F.A.Q. & GUIDES

Here you can find answers to the most popular questions about Dubai real estate investments.

If your question remain without answer, or it’s unclear for you, we’ll be glad to help you on a private consultation.

GROWING POPULATION

Dubai is one of the fastest growing cities in the world with a population that has grown by 1000% in just 40 years. As of 2024, Dubai has approximately 3.48 million residents, most of whom are expats from over 190 countries. This figure is projected to double in the next decade.

0% INSTALLMENT PAYMENT PLAN

All developers in Dubai provide interest-free installments for up to 10 years, with a down payment of just 10% up to 20%.

TAX HEAVEN

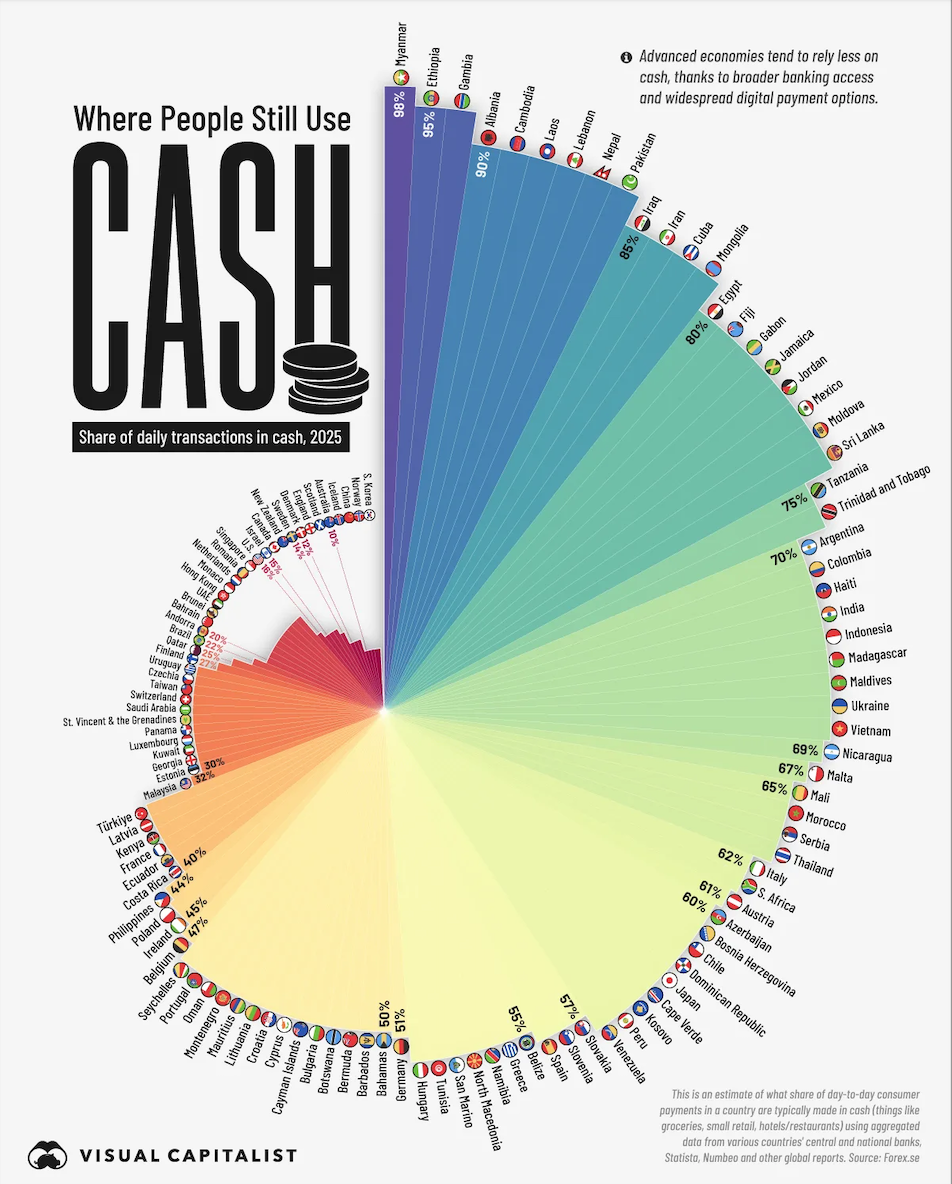

Most areas of activity in the UAE, particularly Dubai, are tax-free, and there are 46 free zones across the country. The UAE does not levy income tax on individuals and the property tax transfer from DLD ( Dubai Land Department) is 4% of the total property cost.

SAFETY AND STABILITY

The UAE is one of the safest countries in the world. In 2017, the World Economic Forum ranked the UAE as THE 3rd SAFEST COUNTRY IN THE WORLD.

REGULATED MARKET

All payments are facilitated through an Escrow account.

Dubai has a Real Estate and Regulatory Agency (RERA) which enforces strict rules and regulations. Foreign investors are protected by an effective legal system.

STRATEGIC LOCATION

Dubai’s strategic location reaches nearly 70% of the world’s population within an 8-hour flight. This makes Dubai International Airport the busiest international passenger hub in the world, with approximately 92.3 million people passing through in 2024.

Over 1200 hotels showing occupancy level about 80%.

