, marking a 50% year-on-year increase.

Total Sales Value: The total value of these transactions reached AED 114.15 billion, reflecting a 29% increase compared to the same period in the previous year.

Average Sale Price: The average sale price climbed to AED 2.7 million, indicating sustained appreciation in property values.

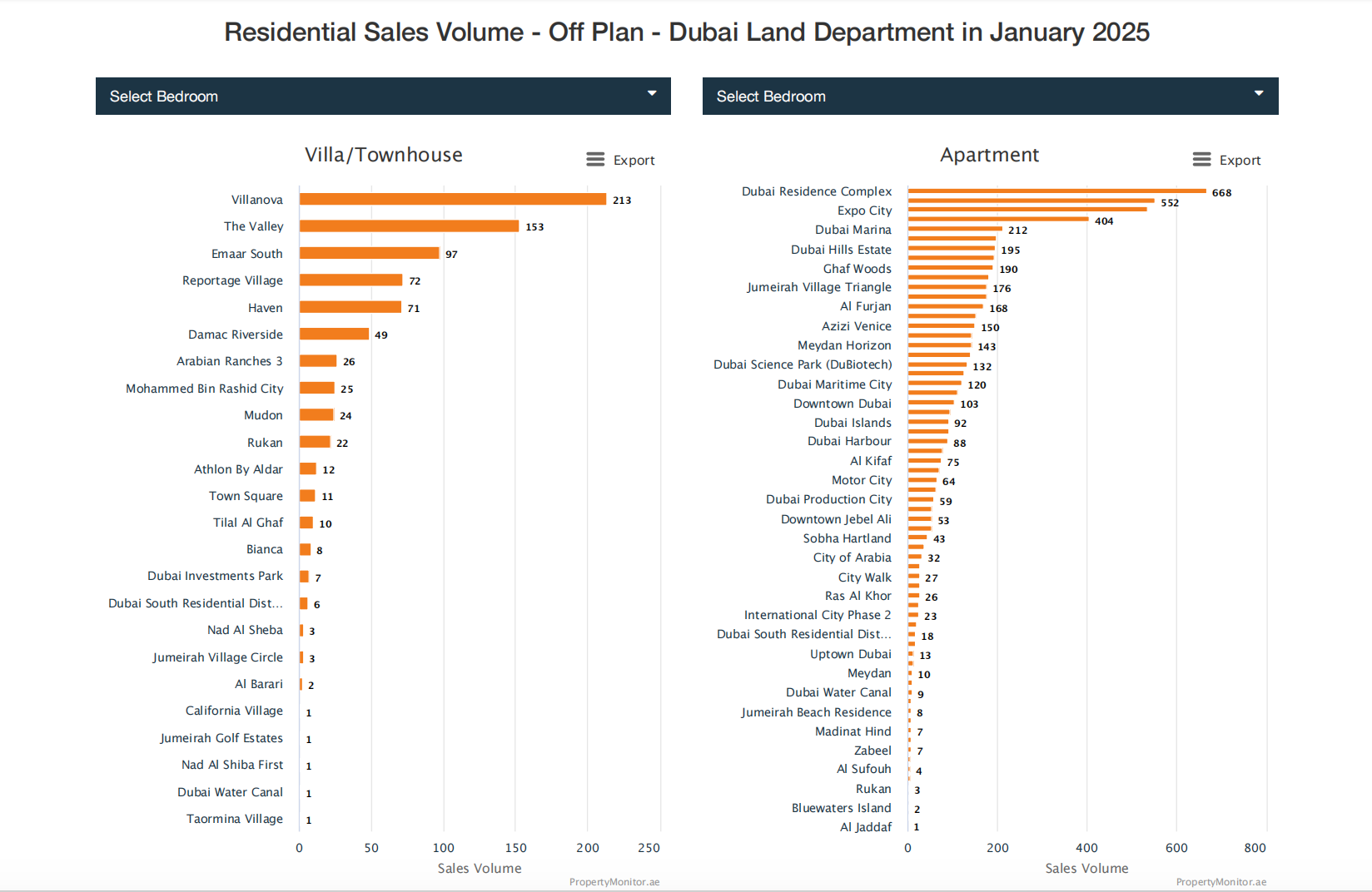

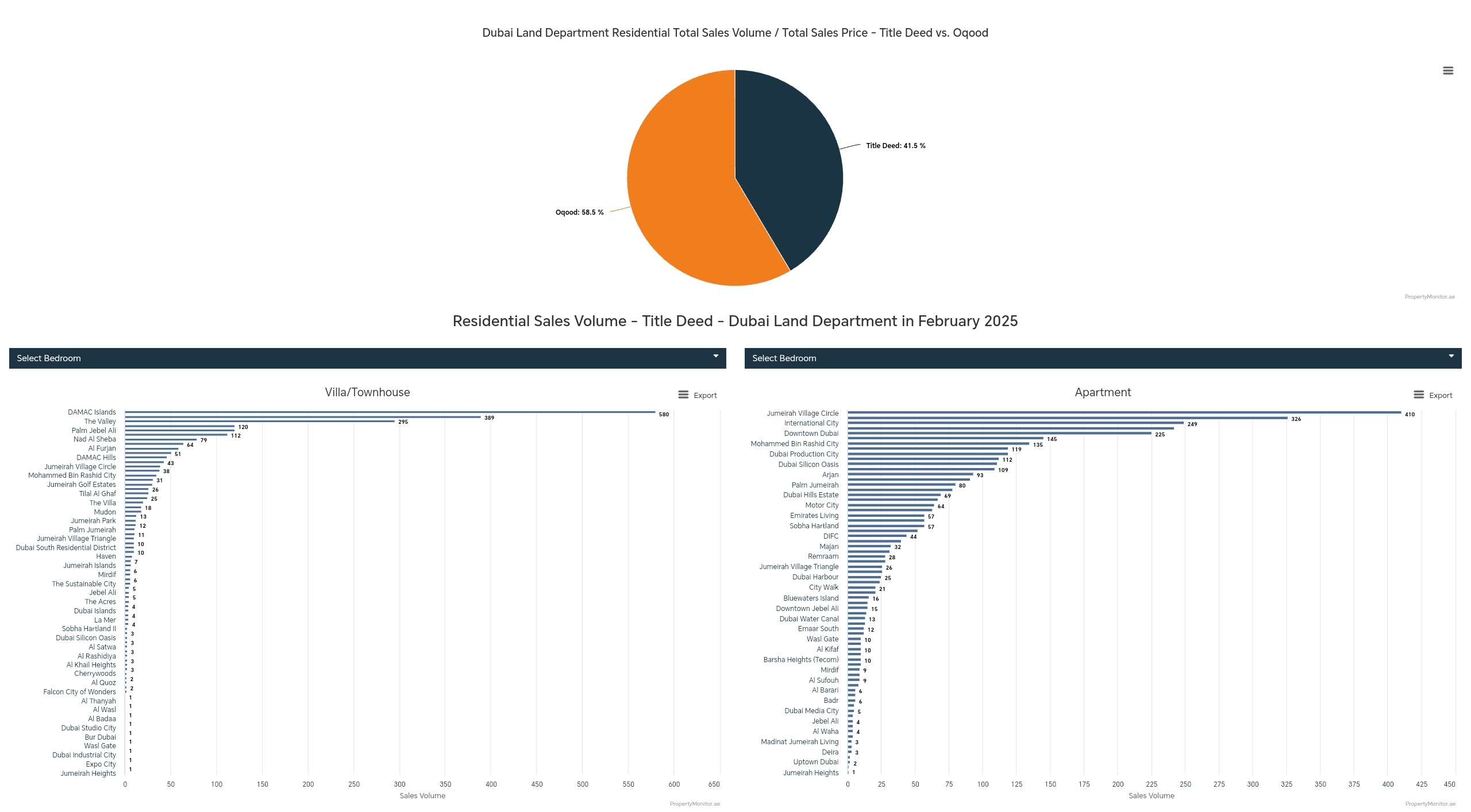

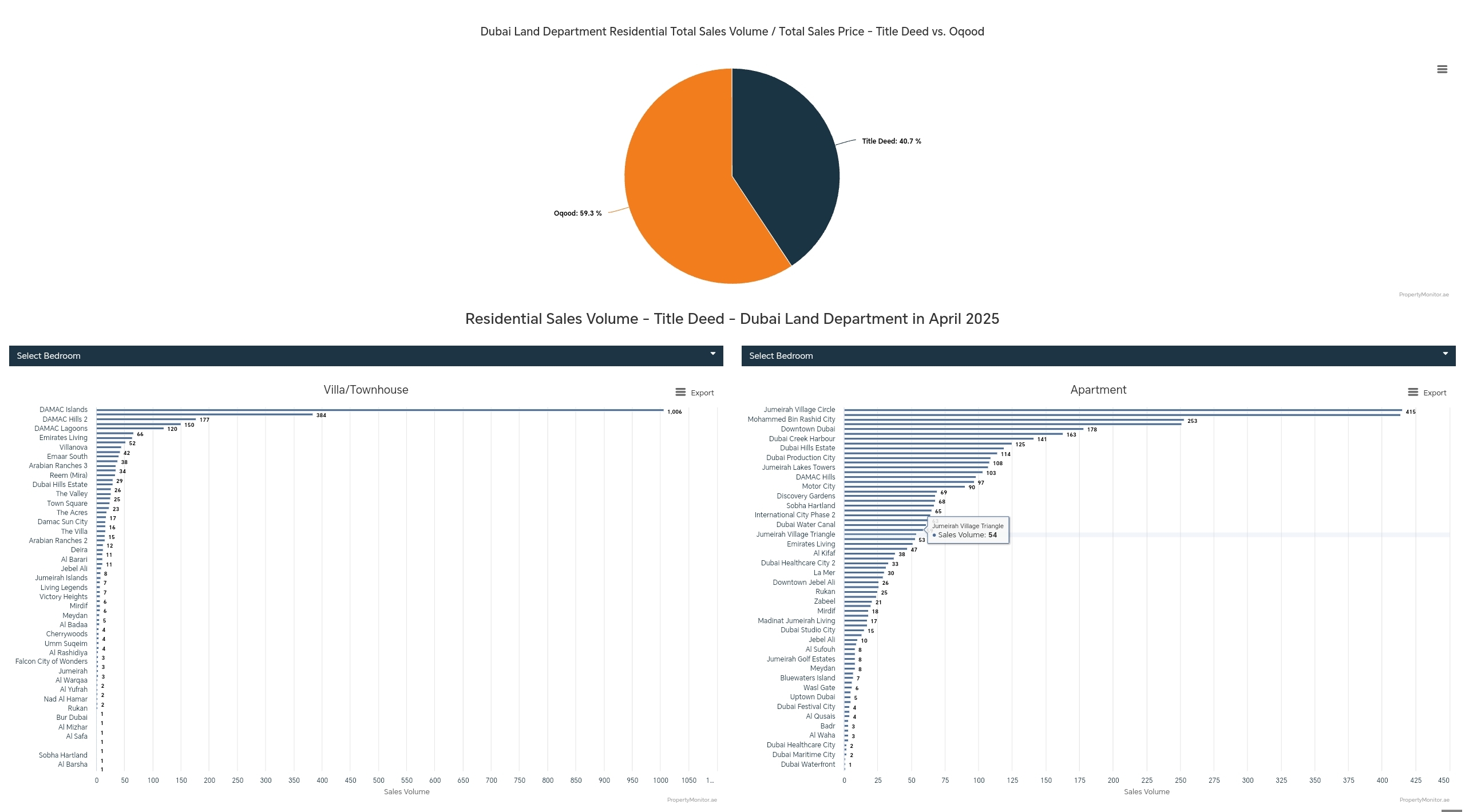

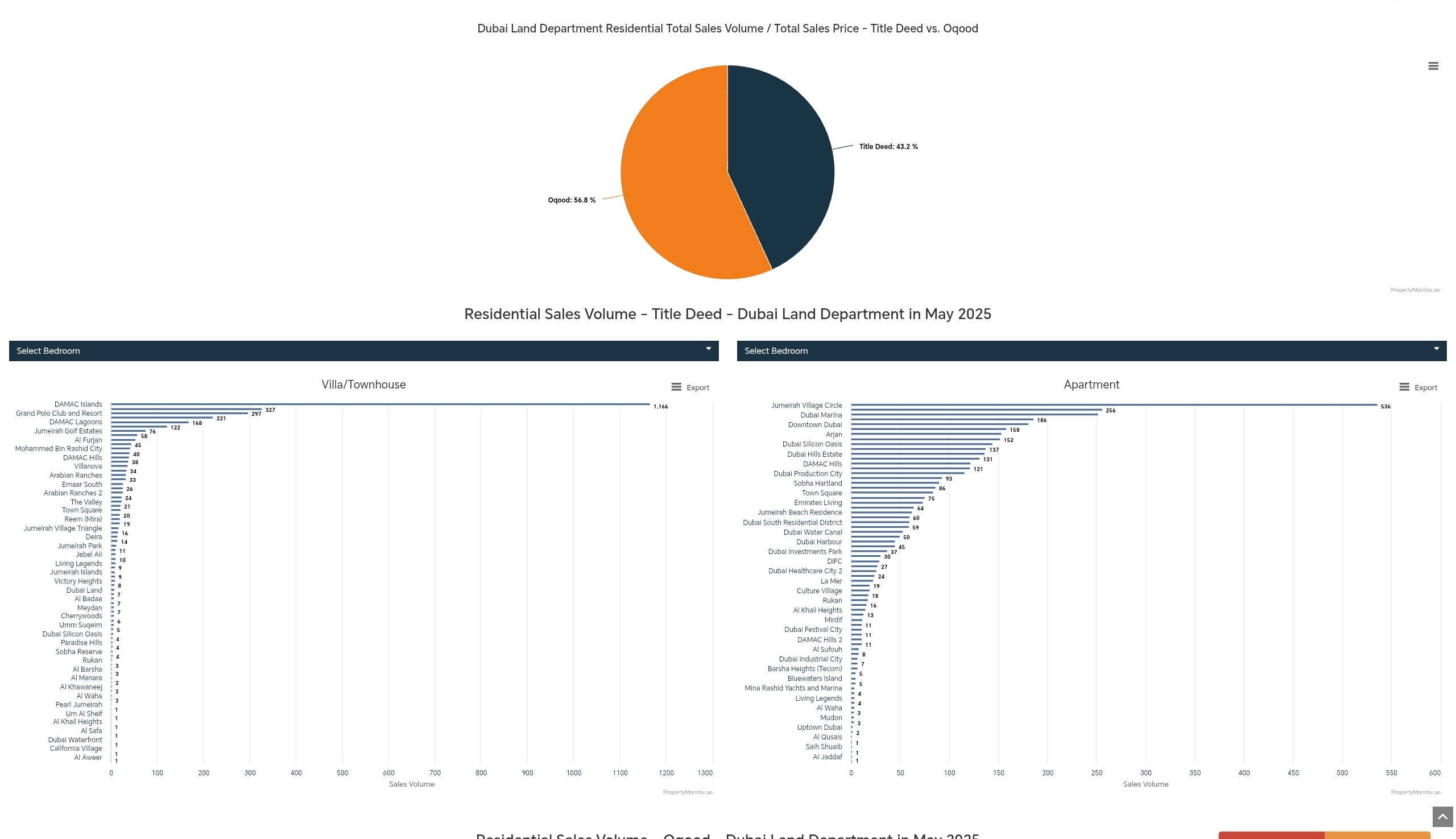

