DISTRICT 11

MEYDAN

BEST OF LAUNCHED:

KARL LAGHERFED

Mansions and villas next to dedicated Lagoon. Av.Starting PRICE: 2'000 AED/sqft, Available SIZEs from 11'345 sqft in 6-br villa, PP: 60/40, HO: Q3 2027

MIRA, BENTLEY HOME

Av.Starting PRICE: 3'450 AED/sqft, Available SIZEs from 7'212 sqft in 5-BR villa, HO: Q1 2026, PP: 50/50

WADI VILLAS

Av.Starting PRICE: 2'250 AED/sqft, Available SIZEs from 6'545 sqft in 4-BR, HO: Q4 2026, PP: 60/40

Meydan District 11, nestled within Mohammed Bin Rashid City (MBR City), stands out as a compelling investment destination in Dubai’s real estate landscape. Here’s an in-depth analysis of its investment potential, highlighting both advantages and considerations.

Strategic Location & Connectivity

Situated at the intersection of Sheikh Mohammed Bin Zayed Road and Dubai-Al Ain Road, District 11 offers seamless access to key areas:

Downtown Dubai: Approximately 10–15 minutes drive

Dubai International Airport (DXB): Around 15–20 minutes drive

Business Bay & Dubai Creek Harbour: Within 15 minutes

This prime positioning enhances its appeal to both residents and investors seeking convenience and accessibility.

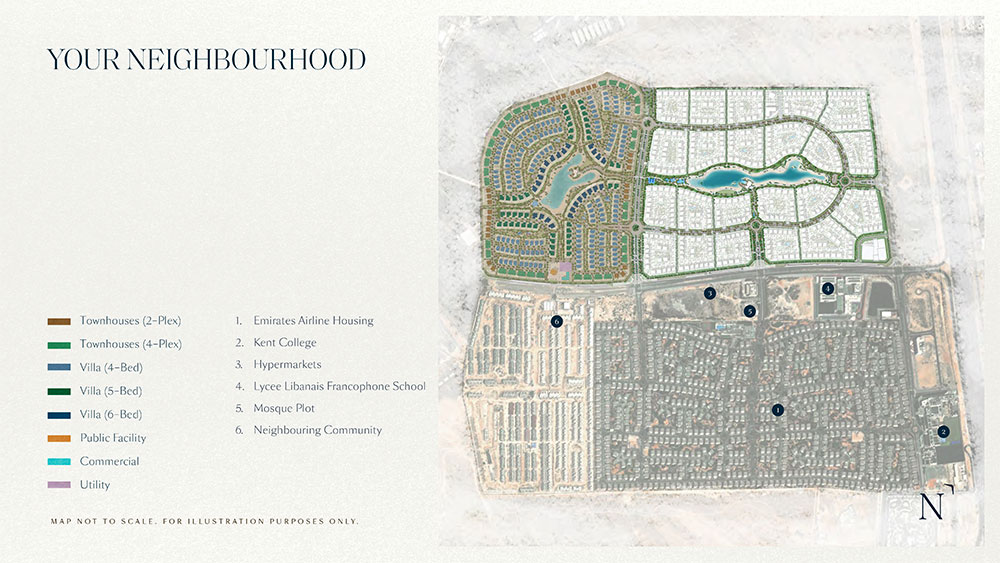

Residential Offerings & Lifestyle

District 11 boasts a diverse range of residential options, including:

Villas & Townhouses: Notable projects like Opal Gardens, Knightsbridge, and The Sanctuary offer luxurious living spaces.

Apartments: Developments such as Samana Rome 3 and Woodland Crest cater to varied preferences.

The community emphasizes a family-friendly environment, featuring:

Green Spaces: Parks, jogging tracks, and landscaped areas.

Amenities: Retail outlets, nurseries, mosques, and health clubs

These elements contribute to a tranquil yet connected lifestyle.

Investment Potential

Pros:

Freehold Ownership: Available to both local and foreign investors.

Tax Benefits: Dubai offers zero property tax, no capital gains tax, and no rental income tax, enhancing net returns.

Capital Appreciation: The area’s ongoing development and strategic location suggest strong appreciation prospects.

Rental Yields: Reports indicate average returns between 5.1% and 5.7% for 1–3 bedroom units.

Cons:

Ongoing Development: Some areas are still under construction, which might affect immediate occupancy or rental opportunities.

Public Transportation: Currently limited, though future infrastructure plans aim to address this.

Summary

| Aspect | Details |

|---|---|

| Location | Prime access to major Dubai landmarks |

| Property Types | Villas, townhouses, and apartments |

| Ownership | Freehold for all nationalities |

| Taxation | No property, capital gains, or rental income tax |

| Rental Yields | Approximately 5.1%–5.7% for 1–3 bedroom units |

| Development Status | Mix of completed and under-construction projects |

| Transportation | Limited public transport; future enhancements planned |

Conclusion:

Meydan District 11 presents a balanced investment opportunity, combining strategic location, diverse property offerings, and favorable economic conditions. While some infrastructural elements are still evolving, the area’s potential for capital appreciation and rental income makes it a noteworthy consideration for investors seeking medium to long-term gains.

If you require further details on specific projects, ROI calculators, or comparative analyses with other Dubai districts, feel free to ask.