WORLD-CLASS INFRASTRUCTURE

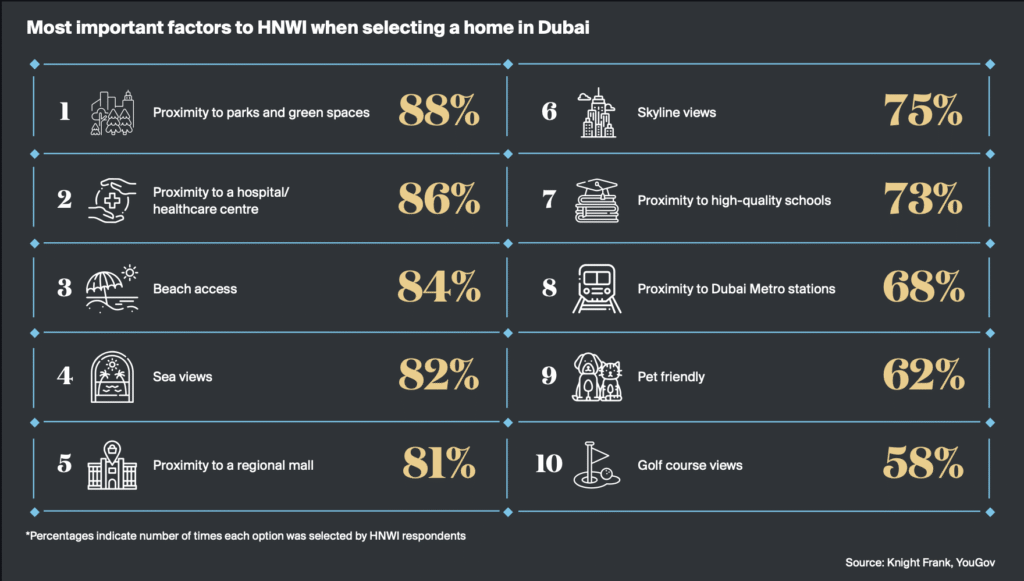

Dubai is a modern world-class city with record-breaking skyscrapers, noisy mega malls and high-tech transport infrastructure. The Dubai Metro is the world’s longest unmanned metro network, and the city’s infrastructure continues to rapidly expand with mega projects.

HIGH QUALITY STANDARDS, BIG CHOICE OF ENTERTAINMENT

Human life expectancy is above 83 years.

Dubai offers an incredible range of activities, such as desert safaris, luxury spa experiences, boutique shopping, wildlife viewing, skydiving, thrilling water park rides and lots of Michelin restaurants, dinner shows… In few years in Ras al Khaima will open the first Casino of UAE.

STABLE EXCHANGE RATE

The dirham/dollar exchange rate has remained unchanged for 45 years at 3.65 AED/$.

GOLDEN VISA

The UAE government has introduced a number of visas for property owners. Investors who purchase real estate worth at least 750,000 dirhams ($204,000) can obtain a residence visa for a period of 2 years. For property purchases over 2 million dirhams (545 thousand dollars) a GOLDEN VISA for 10 years can be obtained.

OPENMINDED INTERNATIONAL VIBE

85% of Dubai’s population are expats.