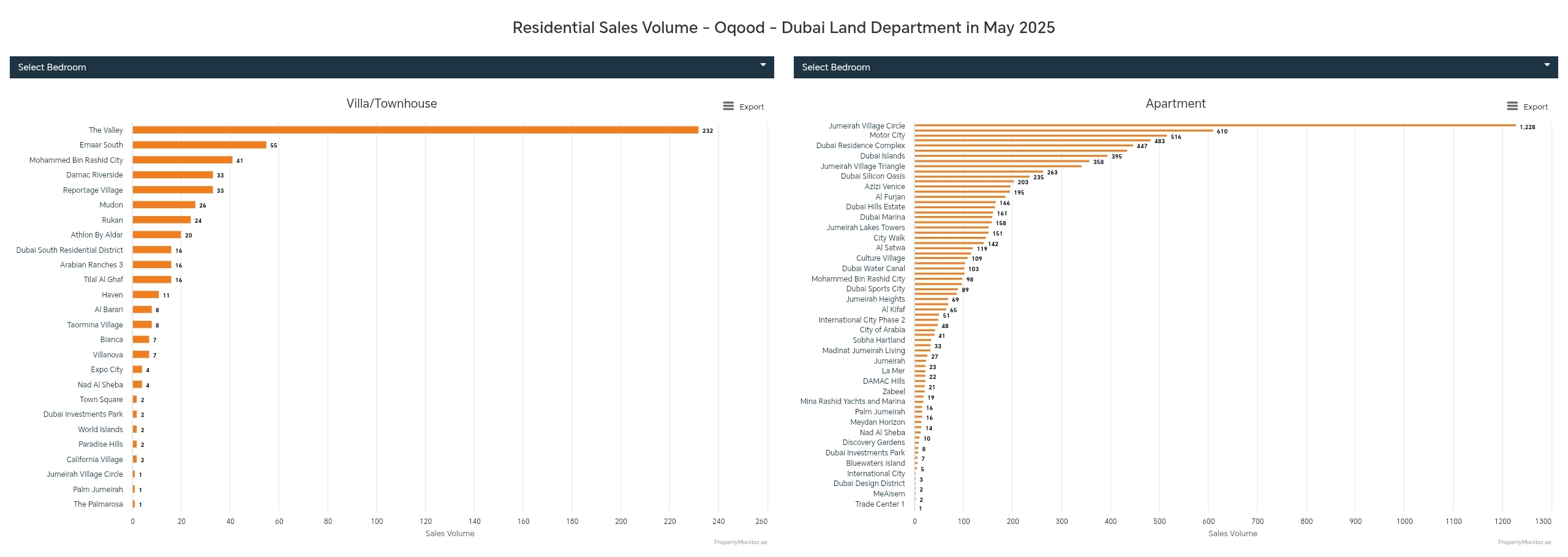

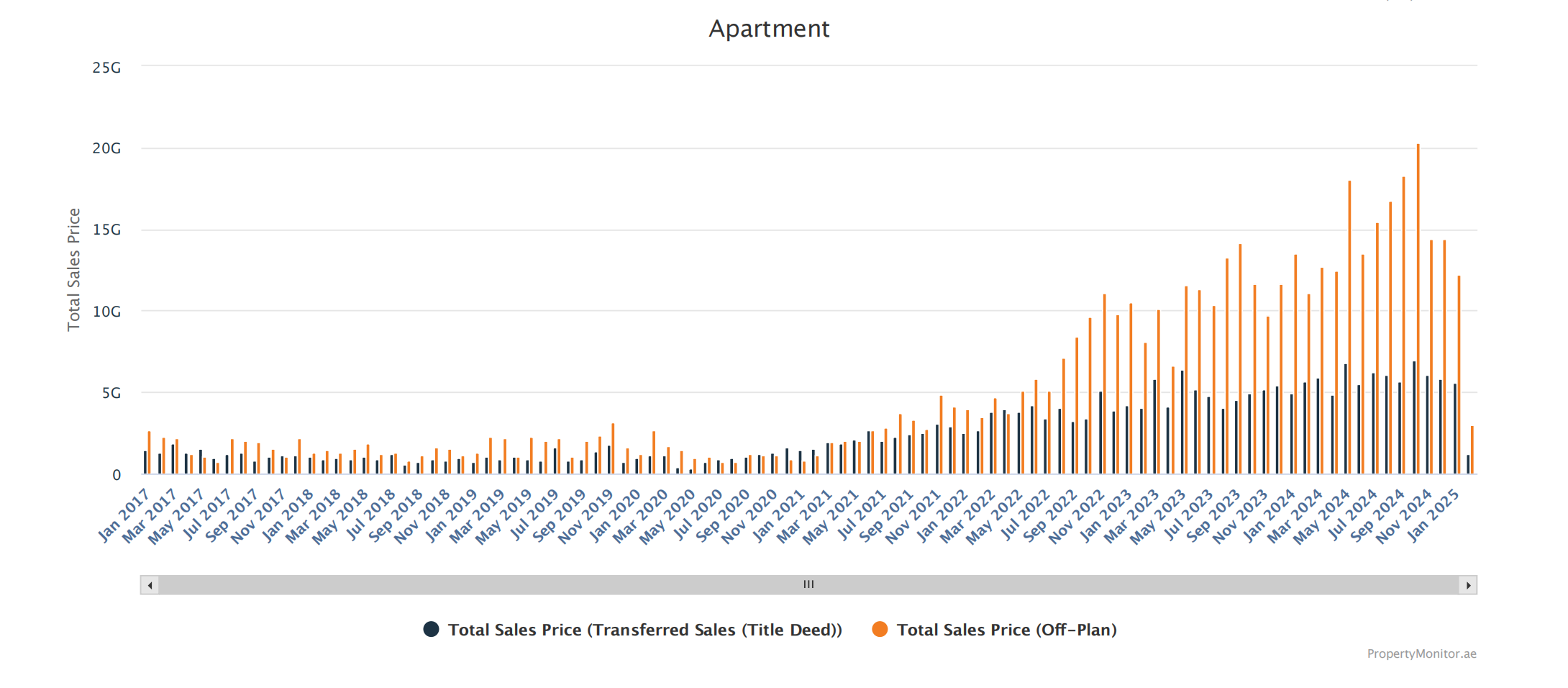

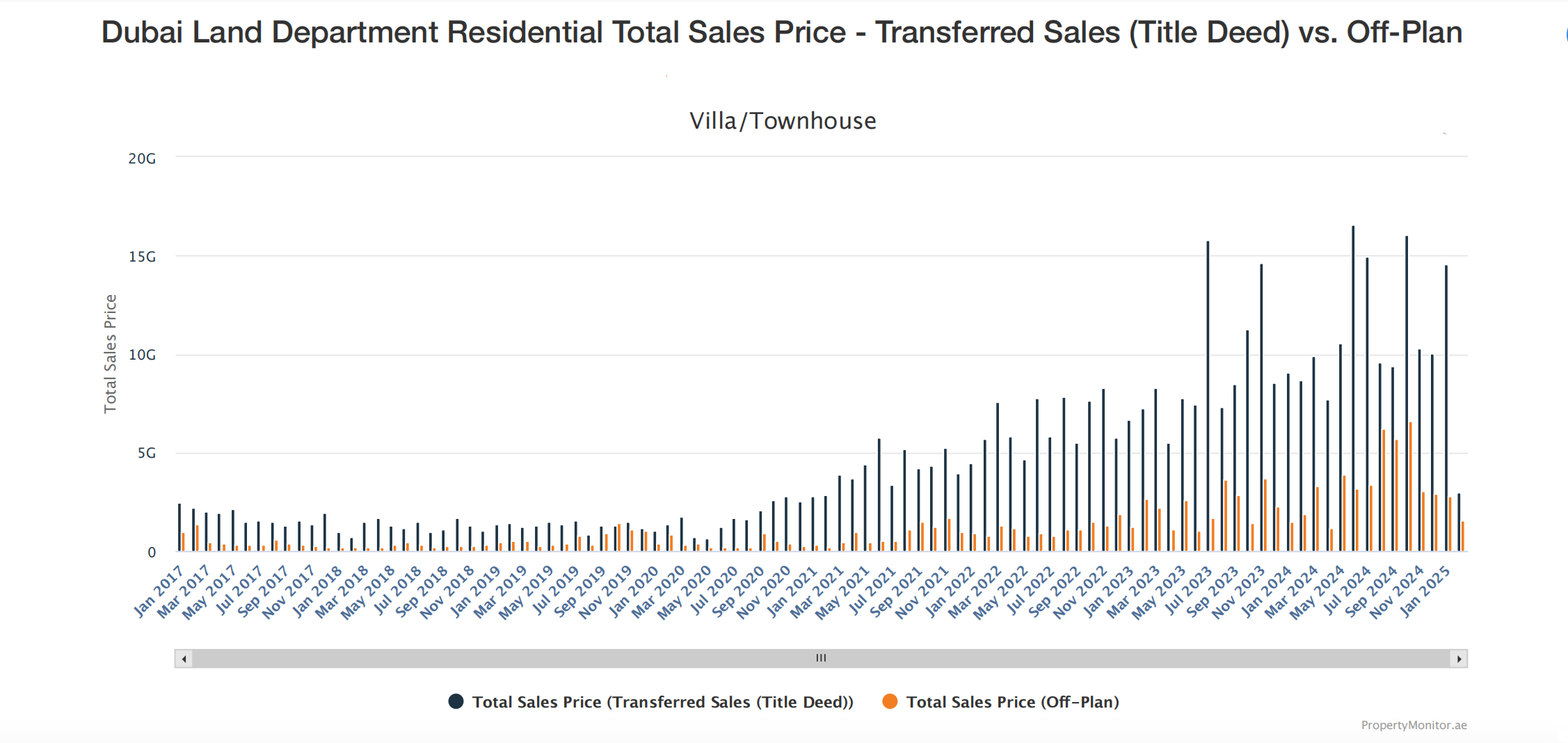

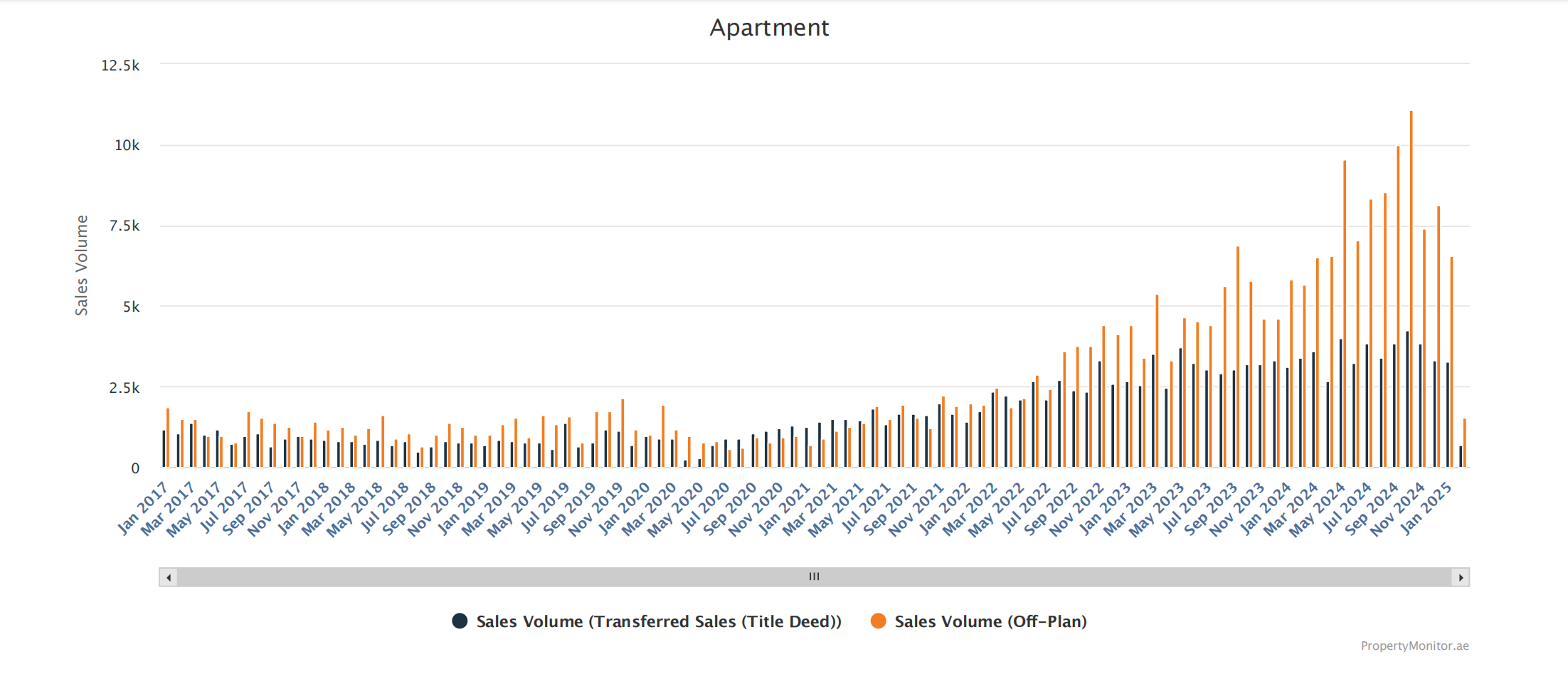

Off-Plan vs. Ready Properties

Off-Plan Dominance: Off-plan properties accounted for 59% of all transactions, underscoring the enduring appeal of new developments for buyers.

Ready Properties: The ready property market also showed resilience, with notable demand for affordable and mid-market homes.