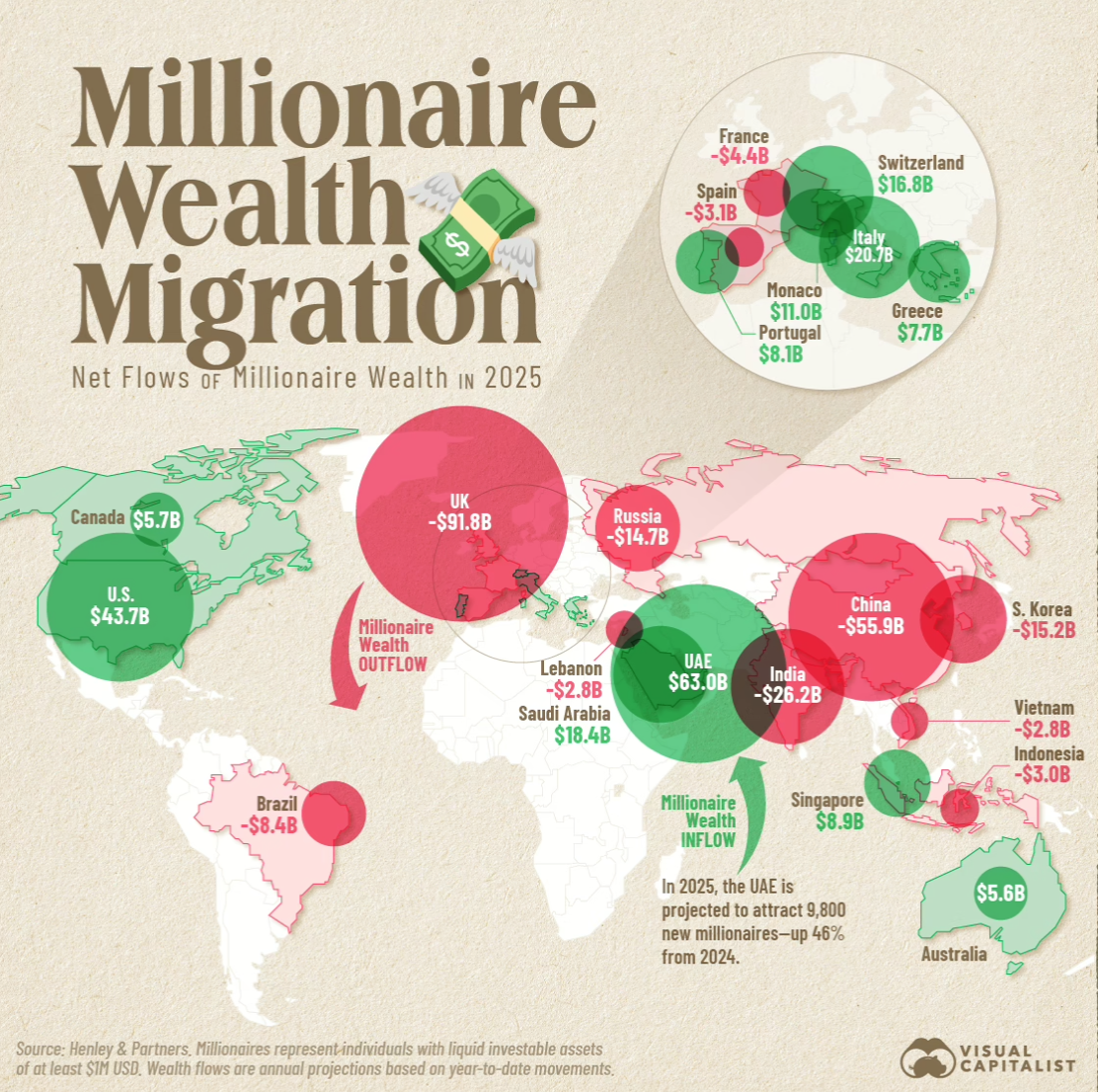

Let’s look at Facts and think logically.

Dubai Property Market is 20 years old now. And now we are facing a huge difference in terms of timeline and purpose of purchase. Instead of investors, 80% of current buyers are endusers, who going to live in UAE by themself. Till 2008 Market was speculative (with just 10% of DownPayment, no regulatory such a Dubai Land Department, no 4% DLD-registration, mortgages was available for off-plan… Smart investors were doing Flipping fast and very successfully. Time passed.

Since then, Schools and Medicine become remarkable better. Safety! There are no many places in the world where you can leave your car or house doors open, coming back in few weeks and everything gonna be fine. It’s much more civilized place now. Lot’s of people are moving here. It’s a worlds safe heaven, people are choosing to relocate and start new life here.

Population and quality of live significantly increased since early 2000. In 2005 it was 1,2 mln of residents. Now we have 3,6 mln of population. At 2040 it’s predicted about 8mln. By 2030 – 5 mln of residents.

Rents are increasing non-stop every single quarter since Covid. Rents are never go up during Oversupply. They are going up only in Undersupply situation. And they are continue to go up, even at low season, during hot summer. With such a high Demand you think prices could start to go down? Demands are making the market.

Fast rising prices is an indicator, right, but not the full picture. Only when Economy of the market, where prices of property are rising, is staying flat without changes, of course, the correction will come. In UAE we have a new growing Megapolis, word financial Hub, attracting people, increasing population, and we are undersupply of available property on the market.

Economy here is growing equal to grows of the property prices, it’s not separated, here their lines having similar parallel pattern. 50k families coming to live here, and we are delivering only 30-40k units/year. We are at Undersupply for at least next 10years, especially for units of big size.

According to Global Research by Swiss UBS bank, Dubai is in a safe zone.

It can have several implications for UAE real estate prices, particularly in the premium and investment property segments. Here’s how it could play out:

🔁 1. More Buying Power for Non-USD Investors

Investors with EUR, GBP, CNY, or other strong currencies will see increased purchasing power in the UAE, where the AED is pegged to the USD.

As the dollar weakens, buying property in UAE becomes cheaper for them, making Dubai even more attractive for European and Asian investors.

✅ Impact: Likely increase in foreign capital inflows, especially from investors seeking dollar-hedged assets with high ROI potential.

💰 2. Safe Haven Appeal of AED-Pegged Assets

In times of USD weakness and currency volatility, currency-pegged and tax-free jurisdictions like the UAE become safer stores of wealth.

Investors may reallocate capital from unstable currencies or inflation-prone markets into real estate in dollar-linked economies like the UAE.

✅ Impact: Higher demand for prime Dubai assets, especially in Downtown, Palm Jumeirah, Dubai Hills, and waterfront areas.

📉 3. Inflation Hedge Behavior

A weaker dollar could lead to global inflationary pressures, particularly if US import costs rise.

Real estate is seen as a hedge against inflation, especially income-generating assets (e.g., serviced apartments, short-term rental units).

✅ Impact: Increased demand for rental-yield properties, especially in communities with strong tourism and digital nomad activity.

🏗️ 4. Construction Costs Might Rise

If the dollar weakens significantly, and UAE imports materials (steel, equipment) from Europe or Asia, construction input costs could increase.

Developers may pass this on to buyers as price increases, especially in off-plan projects.

⚠️ Impact: New launches could come at higher price per sq ft, especially those reliant on imported materials or international contractors.

📈 5. Net Effect on Prices

Short-term: Potential boost in demand from Europe/Asia, supporting or pushing prices higher in premium segments.

Medium-term: If dollar weakness triggers rate cuts in the US, UAE interbank rates might also ease, lowering mortgage costs in AED.

Long-term: Sustained USD weakness could re-rate AED assets upwards, particularly Dubai property, as a stable USD-pegged investment in a no-tax environment.

✅ Overall Outlook:

Bullish for UAE real estate, especially:

Luxury and branded residences

Crypto and fiat-friendly projects

Income-generating units in touristic hubs

Most of new buyers presume that if they will go directly to a developer, they will avoid an agency fee, they assume that they are paying fees to agency/ brokerage company, buying an off-plan property. But it’s a wrong start and misunderstanding the local market. Buying an Off-Plan in UAE, is FREE of Agency Fees, 0% commission.

Experienced Agent will offer you comparable knowledge about all different projects and developers on market, track record, speed and quality of construction, delivery, services, and so on.

Developer could offer you just their current stock, telling that “the Latest is the Greatest”. But if you are buying just a one property, even in a budget, lets say, about 5mln aed, you are not a big fish for them, comparing with their bulk buyers, who are investing about 100k at one time, they will not care about your needs and after-services during the buyers journey.

Besides the help with figuring out what project suit your strategy, your agent will be the one, who manage the entire portfolio of investors, will resell all purchased property for you, guys, rent it out, when the time comes or organize it for you to live in. Agent will be supporting you throwout away. It’s a long term relationship, so you can have a peace of mind.

As an independent Advisor, we could advise you only the best liquidity units, on the best price, meeting the Clients’ expectation.

And moreover, it’s our own interest to catch into our portfolio the best liquid property, because we will be responsible after to resell it for you in future. So we will provide you not only the best market developments availability, but also all related info and analysis, as we personally need all process to be fast, cause we hate to loose and waste a time.

Representing a client, we are looking after his interest. Developers agents are looking after interest of the Developer, they are in charge to sell just all available stock, even undesirable units, cause they are motivated by commission, bonuses. They will never tell you about any negative aspect of the project, will not make a fair comparison analysis.

FINE FINISHING

Absolutely all apartments, even in a low-budget segment, are handovered from a developer with final finishes, which includes:

- Fully fitted bathroom

- Modular kitchen

- Wardrobe furniture

- Ceilings high normally below 3m

Business segment will include also:

- Appliances on kitchen

- Smart home system

- Higher quality of all surfaces

- Ceilings high is around 3m

Premium segment options are usually

- Fully Furnished, including dishes, carpets, bedding, towels, etc.

- Top quality of all elements of design and decor

- Ceilings high is above 3,2m

With each and every unit you are having PARKING slots included in the price.

Normally with Studio / 1-bedroom / 2-Bedrooms apartment you are receiving 1 parking slot. With 3-bedroom apartments – 2 parking slots. 4-berdoom – 3slots, etc, depending on size of apartments as well.

Every single building in Dubai has also minimum amount of AMENITIES:

- swimming pool

- GYM

- kids room

- security

Higher segments has way bigger range of amenities inside the building, and they may vary from SPA, sauna, ice room, golf simulation room, basketball court … till a-la-carte services.

In the Dubai real estate market, there are two prevalent types of property ownership: Freehold and Leasehold.

Freehold ownership gives you total control and ownership of the property without any restrictions. Conversely, leasehold ownership permits you to possess and inhabit the property for a designated duration, usually lasting up to 99 years, after which ownership returns to the freeholder.

While freehold permits perpetual ownership, leasehold allows for a limited ownership period—frequently an extended one. This difference has a considerable impact on property transactions and investment choices, affecting aspects such as property prices, legal entitlements, and potential resale opportunities

7-Step Due Diligence Guide Before Buying Property in Dubai

Dubai’s off-plan market is booming — but not all developers deliver on time.

Before you sign, transfer funds, or believe the brochure, make sure the company behind the project is licensed, experienced, and trustworthy.

This guide walks you through 7 essential checks to protect your capital.

Step 1: Check RERA Registration

Visit [dubailand.gov.ae] and search for the project or developer by name or RERA project number.

You’ll see:

Project status

Escrow account

Legal developer name

If the project isn’t listed — consider some other option.

Step 2: Compare Promised vs Legal Handover Date.

Always ask to see the SPA (Sales Purchase Agreement).

Some brochures show Q4 2025, but the contract says Q2 2026 + 12-month grace period.

✔️ Clarify exact dates and any delay clauses.

Step 3: Look at Past Projects.

Don’t trust renders — ask for:

- Photos of finished buildings

- Exact locations

- Completion dates

Better yet: visit completed projects or talk to existing owners.

Step 4: Escrow Account Verification.

All off-plan deals must go through RERA-approved escrow accounts.

Ask:

- Escrow account number and bank name

- Who manages release of funds (stage-based?)

⚠️ No escrow = high risk

Step 5: Payment Plan Analysis.

Too flexible developer = red flag.

If the plan is 80/20 post-handover or 1% monthly, the project may be underfunded.

✔️ Safer plans link payments to construction progress.

Step 6: Developer’s Legal Entity & Track Record:

Ask:

- What’s the parent company?

- How long have they operated in UAE?

- How many handed-over projects?

- Big branding ≠ big delivery.

Final Tips:

Due diligence isn’t paranoia — it’s protection.

Buying off-plan in Dubai can be profitable, but only if you know who you’re buying from.

EOI

If you want to invest in some specific new upcoming Launch, we can prepare EOI (Expression of interest /in such a form we are highliting your contact details and desired size of the property to proceed with/, which is normally based on transferred amount of Token, fully refundable in case of non satisfied interest. This amount could vary with different developers and projects from 0 up to 10% of announced started prices).

BOOKING

When a project is already launched and you have a chance to choose between available options, next step is to pick the most suitable for your strategy unit and to secure it by the Booking. Amount here also could vary from 5 up to 20% from purchase price of the chosen unit. Usually also here the 4% fee of Dubai Land Department is also should be paid.

SPA

After completed payments of 20%+4% DLD both of sides (Purchaser and Developer) are signing Sales Purchase Agreement, where apart of contact details and specification of the Unit, you can find conditions, which are already reviewed and approved by DLD, so, this part is not changeable.