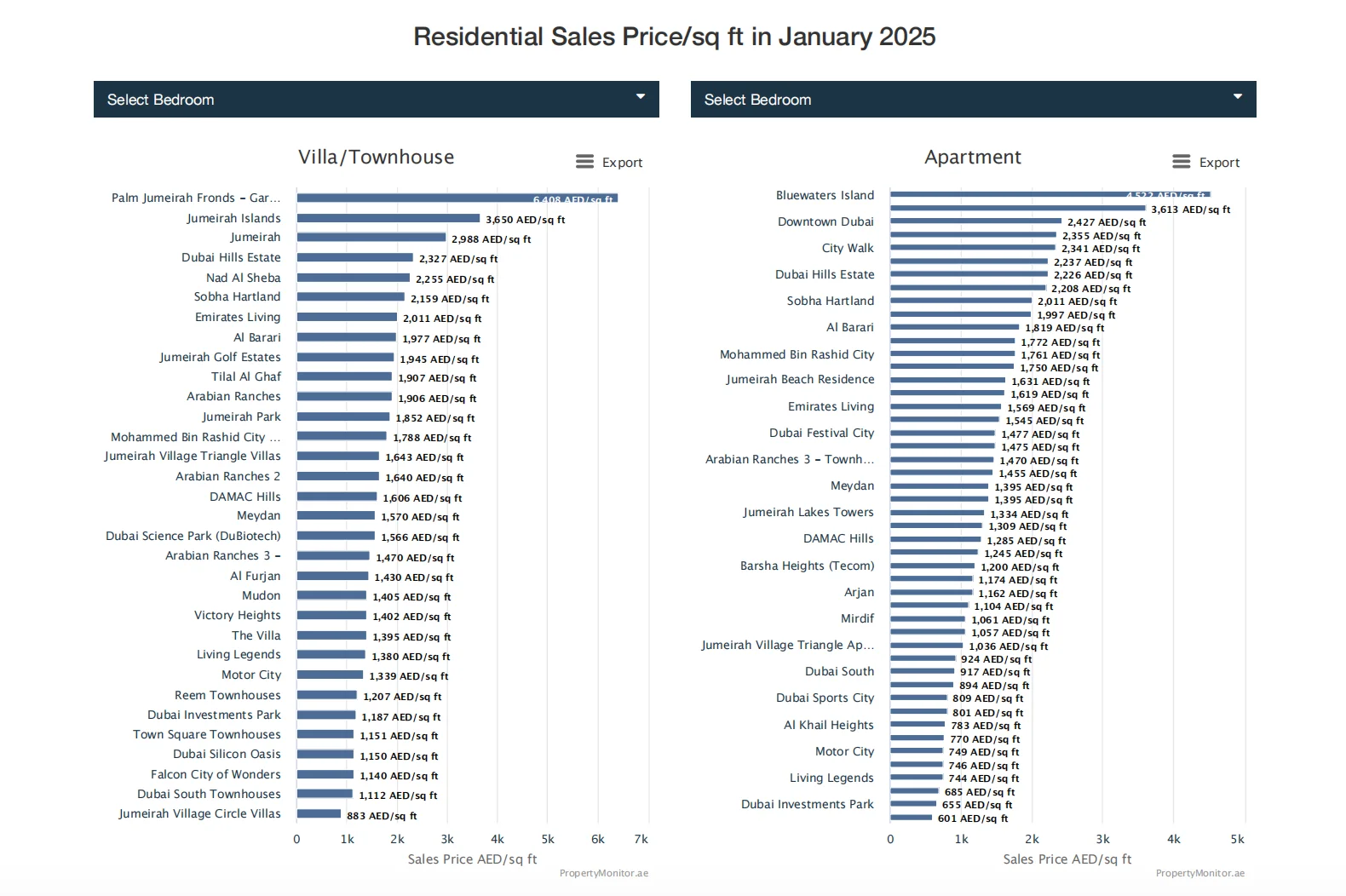

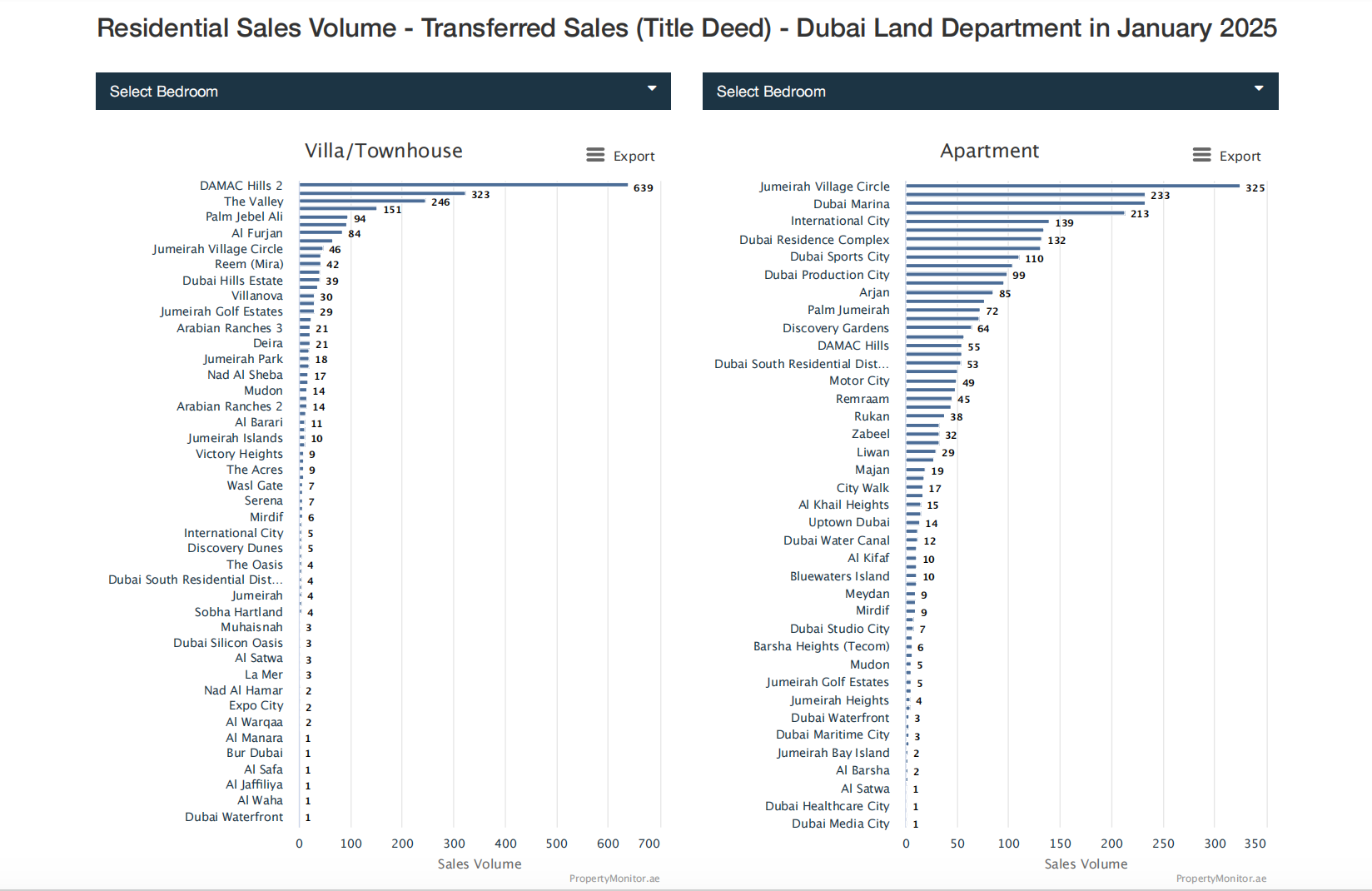

Top Performing Communities

Apartments: Communities like Jumeirah Village Circle (JVC), Dubai Marina, and Business Bay led the market for ready apartments.

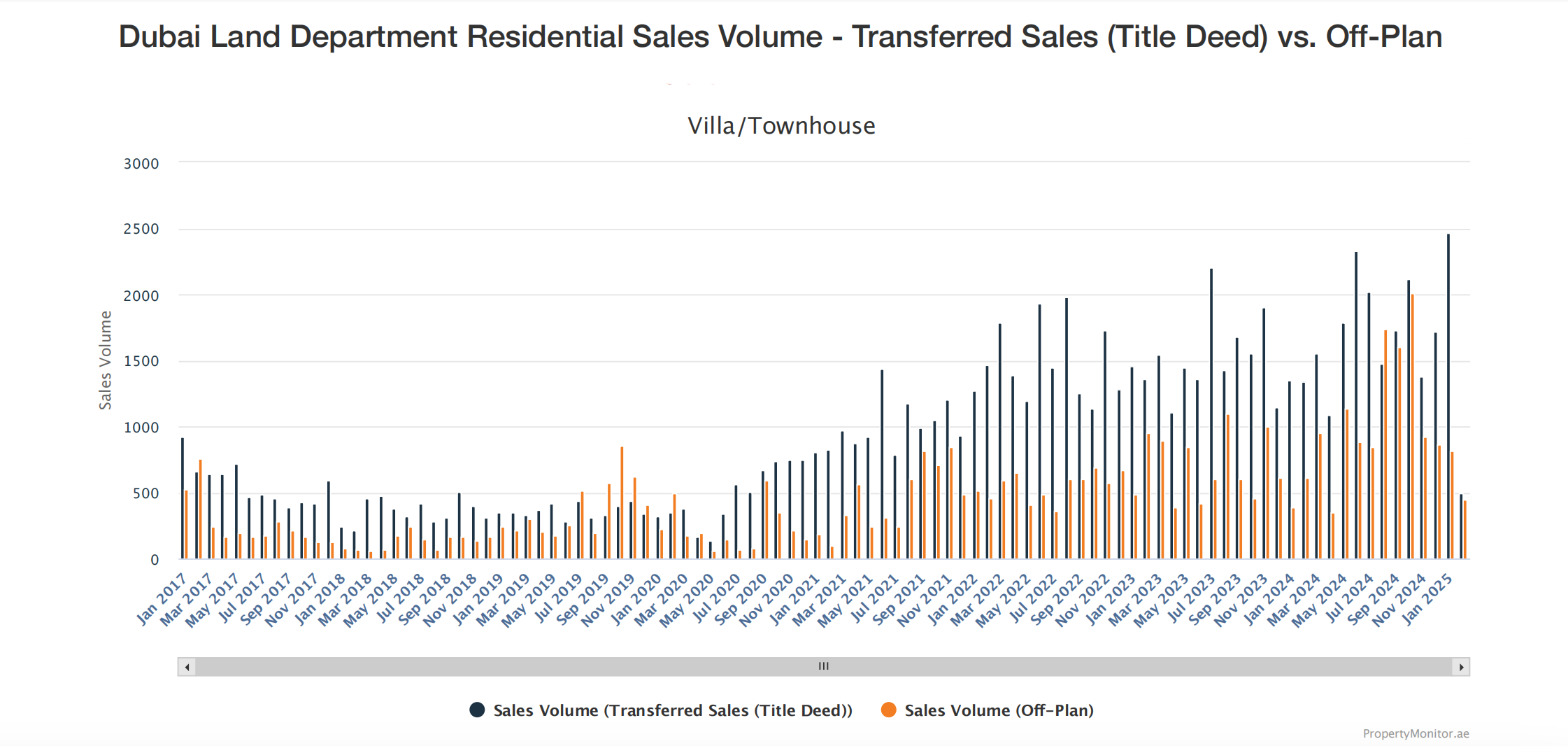

Villas and Townhouses: Areas such as Dubai Hills Estate, Palm Jumeirah, and Jumeirah Golf Estates were among the top-performing for villas and townhouses.