OQOOD

Developer will register SPA at DLD and you will receive the first Certificate about owning the Property, in .pdf formate, “Initial Contract of Sale” (Oqood).

Then you are proceeding with INSTALLMENTS, accordingly to your PAYMENT PLAN, mentioned in SPA. It’s important to pay on time. Otherwise developer can cancel the agreement and you will lose the purchase. Of cause, this procedure is not so simple, developer will have to rise a case in a Court, it will take a time… but I’m sure you don’t want to heck out details of these process, as at the end you will be the one who lost the money.

NOC

During the construction period (which normally take about 3-4 years), you can resell your property after a certain point of Payment Plan, mentioned in SPA).

SNAGGING

When construction will be completed, the developer will receive BCC (Building Completion Certificate) and you will receive a letter to proceed with last installment and snagging. After it signed, the last step is the:

HANDOVER

After successfully payed and clarified all installments, you are receiving KEYS together with TITLE DEED (the final certificate about your owning rights). *it could be also PRE-TITTLE DEED, if the developer was offering a Post-Handover-PaymenPlan (in this scenario, Tittle Deed will be issued when all installments will be paid)

DOCUMENTS requested for a purchase:

- valid passport & visa

- Emirates ID, if you are UAE resident

- current phone number

- physical address for correspondence between Buyer and Developer

Only SERVICE CHARGES, once in a year, are mandatory.

Their size will depends on kind of property, its location and quality segment.

For example, owning a villa or townhouse, service charges range will be about 3-4 AED/sqft, multiplied on the owning area.

For an apartment, you have higher Service Charges, as you have amenities and infrastructure and services included inside your building.

For a standard building, in a “calm area”, SC could be around 14-16 AED/sqft. Standard building in Downtown will have about 21-25 AED/sqft.

Premium branded building with plenture of amenities will cost you more. 70 AED/sqft in Burj Khalifa, for example. Record as for now is 100 AED/sqft in Four Season Residences.

! ZERO TAXES ! for owning a property in Dubai.

Selling your property, you won’t incur any taxes either.

Additionally, if you rent out the property, all income will be entirely yours.

Normally after 40-50% of payments with big developers.

Small developers are more flexible. Most of them will ask you to cover 40%, but it’s possible to find good options with just 30% requested till NOC (Non Objection Certificate). And some rear developer could agree with reselling after 20% (almost immediately after purchasing). Condition for reselling is mentioned in SPA.

Any resell of property in Dubai, even if a project is still under construction, is going through procedure of Secondary Purchase, which has some necessary steps and mandatory structure to follow.

PROCESS of Transfer:

- Form A, Form B, Form A2A, listings…/Your agent will take care of it, no worries/

- Statement Of Account from Developer

- Preparation of MOU (electronic online Form F)

- MOU registration online (approved by both parties) and 10% Security Deposit collected from Buyer

- Application and Issuance of NOC by the Developer/Community Management

- Transferring at Trustee office.

Additional Process (Mortgage Seller):

- Property Blocking

- Seller Mortgage release document

Additional Process (Mortgage Buyer):

- Buyer’s Bank Offer Letter

- Valuation of Property

- Bank to Bank Clearance of Mortgage

- Property Blocking (if applicable or internal bank to bank)

SELLER Documents:

- Passport, Visa

- Emirates ID (if resident)

- Title Deed (Completed Property)

- Sales and Purchase Agreement & Oqood (Off plan)

- Pre-Title Deed (Property is completed but payments with the Developer are still due)

- Attested POA Document – Passport, Visa and Emirates ID (if applicable).

- Seller’s Security Deposit (if applicable)

- Liability Letter from Seller addressed to Dubai Land Department (Original document in ARABIC – ONLY required for Mortgage Sellers)

- NOC Application from Developer (requiring Service Charge Clearance and Receipts in case of ready property)

- Clearance of Utility Bill provided by Seller (DEWA, Empower), Service Charge Statement, Ejari/Tenancy Contract (if rented), Inventory list (if furnished) – in case of ready property

BUYER Documents:

- Passport, Visa and Emirates ID

- Pre-approval copy from bank (if mortgage buyer)

- POA Document and POA’s Passport, Visa and Emirates ID (if applicable)

- Buyer’s Security Deposit 10% from selling price.

Documents Required if either Seller or Buyer is a COMPANY:

- Trade License.

- Articles of Association / Memorandum of Association.

- Incumbency (valid of 6 months).

- Board of Directors/Shares Certificate.

- Certificate of Incorporation and Good Standing.

- Shareholder(s) passport, visa, and Emirates ID.

- Attested POA Document and POA’s Passport, Visa and Emirates ID (or Assigned Signatory).

- NOC from Freezone (only for buying).

- Company Stamp.

Final Handover from Seller:

- Proof of DEWA Clearance/Final Settlement.

- DU/Etisalat Final Settlement.

- District Cooling/Gas Connections and Utility Documents.

- Release Mortgage Letter (unblocking date).

- Pro-rata rent refund and security deposit to Buyer, if applicable.

- Keys and Access Cards.

- Contact Property Management.

Yes – there are a few fees that you’ll be expected to pay, including:

DLD registration fee – Both off-plan and ready property buyers will need to pay a 4% registration fee to the Dubai Land Department. Some developers cover part or the full 4% as an incentive to purchase. + knowledge fee, AED 40.

Transfer fee – applies only on reselling, payable at Trustee office. AED 5,250 +VAT for transferring off-plan property. AED +VAT for a ready property transfer.

Agency fee – 2% + VAT from the purchasing price. Applies only on resell.

Community service fee or maintenance charge – Based on the RERA service and maintenance index, these fees are charged on a per sq.ft basis and usually range between AED 2 to AED 30 per sq.ft depending on the area.

Mortgage registration fee – For mortgage buyers a total of 0.25% of the registered loan amount must be paid to the Dubai Land Department, apart of fees of your bank for PreApproval, Approval and registration of the mortgage.

Conveyancing fee – Applies on reselling, about AED 5,000 + VAT

Banks of UAE are offering mortgage only to cover a price of a READY property.

For residents a mortgage size is covering up to 80% of the property purchase amount, for non residents – up to 50%.

There are several conditions, important for receiving a Mortgage. In general, it’s easier when you are an employee with a salary over 15k AED and you can prove it with your bank statement for the last half-year.

But with Off-plan properties, you don’t need to pay upfront all 100% of Purchasing Price. To sign SPA /Sales-Purchase agreement) is enough 20% + 4% DLD (Dubai Land Departments fees for registration). Then, during construction of the project you are following 0% interests installments of the Payment Plan from developer, transferable to a dedicated to the Project ESCROW account.

And thanks to these procedures lots of investors in Dubai are doing good money. The target is to find a good project with comfortable Payment Plan. 50/50 is already great. Even 60/40 sounds still good. 40/60 – is amazing! The smaller is the first number – the bigger is your income. And the amount of the second number you can always request a Mortgage, if you will decide to keep the property for yourself, or to rent it out.

For the clarification of current rules of this game and any other question,- you are always wellcome to have our support, contact us!

You are eligible to obtain the Golden Visa in the UAE of investor if your total investments amount to properties is above 2,000,000 AED.

Number of properties to summarize till the requested minimum, can be up to 3.

In the case of mortgaged real estate, a minimum of 2,000,000 AED of the property’s value must be paid. A Non Objection Certificate (NOC) in Arabic from your bank is required.

Joint Ownership.

If the property is co-owned by multiple individuals (relatives or non-family members), only investors with a share of at least 2,000,000 AED are eligible for the 10-year visa.

Notice, that when you will plan to sell the property, you have to cancel your visa first, as the property is blocked for transfer to another person until you are benefiting from your visa.

1.Ensure you purchase in a prime location.

When selecting holiday home investment properties, choose a prime location near all the “must-haves”, such as restaurants, cafes, shopping centers, and tourists hotspots. Proximity to the beach and a sea views makes a big difference when it comes to success with a holiday letting.

2.Choose the size of the unit

Since many holiday apartments are build for short term rentals, they have smaller layouts. While studios may yield a higher rental return on the purchase price and are perfect for investment, a one-bedroom unit gives you an option to move in yourself if you will ever decide it’s time for a change of lifestyle. So ask yourself how you see yourself using this holiday home a few years from now. Will it be just for investment or for personal use?

3.Choose a professional management team

Ensure that the management of the complex you are considering has a strong track record in apartment complex management as well as a comprehensive understanding of the highly competitive holiday accommodation market.

4.Do your calculation

Holiday rentals are usually much higher than those for normal properties and increase even more in peak season. This may make the initial sums for holiday properties looks great.

However, you will need to allows for longer vacancy periods and fluctuating occupancy levels from season to season.

Also remember that every week you stay in your holiday property is a week less of rental income you will receive. And the times you would usually like to stay in your apartment will be the time that most other tourists would want to stay there too.

Dubai offers significantly higher property rental return compared to London, NY, Hong Kong and Singapore. The increasing number of tourists and also regional and global corporates who bring their executives on a short- or long-term basis to Dubai created an opportunity to look at serviced holiday homes as a lucrative income-generating asset.

Consumers today are more sophisticated, they are looking to experience the best of both worlds – the luxury and amenities of a 5* hotel in the comfort and privacy of a home. This demand represents an opportunity to tap into the market of hotel apartments and serviced branded residences, where you get a “turnkey solution”.

Many expatriates in the UAE concentrate heavily on their careers and investments, often overlooking the importance of drafting a will. In the unfortunate event of a family crisis without a clear will, all accumulated assets and wealth might be distributed inappropriately or unevenly. Moreover, your children could be entrusted to caregivers you would not have considered reliable or appropriate.

In general, any questions about inheritance in the UAE are governed by Sharia law. In order to guarantee that guardianship and all property and assets are protected according to their wishes, expats should register their will either with the Dubai Courts Public Notary, the Abu Dhabi Judicial Department (ADJD) Registry of Wills or the DIFC Courts Wills Service Center.

Having an official Will allows non-Muslim expats to circumvent Sharia law and choose their own heirs and guardians for minors. It is important that the will be officially registered in the UAE, and as long as it is, then the issue of inheritance becomes quite simple.

Making a Will is crucial if:

- You have children under 21 years of age. You can appoint legal guardians for minors in the will.

- You wish to divide up real estate assets amongst the heirs of your choice.

- You wish to divide up assets amongst other beneficiaries.

If a Will is not written:

If a last will and testament has not been written, upon the death of the individual, property in the UAE is distributed in accordance with the local law of inheritance. The succession of heirs and the amount they are to receive is based on the principles of Sharia law.

All assets of the deceased located in the territory of the UAE will be frozen until the court decides how the inheritance will be distributed amongst the beneficiaries. This process can take several months, but if any disputes arise, it could even take years to resolve the issues.