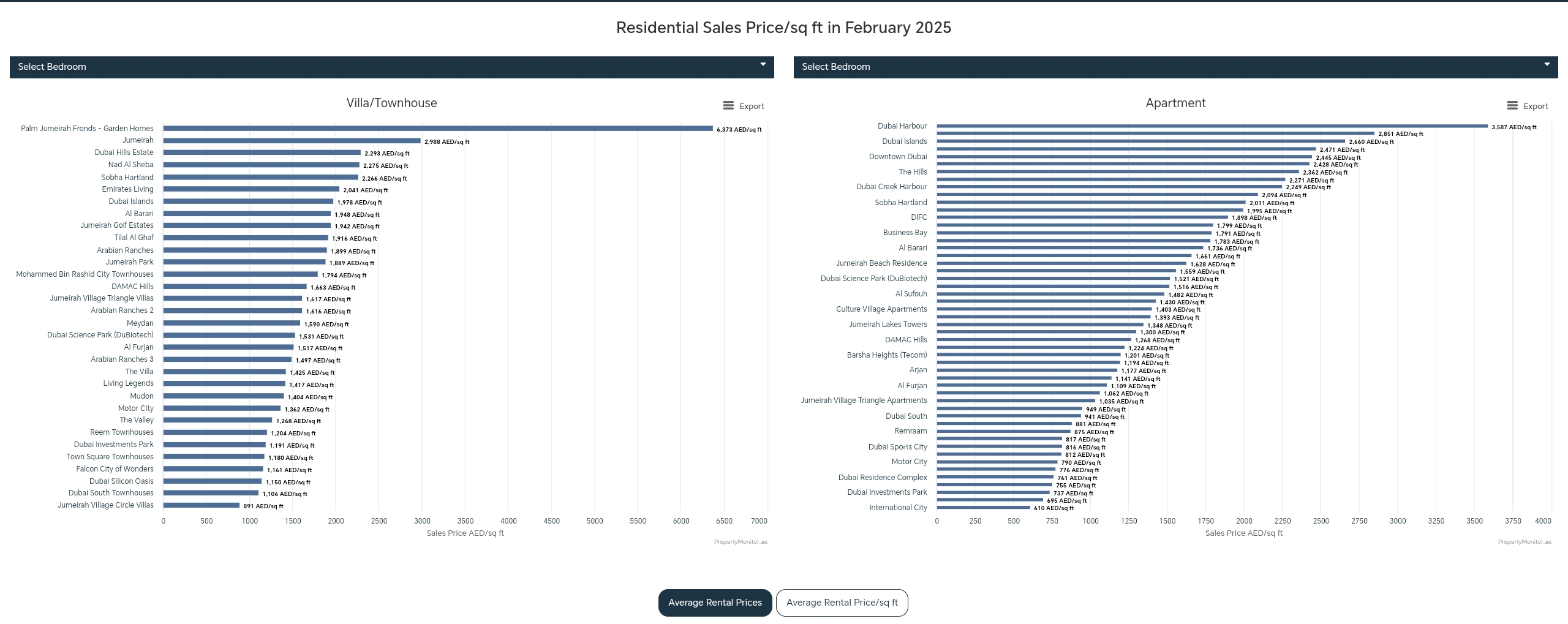

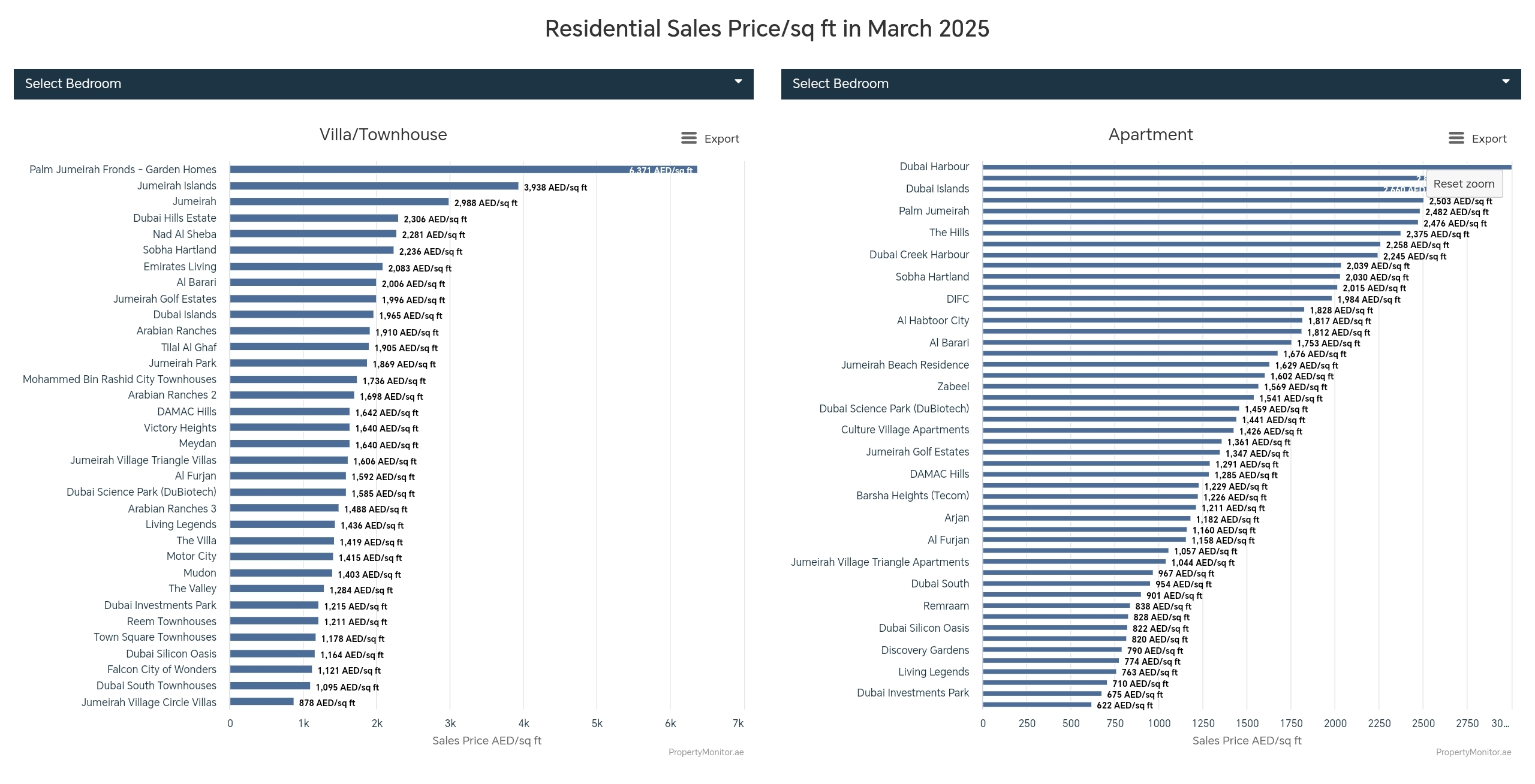

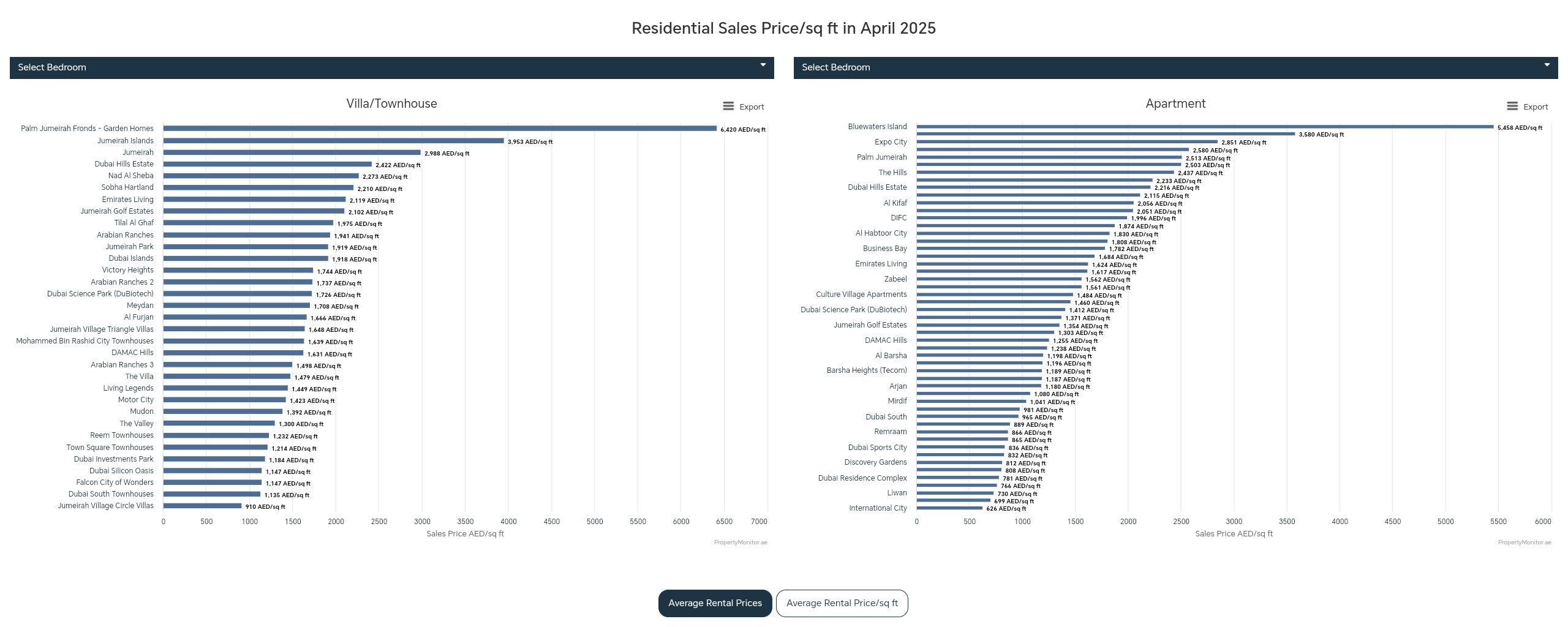

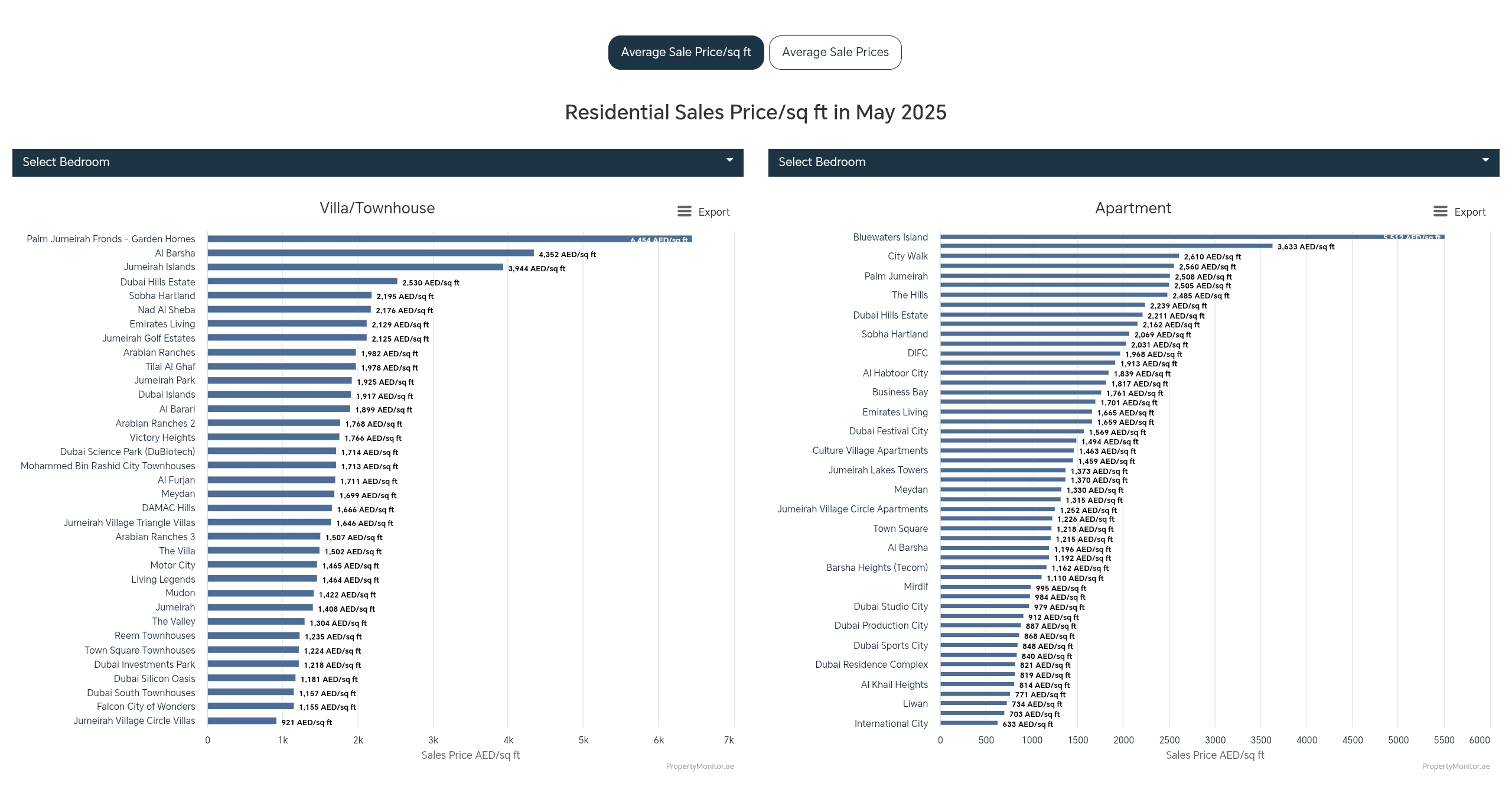

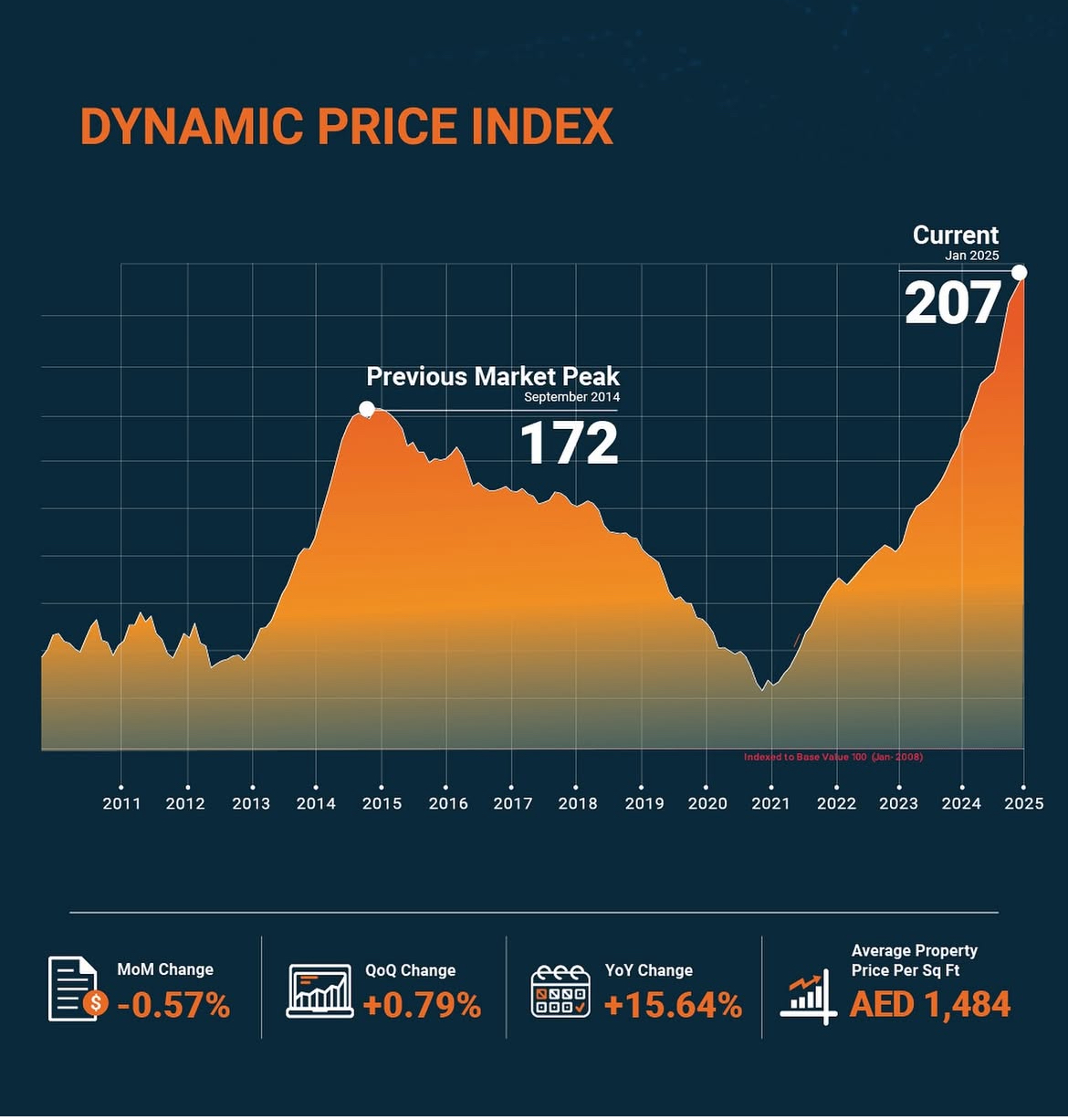

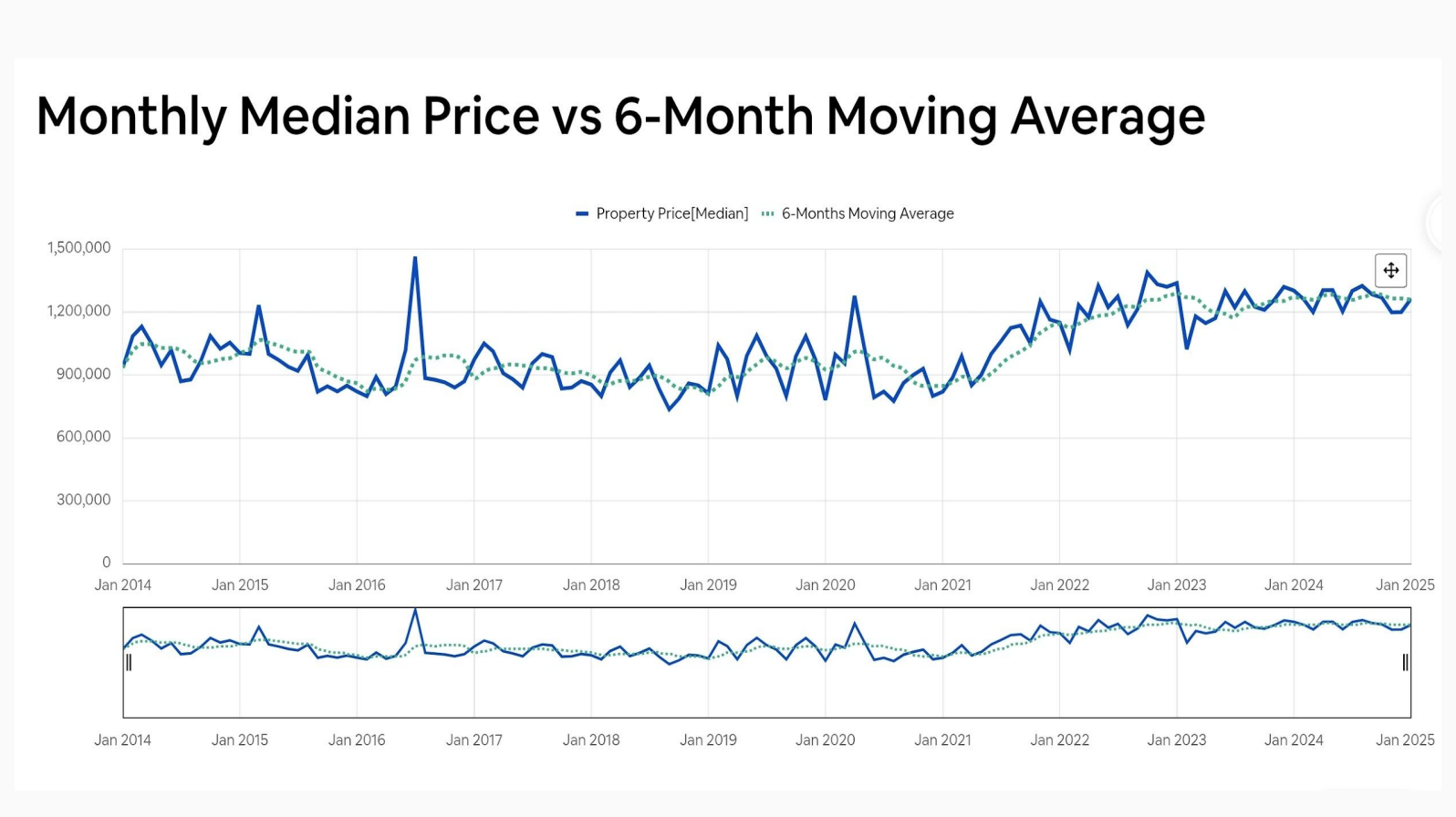

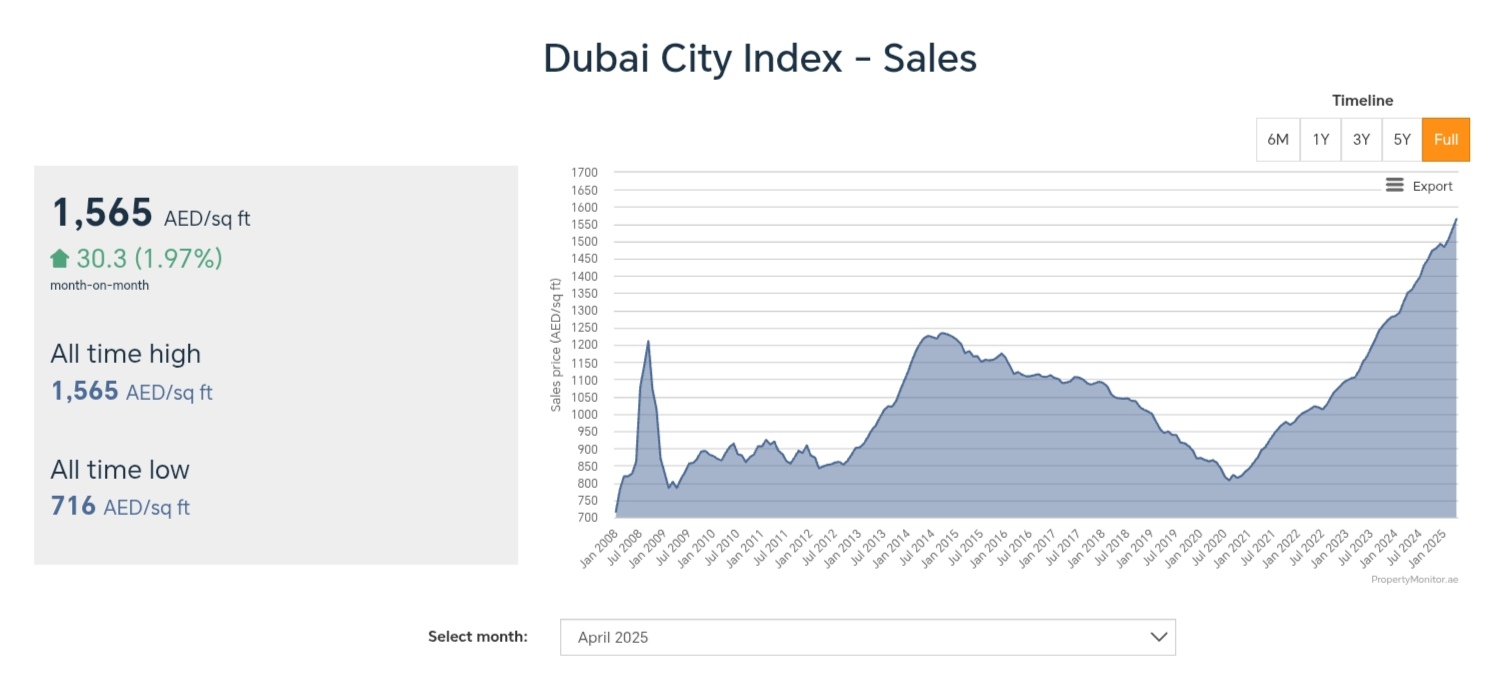

Price Trends

Off-Plan Apartments: The price per square foot for off-plan apartments reached AED 1,926, marking a 28.6% increase from Q3 2024.

Luxury Villas: Villa prices rose 13% from Q3 2024, led by demand for 4-bedroom and larger units across premium master communities.

Market Drivers

Population Growth: Dubai’s population increased by approximately 1,000 residents per day in Q1 2025, reaching 3.92 million by the end of March.

Investor Confidence: The market’s robust performance has been fueled by sustained end-user demand and investor confidence, marking Q1 2025 as one of the strongest quarters on record for Dubai real estate.

Future Outlook

Supply Pipeline: Over 300,000 new homes are expected to be completed and handed over by 2028, with 81,084 units anticipated in 2025.

Emerging Communities: Areas like EXPO City, Dubai South, and Dubai Islands are gaining traction due to planned infrastructure, affordability, and future connectivity to key urban zones.

Sales reached a record-breaking AED 519 billion, a huge 37% increase from the previous year. This surge was driven by high demand exceeding available supply, which led to price growth and reinforced Dubai’s status as a leading global real estate market.

Sales highlights:

- Villas and townhouses: Average prices soared by 32% to reach AED 7 million.

- Apartments: Not far behind, with a solid 12% increase to AED 2.4 million.

- Hotspots: Business Bay and Dubai Land saw significant growth in apartment sales, while established villa communities like The Springs and Arabian Ranches remained popular.

- Emerging Stars: Tilal Al Ghaf and Al Furjan attracted buyers with new projects and developments.

Sales Market Performance:

– Total Sales Value: AED 519 billion, a 37% increase from 2023.

– Total Residential Sales Transactions: 168,407 units, a 42% rise compared to 2023.

– Off-Plan Market Boom:

– 63% of total sales were off-plan properties.

– Developers launched branded projects with upscaled amenities to attract investors.

– Average Property Prices:

– Villas/Townhouses: AED 7.06 million (32% increase YoY).

– Apartments: AED 2.4 million (12% increase YoY).