In order to prove your relationship with the deceased, any and all documents must be translated into Arabic and legalized. The court proceedings also take place in Arabic and only a lawyer can represent you in court, you can not represent yourself. The costs for an attorney start at AED 75K (USD 20.4K).

If the Will was written outside of the UAE:

If the will and testament was written and registered outside of the UAE, you must first submit the inheritance documents in the country where the will was made. Then, all documents must be translated into Arabic and legalized by the consulate. Only after these steps have been taken and relationship status has been proven can you submit everything to the court in the UAE.

This process can take up to six months. Court proceedings are done only in Arabic and you must have a lawyer there for legal representation.

This representation starts at AED 40K (USD 10.8K).

WHERE to REGISTER a WILL in the UAE:

- DIFC Courts Wills Service Center.

There are four types of wills that can be registered at DIFC:

- a full Will and testament – the distribution of wealth and assets can be specified how and to whom, and a guardian for children can be appointed;

- a Will of assets;

- a Will specifying guardianship for minors;

- a business Will – the distribution of the business or company shares can be specified how and to whom.

Inheritance laws in the UAE are based on Sharia law, which mandates the distribution of assets in fixed shares. The DIFC allows non-muslims to circumvent these rules in accordance with Emirati laws and the British legal system.

A Will that is registered with the DIFC Courts Wills Service will be carried out in the UAE without additional administrative procedures or appearing in court. The Will is saved in a protected folder for 120 years from the date of birth of the testator.

The process of registering the Will is done in English and can even be done remotely through a video conference. This service is available to residents and non-resident citizens alike. Spouses can also make a mirror will.

/The cost of registering a will starts from AED 10K (USD 2.1K).

Legal support from AED 6K (USD 1.7K)/.

- Dubai Courts Public Notary

The Dubai court can certify the wills of both Muslims and non-Muslims. This covers all assets and property located in any and all of the seven emirates of the UAE. A notary public is also able to register guardianship for minors. The testator can appoint either temporary or permanent guardianship in the event of death of both parents.

If the original Will was written in another language other than Arabic, it must be translated by a sworn translator. The document will then be registered by the notary in Arabic or in both languages.

The testator must be physically present to register a guardianship Will.

/The cost for this service starts from AED 3.5K (USD 960).

Legal support from AED 2K (USD 550)/.

- Abu Dhabi Judicial Department

The Abu Dhabi Judicial Department (ADJD) Registry of Wills operates in accordance with the laws of the emirates, in the jurisdiction of civil law. It is a special registry for non-Muslim immigrants, administered in the local courts of Abu Dhabi and conducted in Arabic. A will registered in the ADJD covers all assets and property in all seven emirates of the UAE.

Upon registering a Will in the ADJD, UAE Sharia law will no longer apply: a non-Muslim can divide up their assets to anyone, in any way they so choose. This document can also appoint guardianship for minors.

If the Will was not written in Arabic, it must be translated by a sworn translator. The will can then be registered in the ADJD Registry of Wills in Arabic or both languages.

/The cost for this service starts from AED 3.5K (USD 960).

Legal support from AED 2K (USD 550)/.

*Wills and questions of inheritance are regulated by the following UAE laws:

Federal Law No. 28 of 2005 on Personal Status.

Federal Law No. 05 of 1985 on Civil Code.

If you’re planning to invest in Dubai property, AML laws aren’t just legal technicalities — they’re essential protection for your capital.

In recent years, the UAE has taken aggressive steps to combat money laundering and financial crime, especially in the real estate sector. These laws not only help clean up the market, they make Dubai one of the most secure places in the world to invest — if you’re on the right side of compliance.

What Is AML and Why Does It Matter in Dubai?

Anti-Money Laundering (AML) refers to the legal framework that prevents illegal money from being disguised as legitimate income. Real estate is one of the most common tools for money laundering globally, due to the high-value nature of transactions and the ease of holding assets.

In 2018, the UAE introduced Federal Decree-Law No. 20, followed by Cabinet Decision No. 10 and specific real estate AML regulations in 2022. These laws require full transparency for anyone purchasing property — especially with cash, crypto, or via companies.

⚖️ What Are the Penalties?

AML violations in the UAE come with serious consequences:

Individuals: 5–10 years imprisonment + fines between AED 100,000 and AED 5 million

Companies: Up to AED 50 million in fines

Additional measures: Asset seizure, license suspension, public blacklisting, and criminal liability

📜 Under UAE law:

➡️ Up to 10 years in prison

➡️ Fines up to AED 50 million

➡️ Confiscation of assets

➡️ License cancellations for companies

Laws:

2018: Federal Decree-Law No. 20 — criminalized laundering with 5–10 year prison sentences.

2019: Cabinet Decision No. 10 — added inspections, penalties, and agent responsibilities.

2022: Real estate guidance — all cash deals above AED 55,000 require source-of-funds verification and reporting to the goAML system.

2023–2025: Fines, seizures, global cooperation with FATF, Interpol, and financial crime units.

Real Cases That Show AML in Action

Here are 4 recent examples that show just how seriously the UAE takes compliance:

🧨 1. The Bahloul Gang (2025)

A criminal syndicate laundered funds through real estate and gold purchases.

✅ 18 members sentenced to life

✅ Fines of AED 1 million per person

✅ Properties and assets seized

💻 2. Operation Destabilise

A crypto-based laundering network linked to Russian oligarchs used Dubai real estate to move billions.

✅ International investigation

✅ Asset seizures and blacklisting

✅ Ongoing enforcement across multiple jurisdictions

🏠 3. The Prison Property Scheme

UK fraudster Imtiaz Khoda bought £3.6 million worth of Dubai real estate — while serving time in the UK.

✅ Assets are now frozen

✅ Ongoing cooperation between UAE and UK authorities

🏢 4. Brokerage Fined AED 1.2 Million

One Dubai agency failed to report an AED 3.5M cash purchase — no UBO disclosure, no goAML filing.

✅ Massive fine

✅ Compliance failure listed publicly

📋 What You Need to Stay Compliant

If you’re an honest investor, compliance is simple — and it protects your deal.

✅ Provide your passport and visa

✅ Declare your source of funds (salary, business, crypto, etc.)

✅ Use licensed agents and developers

✅ Avoid third-party payments

✅ Declare beneficial owners if using a company

✅ Crypto records if relevant

Final Thoughts: AML is Good News for Serious Investors

While the process may seem strict at first, it’s ultimately designed to protect your capital, stabilize the market, and increase global investor trust in Dubai.

Want to make sure your investment is fully compliant?

📥 Download our free AML Investor Checklist

Contact us for a secure property consultation

💻 Cryptocurrency is no longer just for tech insiders — it’s now a growing payment method for real estate investors in Dubai.

But while buying property with crypto in the UAE is possible, it must be done through the right legal and regulatory channels to avoid risk.

In this article, we’ll walk you through the safe and compliant way to invest in Dubai real estate using crypto, including all documents, risks to avoid, and tips to protect your capital.

🪙 Can You Buy Real Estate with Crypto in Dubai?

✅ Yes — but not directly.

The UAE allows property purchases funded by cryptocurrency, as long as the crypto is converted into AED (UAE dirhams) through a registered and regulated exchange.

You cannot hand over Bitcoin or Ethereum to a developer. The funds must be liquidated into fiat and processed through proper KYC/AML checks.

🔐 How to Buy Property Safely with Crypto: Step-by-Step

1. Work with a licensed real estate broker

Start by choosing an AML-compliant agency that is familiar with crypto-funded transactions. Not all agents are trained or authorized to handle this process.

2. Use a registered OTC or crypto exchange

Your crypto will need to be converted into AED through a UAE-licensed exchange. The transaction must be traceable — no peer-to-peer cash deals or unregistered wallets.

3. Complete KYC and AML checks

You’ll need to provide:

Passport and residency (if applicable)

Proof of source of funds (how and when you acquired the crypto)

Wallet history and exchange records

If applicable: Tax filings from your home country

4. Sign the SPA (Sales Purchase Agreement)

Once the AED funds are cleared and verified, you’ll proceed like any traditional buyer — including signing the SPA, submitting the down payment, and following the off-plan or handover schedule.

⚠️ What to Avoid: Red Flags & Risks

❌ Never use a broker who says “we’ll skip paperwork”

❌ Don’t use 3rd-party wallets or anonymous crypto sources

❌ Avoid large payments without a clear transaction trail

❌ Never send crypto directly to a developer’s address — it’s not legal tender

Dubai’s AML system is integrated with goAML — and every transaction can be audited.

✅ Why Crypto Investors Are Choosing Dubai

0% capital gains tax

Asset-backed investments in a stable, appreciating market

Regulatory clarity on crypto use

Growing acceptance from top-tier developers and wealth managers

📌 Final Checklist for Crypto Buyers

✔️ Use a UAE-regulated crypto exchange

✔️ Work with AML-compliant real estate professionals

✔️ Have documentation for all crypto-related income

✔️ Declare all sources honestly and in advance

✔️ Convert crypto to AED before completing the transaction

💼 Want help securing a premium property in Dubai using crypto — safely and legally?

📩 Contact our team today or download your free Crypto Investor Checklist below.

AI is transforming real estate by streamlining processes like property searches, valuations, and market research. However, it cannot replace the human expertise and local knowledge that agents bring.

Real estate is more than data—it’s about relationships, trust, and creating a seamless journey for buyers and investors, something AI simply cannot replicate. The success of top developers in Dubai often hinges on their ability to deliver a personalised and human-centered experience.

While AI can make anyone seem knowledgeable, it also emphasises the need for buyers, sellers, and landlords to be more discerning. The role of skilled agents becomes even more vital in navigating the market with authentic insights and expertise. AI may assist, but the human touch will remain essential in ensuring successful transactions.

Timing is a crucial point at investments into highly dynamic market of Dubai.

Just to keep it in your mind, when we will find a good option, you might have a couple of hours or a day maximum to take a decision.

It might sounds stressful and pushy, but that’s reality of the local market.

At hot launches in premium locations by famous developers you don’t have time at all. Sometimes you don’t have even a chance to book a unit. First of all you have to go through the barrier of getting access to allocation. It’s almost a Blessing to get an allocation & secure a Unit last years, as we are facing really high demand.

So, just to prepare you for that, guys, do as much preparation as possible in advance, but when it comes time when Units are released, we either need submit an EOI in advance, so we will have priority on allocation with possibility to choose the type of preferred layout, view, floor level), or act fast at time of launch.

Knowledge is power and Dubai investment success goes to those who really understand the market which is strongly influenced by a variety of factors such as economic conditions, government policies, and global events.

Keep an eye on industry market reports, property price indices, and keep in touch with an expert to stay updated on market dynamics. This knowledge will help you identify the best times to buy or sell property, ensuring you maximise your returns.