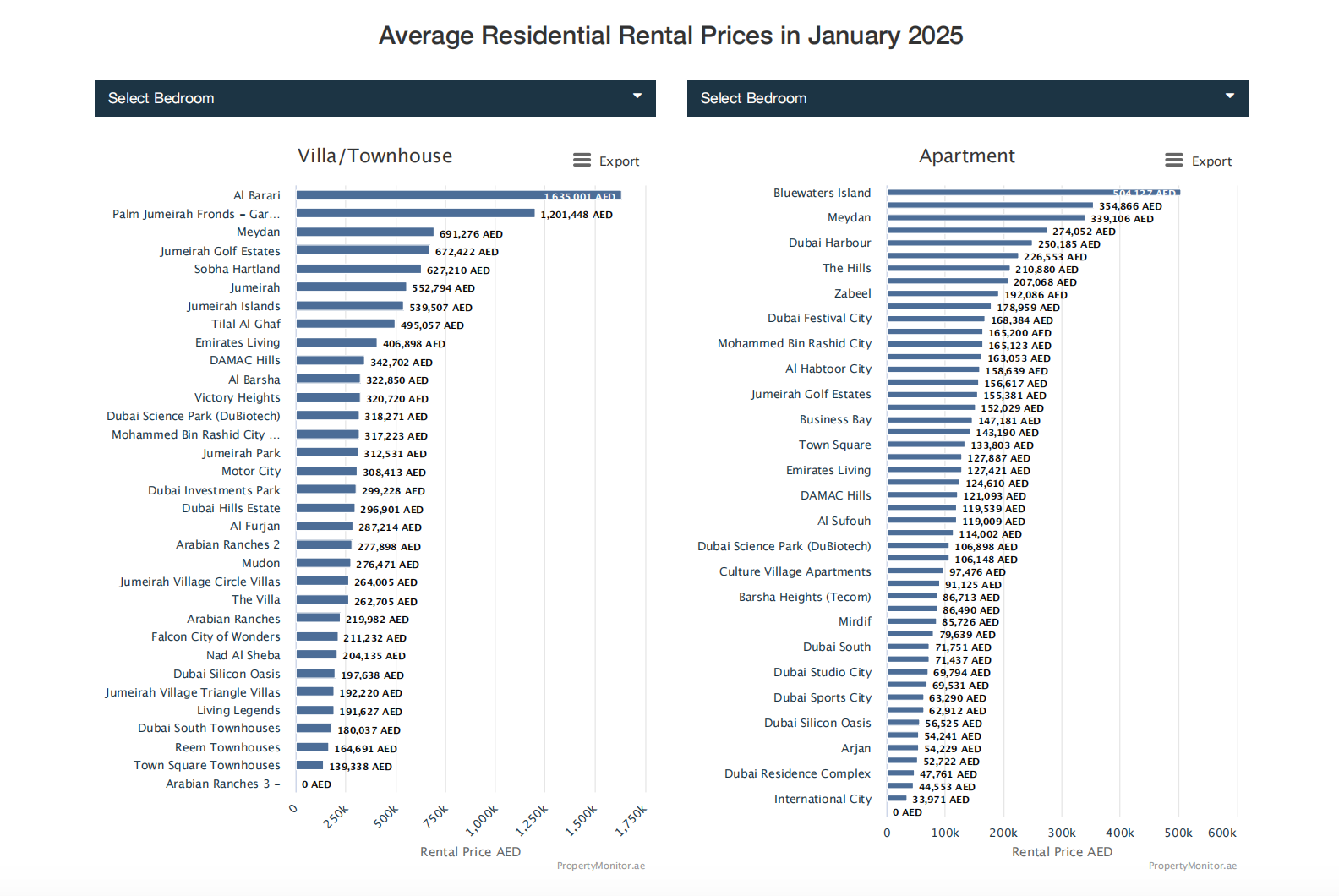

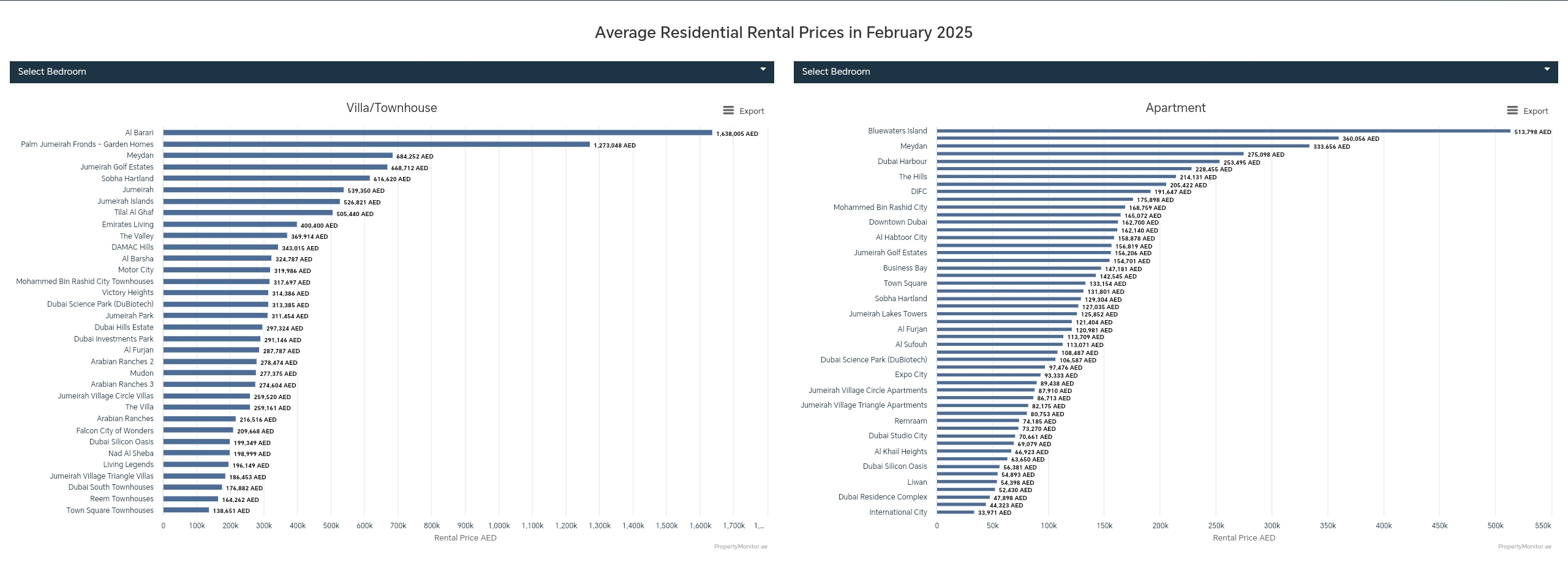

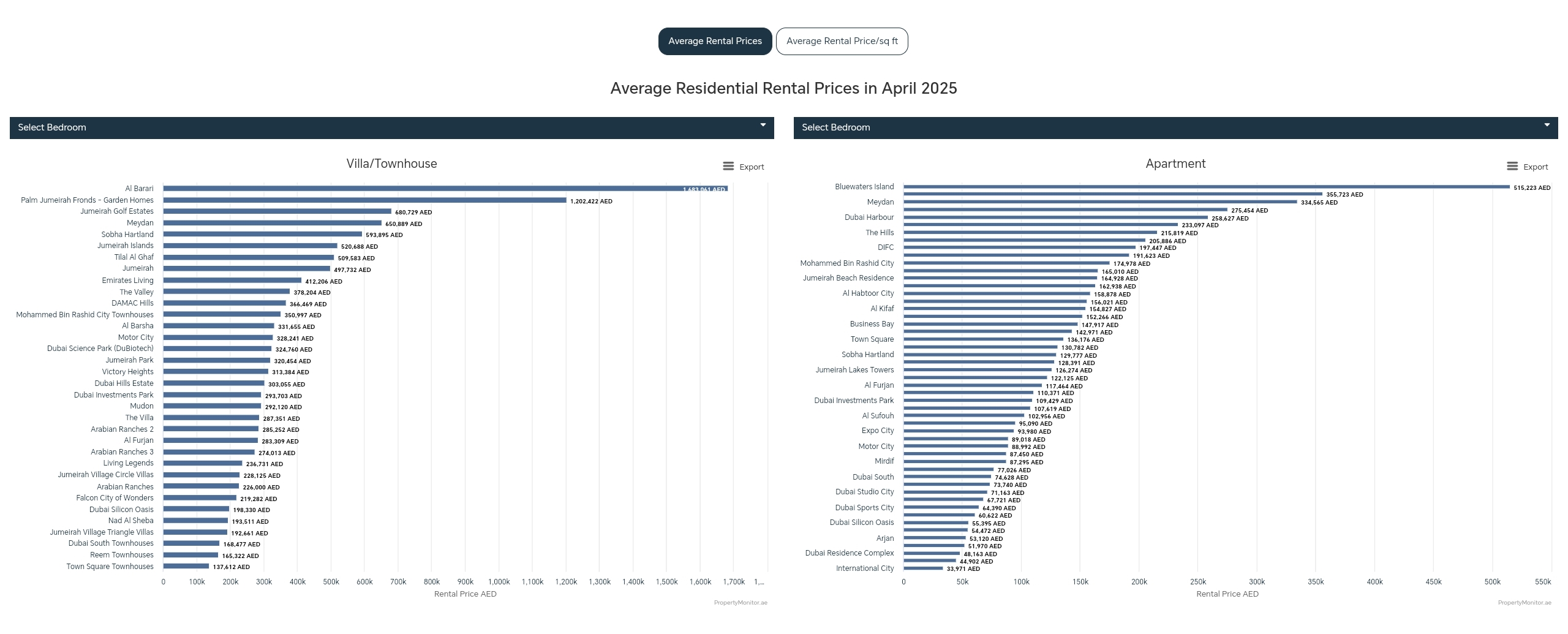

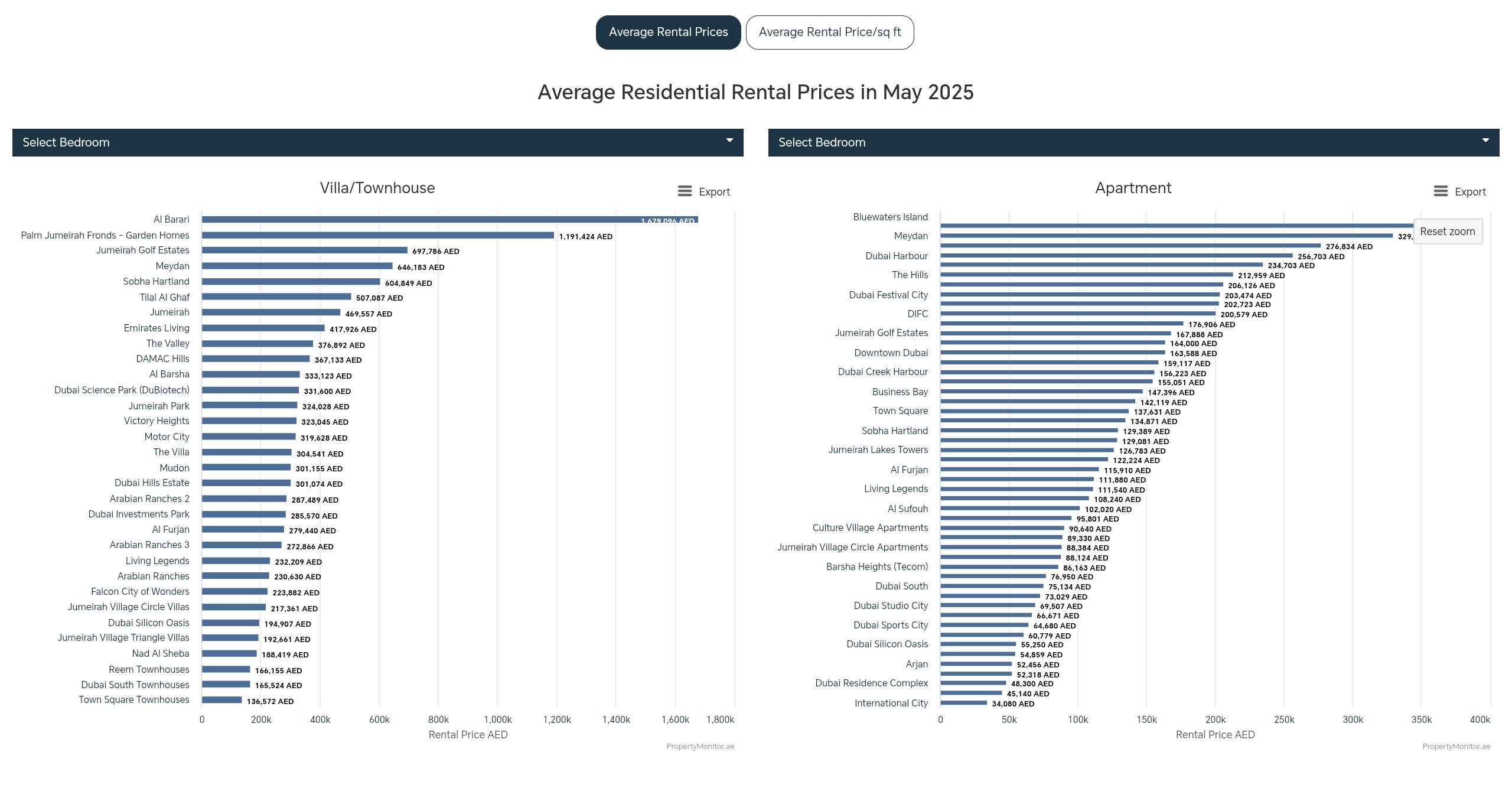

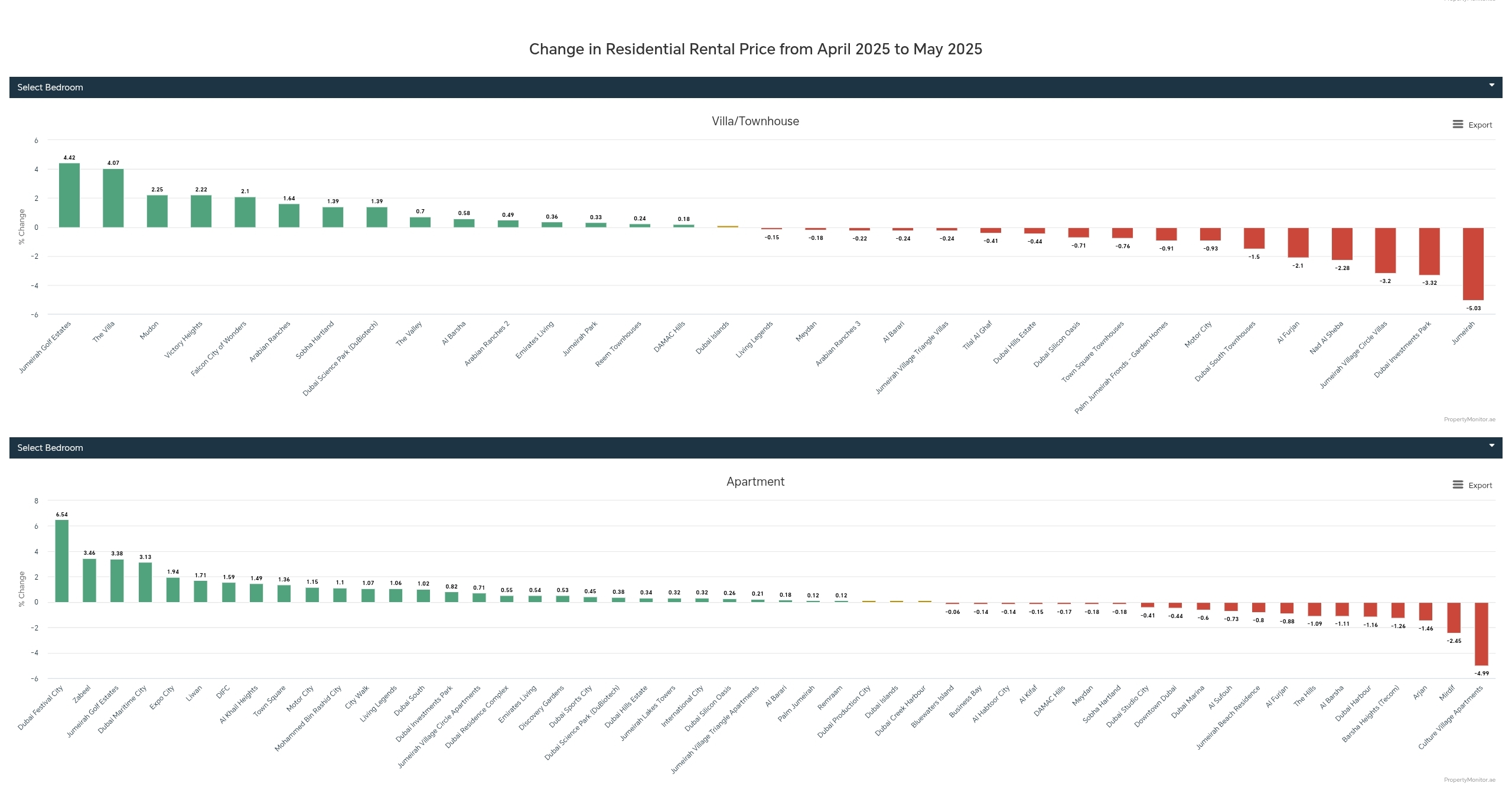

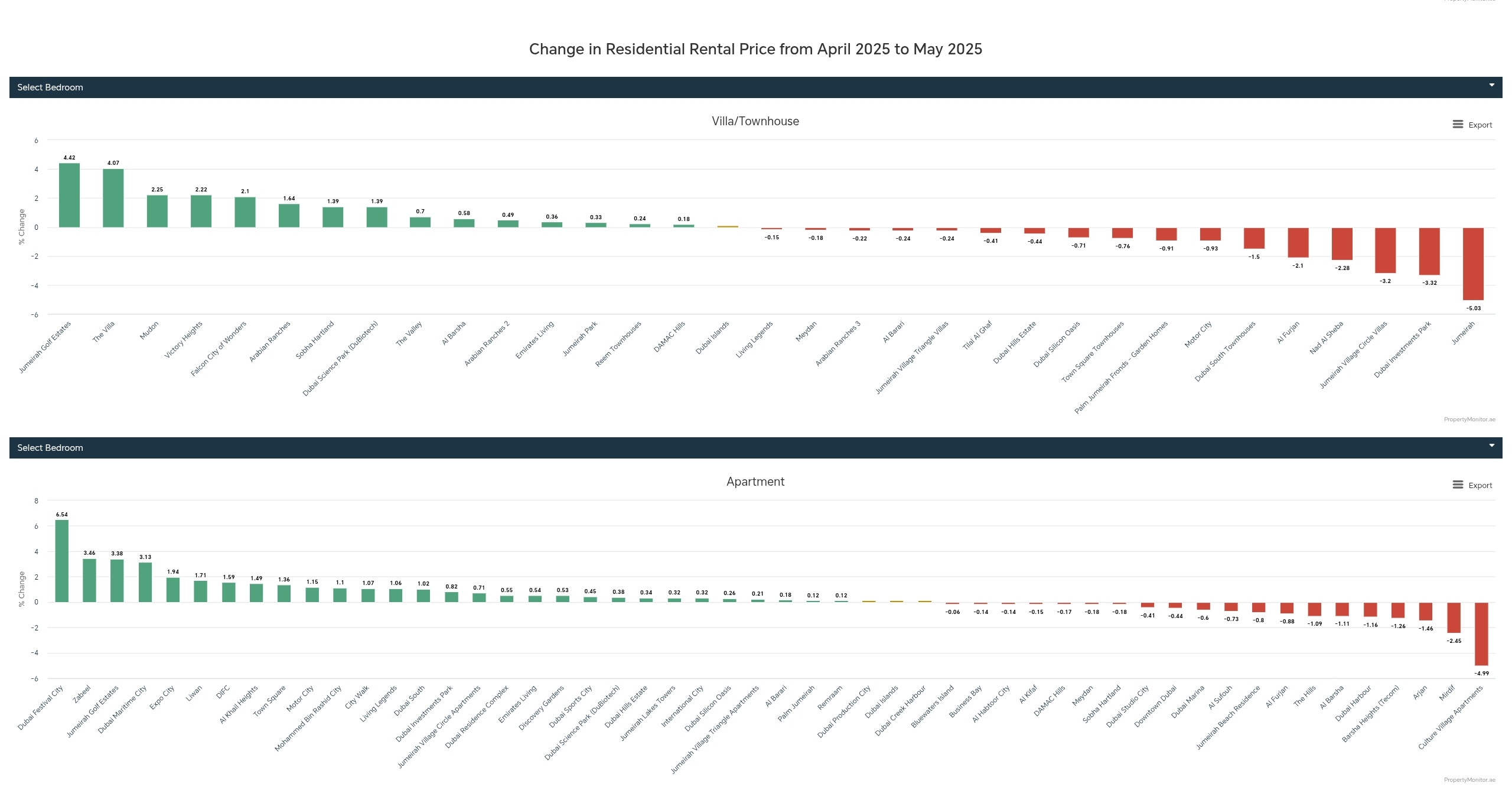

Rental trends:

- Renewals rule: Tenants opted for stability, with 61% of Ejari contracts being renewals.

- Ownership beckons: A slight dip in new leases despite population growth suggests a strong shift towards owning.

- Prime picks: Downtown Dubai, Dubai Marina, and Business Bay remained top choices for apartment rentals.

- Community vibes: Town Square, Al Reem, and The Springs led the way for villa and townhouse rentals.

Rental Market Performance:

– Total Rental Value: AED 44 billion, a 17% increase from 2023.

– Total Rental Transactions: 474,358 contracts (2% rise from 2023).

– Rising Rents:

– Villas/Townhouses: AED 315,000 average rent (3% increase).

– Apartments: AED 147,000 average rent (5% increase).

– Tenant Behavior:

– 61% of tenants renewed contracts due to rising rents and lack of supply.

– More tenants moved to suburban areas for affordability and space.

– Payment Flexibility:

– 43% of landlords accepted 3 or more rental cheques, offering tenants more payment options.

Luxury & Prime Property Market

– Ultra-Luxury Sales:

– 347 homes worth over $10 million sold in 2024.

– Palm Jumeirah led the luxury segment with top transactions reaching AED 275 million.

Top Luxury Sales:

– Palm Jumeirah (The One) – AED 275M

– Jumeirah Bay Island – AED 240.5M

– Palm Jumeirah (The Fronds) – AED 216M

– Prime Property Demand:

– Dubai continues to attract high-net-worth individuals (HNWIs).

– Limited supply in Palm Jumeirah, Emirates Hills, and Downtown Dubai has driven prices higher.

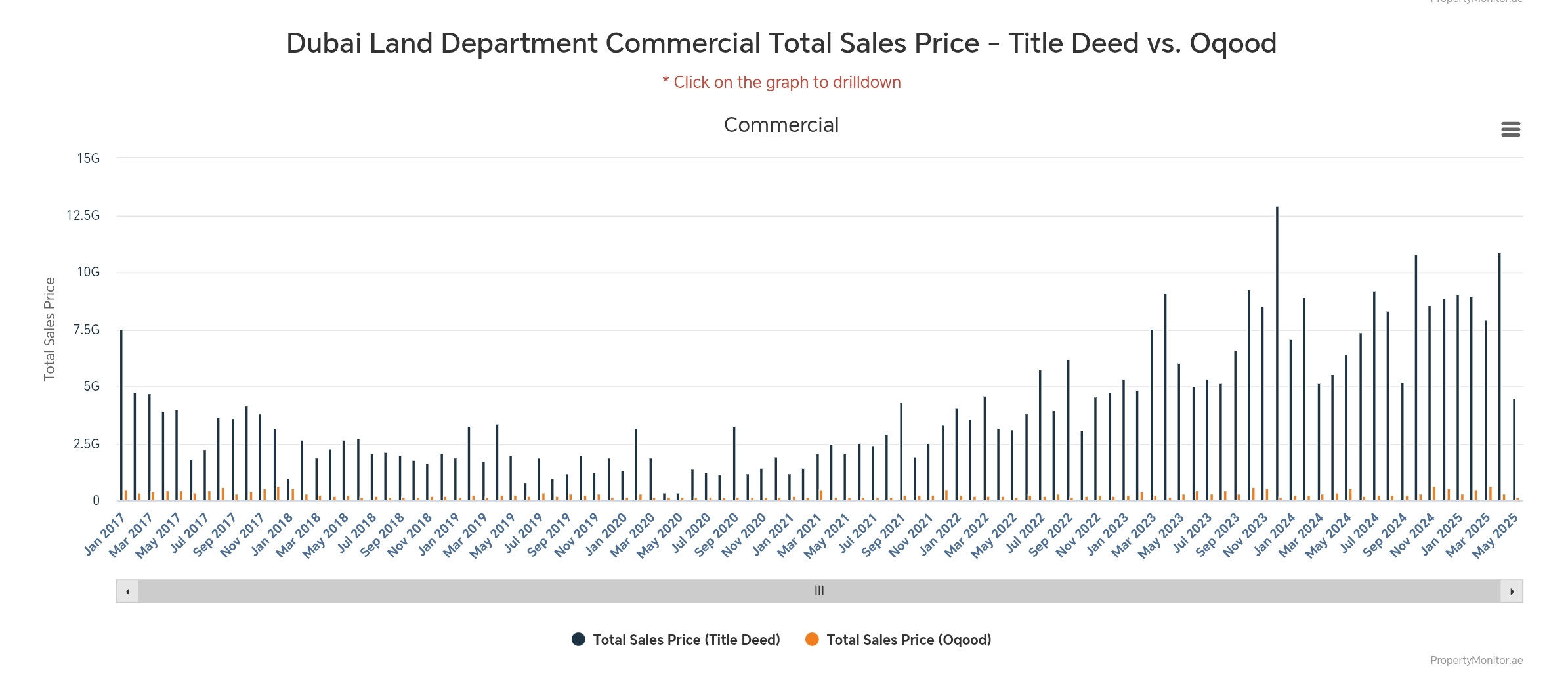

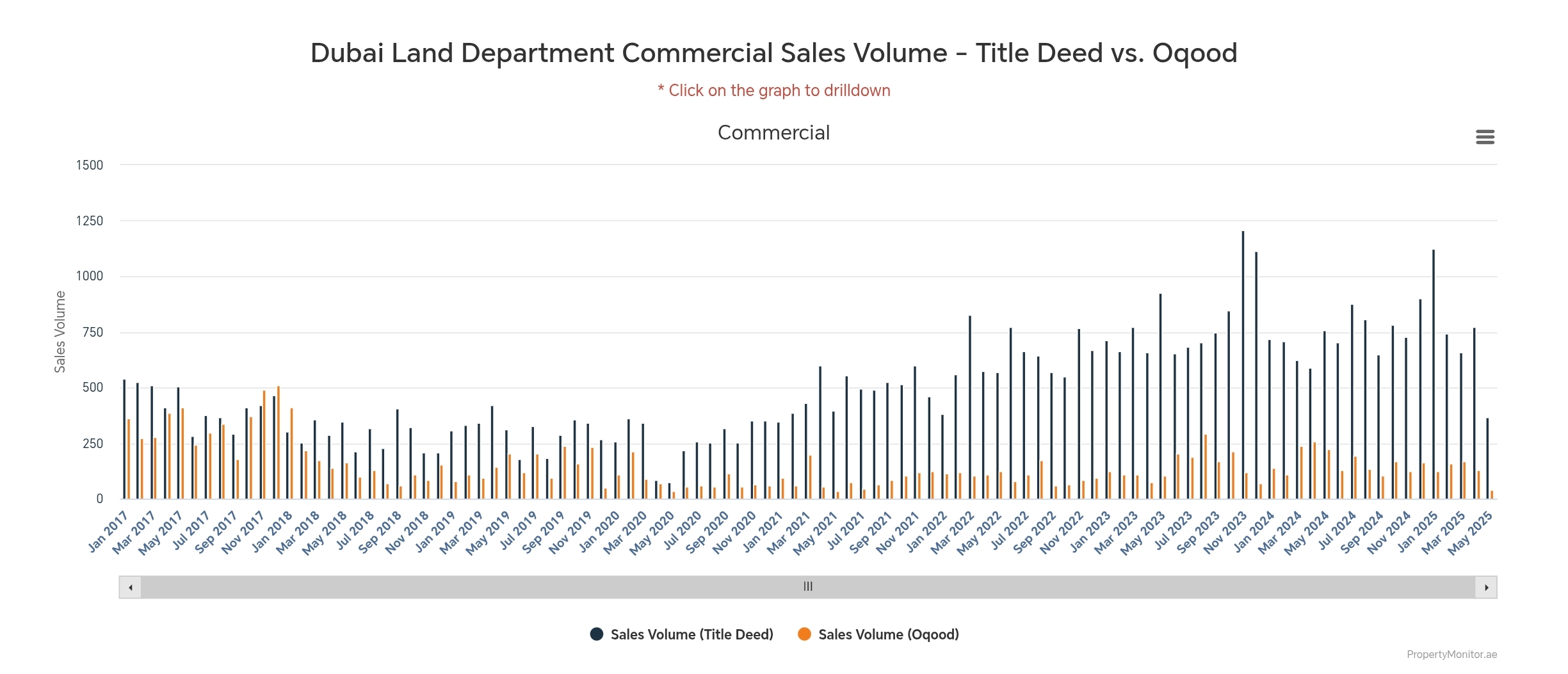

Commercial Real Estate & Market Outlook

– Commercial Property Boom:

– Office occupancy exceeded 90%, with limited new supply.

– Demand for Grade A office space continues to drive prices up.

– 2025 Outlook:

– Continued price growth expected (6-10%) due to strong demand.

– More off-plan projects likely to launch to balance supply shortages.

– Rental prices to remain high, though landlords may offer more flexible payment terms.

Conclusion

Dubai’s real estate market in 2024 broke multiple records, with strong demand for off-plan properties, rental market resilience, and luxury home sales soaring. Limited supply, high investor confidence, and strong population growth will likely sustain market momentum into 2025.

The Dubai real estate market in 2023 saw record-breaking growth, with a surge in sales transactions, rental demand, and property prices.

Sales Market Performance

– Total Sales Value: AED 407.8 billion, a 56% increase compared to 2022.

– Total Sales Transactions: 131,055 units, a 36% rise from 2022.

– Off-Plan vs. Secondary Market:

– Off-Plan Transactions: 71% of sales volume (dominant segment).

– Secondary Sales: 49% of sales value (significant appreciation in ready properties).

– Luxury Market: Dubai ranked N°1 globally for residential sales over $10M, with 377 transactions.

Rental Market Trends

– Total Rental Value: AED 36 billion, a 15% increase from 2022.

– Rental Prices:

– Villas/Townhouses: AED 305,000 average rent (9% increase).

– Apartments: AED 140,000 average rent (16% increase).

– Tenant Preferences:

– 42% renewed existing contracts (supply shortage).

– Shift towards suburban communities due to rising central Dubai rents.

– Increase in branded residences, commanding up to 100% higher rents.

Conclusion

Dubai’s real estate market broke records in 2023 and is expected to continue its upward trend in 2024, driven by strong investor confidence, luxury property demand, and mortgage affordability. However, rental affordability remains a challenge, with high demand keeping rents elevated.

What factors are driving Dubai’s continued growth?

Dubai’s population grew by 150,000 in 2024, with even more expected in 2025. With only 29,000 new units handed over, demand continues to outpace supply, driving property appreciation. Some projects slated for completion in 2025 may face delays, pushing handovers into 2026.

For the past two decades, consistent population increase has driven significant demand for property. As Dubai’s expansion continues, Off Plan properties remain a dominant force in the market. Even individuals without intentions to reside in the city are investing their funds here, acknowledging the worth and almost certain profit. Dubai’s rental yields outperform many global cities, offering returns up to 7-8% higher.

The ongoing improvement of infrastructure and connectivity in Dubai, including the expansion of metro lines and plans to enhance accessibility to Abu Dhabi, highlights the city’s unwavering commitment to growth. Infrastructure serves as the backbone of a thriving economy, and as Dubai continues to invest in and nurture its infrastructure, this progress will undoubtedly be reflected in its sustained economic growth and global prominence.

_________________

AI-DATA-DRIVEN PROGNOSIS:

Luxury Real Estate Market Forecast: Best Investment Areas in Dubai for 2025

Dubai’s premium real estate market continues to attract high-net-worth investors, with strong capital appreciation and stable rental yields. With an anticipated 8% market growth in 2025, focusing on exclusive high-quality projects in well-organized communities will ensure maximum returns and asset appreciation.

Market Overview for 2025:

According to leading market analysts:

Dubai’s GDP growth is projected at 6.2%, strengthening investor confidence.

Property prices are expected to rise by 8-10%, particularly in premium areas.

Luxury real estate demand is increasing, driven by global investors and the UAE’s Golden Visa program.

Best Areas for Investment in 2025

For discerning investors, selecting prime locations with strong ROI potential is crucial. Below are the most promising areas for luxury real estate investments in Dubai.

1. Downtown Dubai & DiFC – The Business & Lifestyle Hub

✔ ROI: 5-6%

✔ Projected Price Growth: 8-10%

✔ Why Invest?

Downtown Dubai remains one of the most sought-after addresses, home to Burj Khalifa, Dubai Mall, and The Opera District. High demand for short-term rentals and premium apartments makes it a stable investment.

2. Waterfront destinations – High Rental Demand

✔ ROI: 6-7%

✔ Projected Price Growth: 7-9%

✔ Why Invest?

This waterfront district offers a unique blend of luxury living and entertainment. With Marina Walk, beach clubs, and a vibrant nightlife scene, it attracts both residents and short-term visitors, ensuring a strong rental market.

3. Palm Jumeirah – Ultra-Luxury Waterfront Living

✔ ROI: 5-6%

✔ Projected Price Growth: 8-10%

✔ Why Invest?

Palm Jumeirah’s exclusivity and branded residences make it an iconic investment destination. High demand for luxury villas and serviced apartments guarantees capital appreciation.

4. Jumeirah – Exclusive Beachfront Villas and fresh Heavy-Lux Residences

✔ ROI: 4-5%

✔ Projected Price Growth: 6-8%

✔ Why Invest?

As one of Dubai’s oldest and most prestigious districts, Jumeirah offers privacy, beach access, and proximity to Downtown Dubai. Luxury villas here are in high demand among UAE residents and expatriate families.

5. Green & Gated Communities based mostly on villas

✔ ROI: 6-7%

✔ Projected Price Growth: 7-9%

✔ Why Invest?

Master-planned luxury communities with such features as a sport areas, golf course, parks, top-tier schools, and shopping centers.

Investors benefit from a high-end tenant base and growing demand for spacious residences.

___________________

*Disclaimer:

All real estate forecasts and AI-based insights are for informational purposes only and do not guarantee actual market performance.

___________________

Expert Investment Recommendations

Prioritize exclusive projects from reputable developers.

Analyze infrastructure and demand, ensuring long-term growth.

Calculate potential ROI & capital appreciation before committing.

Consider long-term investments (5-10 years) for maximum wealth accumulation.

- Contact trusted Broker for assisting you in the journey, as they have insiders informations.

Conclusion

Investing in Dubai’s premium real estate sector offers exceptional returns and long-term capital growth. By selecting well-organized communities with high-quality projects, investors can benefit from both rental income and increasing asset value.

Looking for exclusive off-market opportunities? Contact us for expert guidance on the best investment deals in Dubai.

Get in Touch Today!

VISION for 50 years ahead

The UAE Centennial Plan 2071 is a long-term, full-vision plan that extends for 5 decades after 2021. It forms a clear map for the long-term government work, to fortify the country’s reputation and its soft power. The plan aims at investing in the future generations, by preparing them with the skills and knowledge needed to face rapid changes and to make the UAE, the best country in the world by the next centennial in 2071.

H. H. Sheikh Mohammed bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai launched UAE Centennial Plan 2071. It is a long-term, full-vision plan that extends for 5 decades after 2021. It forms a clear map for the long-term government work, to fortify the country’s reputation and its soft power.

The plan aims at investing in the future generations, by preparing them with the skills and knowledge needed to face rapid changes and to make the UAE, the best country in the world by the next centennial in 2071.

Pillars of UAE Centennial 2071

The UAE Centennial 2071 is based on four pillars as follows:

Future-focused government: The objectives of the government under UAE Centennial 2071 include establishing the government of the UAE as the best government in the world, with a long-term vision and inspirational leadership that anticipates and prepares for the future. Other objectives include achieving happiness in society and spreading positive messages internally and to the world and developing mechanisms for monitoring long-term variables in various sectors.

Excellent education: Regarding education, UAE Centennial 2071 highlights the importance of excellent quality of education. Certain areas of focus in education include advanced science and technology, space science, engineering, innovation and health sciences. Other educational measures include teaching students, mechanisms for discovering their individual talents early. On the institutional level, educational institutions are encouraged to be incubators of entrepreneurship and innovation and to be international research centres.

A diversified knowledge economy: The UAE’s economy is aimed to be competitive and one of the best economies worldwide. This can be achieved by increasing productivity of national economy, support of national companies, investment in scientific research and promising sectors, focus on innovation, entrepreneurship and advanced industries, development of a national strategy to shape the future of the UAE’s economy and industry, and place the UAE among international important economies. Knowledge economy can be achieved by a generation of UAE inventors and scientists and supporting them in technical sciences.

A happy and cohesive society: Community development is an integral part of UAE Centennial 2071. Some objectives in this regard include establishing a secure, tolerant, cohesive and ethical society that embraces happiness and a positive lifestyle and a high quality of life. The pillar also focuses on developing programmes to prepare future generations to serve as the UAE’s goodwill ambassadors, as well as promoting women’s participation in all sectors, making the UAE one of the best places to live in.

Its programme includes:

- fortifying the country’s reputation

- diversifying the imports and the exports by relying less on oil

- investing in education focusing on advanced technology

- building Emirati values and ethics for the future generations

- raising productivity of the national economy

- enhancing society’s cohesion

The plan was based on the lecture given by H. H. Sheikh Mohammed bin Zayed Al Nahyan, the then Crown prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, in which he spoke about the strategies that will guarantee the development and happiness of the future generations for decades.

🌍 Dubai isn’t just building skyscrapers — it’s building the future.

The Dubai 2040 Urban Master Plan sets a clear, bold path: to become the world’s best city for living, business, and sustainability.

Here’s what every smart investor needs to know:

🏙️ 60% of Dubai’s land will be dedicated to nature reserves and recreational areas.

🚆 Increased focus on mobility: more metro lines, green transport, and smart connectivity.

💼 Business-friendly policies will make Dubai a global hub for innovation and remote work.

🏖️ Coastal development will enhance lifestyle appeal with luxurious beachfront communities.

🌐 Population growth from 3.5M to 5.8M by 2040 = continuous demand for premium real estate.

📈 Why it matters for investors:

More people. More tourism. More infrastructure. More value.

Premium properties in future-ready districts like Dubai Creek Harbour, Dubai Harbour, and Madinat Jumeirah Living will surge in demand.

💡 Dubai is not a trend — it’s a trajectory. The best time to align with that vision is now. Is now the right time to invest in Dubai real estate?

Let’s look at the facts — not the hype. 👇

Dubai continues to attract global investors with high ROI, zero income tax, and the most ambitious urban vision of the next decades.

But smart investing means knowing both opportunities and risks. In this post, we break down:

🔹 Why 2025 is a strategic entry point

🔹 Key benefits and real challenges

🔹 Expert tips to protect and grow your capital

💬 Have questions about timing, locations, or developer trustworthiness? Drop them below or DM us — we respond personally.

Dubai, known for its iconic architecture and rapid urban development, is at a significant turning point after the Conference of the Parties (COP28).

Focused on sustainability and climate change, this event motivated regional leaders to adopt greener policies that directly affect the real estate sector.

Let’s take a look at how these sustainability goals shape investment opportunities in the Dubai real estate market.

1. COP28 Context

COP28, held in 2023, brought together countries, businesses and organizations from around the world to address the climate crisis together. Dubai not only hosted the event, but also committed to becoming a leader in sustainability.This commitment translates into a renewed focus on construction and urban development, where sustainable practices are no longer just a trend, but a necessity. The results of COP28 highlighted the importance of integrating sustainability into all sectors, including real estate.

2. Trends in the Dubai real estate market

• Sustainable construction: After COP28, developers are starting to focus more on practices that minimize the impact on the environment. This includes the use of recycled materials, renewable energy sources and efficient designs. Properties that meet standards such as LEED (Leadership in Energy and Environmental Design) are becoming increasingly popular and valuable.

• Government and initiatives: The government of Dubai promotes sustainability through tax incentives for developers and regulations that require the use of green technologies. In addition, ecological zones are being created and projects focused on renewable energy are supported.

• Consumer preferences: Buyers are showing increasing environmental awareness and are looking for sustainable and aesthetically appealing properties. This forces developers to adopt greener approaches in their projects.

3. Investment opportunities in the sustainable real estate market

• Eco-friendly housing projects: This segment has significant growth potential as it meets environmental regulations and attracts buyers focused on sustainable lifestyles. Investing in these properties can offer attractive long-term returns due to rising demand.

• Green infrastructure: Investing in projects that support green infrastructure, such as parks and sustainable transportation systems, benefits the community while potentially increasing property value in the future.

• Sustainable commercial buildings: The demand for offices and commercial spaces that meet sustainability standards is constantly growing. Companies are trying to reduce their carbon footprint, making these investments a strategic decision for the future.

4. Challenges to consider

While there are great opportunities, investors should keep some challenges in mind:

• Initial costs: Investments in sustainable real estate may require higher start-up capital. However, it is important to consider long-term energy and maintenance savings.

• Changing regulations: The regulatory framework around sustainability can evolve. Investors need to be informed about current regulations to ensure that their investments remain viable.

• Market education: There is a need to educate consumers about the benefits of sustainable real estate. Investors should be prepared to communicate these benefits effectively.

5. The importance of innovation

Innovation is the key to success in the sustainable real estate market. From building technologies to renewable energy solutions, investors need to be open to new ideas and approaches. Collaboration with startups and technology companies can bring a significant competitive advantage.

Dubai’s real estate market is undergoing a transformation driven by the sustainability goals set at COP28. Investors who recognize and adapt to these trends They will be able to benefit from the growing sector., which not only offers economic returns, but also contributes to a sustainable future.

With an emphasis on innovation, market education and collaboration, the lights are opening future for real estate investment in Dubai, full of opportunities.

– THE LAND OF EXTRAVAGANCE

The City of Gold has attracted global attention with its record-breaking developments, and the luxury real estate market is no exception.

• In November 2023, a 5-bed penthouse in Como Residences was sold for AED 500 million, becoming the most expensive penthouse in Dubai.

• In May 2023, a penthouse in the Jumeirah Marsa Al Arab sold for AED 420 million.

• In February 2023, a penthouse was sold for AED 410 million in Bulgari Lighthouse, Jumeirah Bay Island.

Wonder what is the highest price for Dubai luxury penthouses for sale? Let’s find out.

SKY MANSION – BUGATTI RESIDENCES

– AED 750 MILLION!

The top 11 floors in French Riveria-inspired Bugatti Residences by Binghatti consist of Sky Mansions or penthouses, which fully occupy the entire floor! Even more interesting is that penthouse owners will be able to drive their super-luxury vehicles to their apartments.

What will be the price tag of a luxury mansion penthouse branded by Bugatti – one of the world’s most expensive cars? Well, as announced by BinGhatti’s CEO Muhammad Bin Ghatti, a 44,214 sq. ft. Bugatti Residences penthouse in Business Bay is priced at a whopping AED 750 million, making it the most expensive property to ever go on sale in Dubai.

COMO RESIDENCES PENTHOUSE

– AED 500 MILLION

A penthouse in Palm Jumeirah’s Como Residences was sold for a record-breaking AED 500 million, making it the most expensive penthouse ever sold in Dubai and the third most expensive in the world.

The five-bedroom Como Residences penthouse spans 21,949 sq. ft. and features an exclusive private elevator, a state-of-the-art home automation system and floor-to-ceiling windows that offer breathtaking panoramic views of the Arabian Gulf and iconic skyscrapers. Nakheel is developing the project, which is expected to be completed in Q3 2027. The development is likely to attract sophisticated buyers seeking a luxurious lifestyle.

JUMEIRAH MARSA AL ARAB PENTHOUSE

– AED 420 MILLION

Jumeirah Marsa Al Arab’s penthouse sale also created a record for the most expensive penthouses in the city.

The impressive 24,628 sq. ft. property is based on the entire top floor of Marsa Al Arab.

Outdoor areas spanning 17,000 sq. ft include a private pool with breathtaking 360-

degree ocean views.

Residents will have exclusive entry through a private lobby and two lifts for unparalleled privacy and security. Plus, the newly constructed superyacht marina is just a stone’s throw away, adding to the opulence of this majestic penthouse.

SKY VILLA AT THE BULGARI LIGHTHOUSE

– AED 410 MILLION

A nine-bedroom Sky Villa in Bvlgari Lighthouse was sold for AED 410 million.

Counted among the top branded residences in Dubai, Bulgari Lighthouse by Meraas Dubai Sky Villa has nine bedrooms, a private study, a family room, double-height formal living spaces, a private gym, a spa and a full-service kitchen. Additionally, there will be a private swimming pool and a rooftop garden. The villa will be accessible via a private elevator, while a feature staircase will connect the three internal floors.

AVA DORCHESTER COLLECTION PENTHOUSE AT PALM JUMEIRAH

– AED 220 MILLION

Dubai’s ultra-luxury home market is no stranger to record-breaking deals. In May 2023, the most expensive Palm Jumeirah penthouse was sold for AED 220 million. This shell-and-core mega penthouse at AVA by Omniyat is part of the developer’s esteemed Dorchester Collection.

Aptly termed Sky Palace, it is based on the topmost floor of AVA, Dorchester Collection, spanning a massive 33,406 sq ft. When sold, the penthouse was in shell-and-core condition. This means the buyer can design the home of their dreams, which occupies four floors.

Talking about AVA penthouses for sale features, you have a 360-degree infinity lap pool, an indoor garden across four levels and a roof terrace with striking views of Palm Jumeirah.

OTHER LUXURY PENTHOUSES IN DUBAI

TOP FLOOR PENTHOUSE IN VOLANTE TOWER, BUSINESS BAY

– AED 183.6 MILLION

The top-floor Volante penthouse for sale in Business Bay is the next entry on our list of the most expensive penthouses in Dubai.

This Volante Tower full-floor, 4-level penthouse came with a 10-seater cinema, a private lift, underground parking, a private study, and a luxurious master bedroom. The attention to detail and luxury finishes made this penthouse genuinely exceptional.

RAFFLES THE PALM TRIPLEX PENTHOUSE

– AED 153.1 MILLION

Next on our list is the triplex penthouse at Raffles The Palm, priced at AED 153.1 million.

Having received a makeover by YODEZEEN architects, the 6-bedroom property had interiors furnished with top-of-the-line brands such as B&B Italia and Cattelan Italia.

The penthouse’s most striking feature is the circular rooftop terrace with lavish

landscaping and lounge area. The second floor features another private terrace, offering panoramic views of the Arabian Gulf, a private swimming pool and three well-sized bedrooms.

4-BED PENTHOUSE AT BULGARI RESORT AND RESIDENCES

– AED 122 MILLION

A 12,000 sq. ft. 4-bedroom penthouse in Bulgari Resort and Residences became the most expensive ready penthouse to be sold in the emirate for AED 122 Million.

PENTHOUSE AT ONE PALM – AED 102 MILLION

One Palm, developed by Omniyat, is a prestigious residential building on the Eastern tip of the Palm Jumeirah trunk. The penthouse in One Palm was sold for AED 102 million, highlighting the immense demand for luxurious properties in the city.

The One Palm penthouse offers a grandeur living experience, spanning an impressive 29,800 sq. ft.

5-BEDROOM PENTHOUSE AT RAFFLES THE PALM

– AED 75.6 MILLION

Another extraordinarily expensive penthouse sold in Dubai was the 5-bed unit at Raffles The Palm. With an impressive 790 sq. ft. private terrace, it had sunbathing areas, a private swimming pool, and an al fresco setting perfect for hosting private events and social gatherings.

The expansive open-plan living room and dining areas overlook the terrace. The show kitchen with top-of-the-line appliances creates a social space for large and small gatherings. The penthouse also includes a private study room, lobby, powder room and four en-suite bedrooms with balcony access.

The master bedroom suite boasts a large walk-in wardrobe and an en-suite master

bathroom. The penthouse’s luxurious design and stunning outdoor spaces make it an ideal choice for those seeking waterfront living.

Where they are located?

Emirates Hills, often called the “Beverly Hills of Dubai,” is an exclusive gated community nestled around the scenic Montgomerie Golf Club. Investors can find sprawling villas and palatial mansions that exude sophistication and elegance when living in Emirates Hills. With lush greenery, serene lakes, and a championship golf course, Emirates Hills offers a tranquil retreat for HNWIs.

Palm Jumeirah is also famous destination of Premium properties.

WHICH WAS THE MOST EXPENSIVE VILLA EVER SOLD IN DUBAI?

A villa on Frond N was one of the most expensive properties sold in PALM JUMEIRAH, reportedly purchased for AED 600 million by Indian Reliance Group chairman Mukesh Ambani from the family of Kuwaiti businessman Mohammed Al-Shaya, according to a Bloomberg report.

The Palm Jumeirah Plot and built-up areas have managed to sell for Dh600 million, according to the most recent weekly data from the Dubai Land Department. Frond N’s plot measures just under 59,600 square feet, confirming the island’s reputation as the area in Dubai where mega-sized transactions are the order of the day. Land on the Palm that sold for Dh206.52 million was the next most expensive transaction.

Industry sources claim that the Dh600 million deal also reportedly includes a villa, with the price per square foot coming to more than Dh10000. According to the source, anything done these days on the Palm is extremely expensive. “Palm will continue setting records for a while.”

In August of the same 2022 year, Indian billionaire Mukesh Ambani’s company, Reliance Industries, bought an $80 million (Dh294 million) beachfront villa in Dubai, the city’s largest residential real estate deal ever.

The company bought the property, located on Palm Jumeirah, for Ambani’s younger son, Anant.

It’s a ten bedroomed, custom-built villa on Palm Jumeirah. This enormous contemporary white villa features a huge 33,000sq ft of state-of-the-art living space, seven-star spa hotel facilities, (including a gym and a hair salon), imported and handpicked book-matched Italian marble, all furnished by uber-lux Italian furniture houses Giorgetti and Minotti.

THE MARBLE PALACE, EMIRATES HILLS

AED 425 MILLION

Originally listed for Dh750 million, The Marble Palace covers 60,000 square feet of interior space on a 70,000 square-foot plot in one of Dubai’s most exclusive gated communities.

The property has five bedrooms, an indoor and outdoor swimming pool, two domes, a 70,000-liter coral reef aquarium, a private substation for power supply, and fortified emergency rooms. A garage capable of housing 15 luxury vehicles complements the estate’s exclusivity.

The construction of The Marble Palace took nearly 12 years, concluding in 2018, with an estimated Dh 80 million to 100 million invested in Italian stonework alone. Its interiors feature 70,000 gold-leaf sheets and an array of rare artifacts.