BUSINESS BAY

Urban Oasis, Dubais Thriving Hub

Business Bay stands out with its unique blend of modern architecture, urban planning, and commercial buildings with offices. Prime commercial and residential district in Dubai, goes around Downtown, attracting global businesses and investors. Divided on two parts by Water Canal, offering pedestrian-friendly spaces and water features, creating a harmonious environment for both residents and visitors.

BEST OF LATEST LAUNCHES

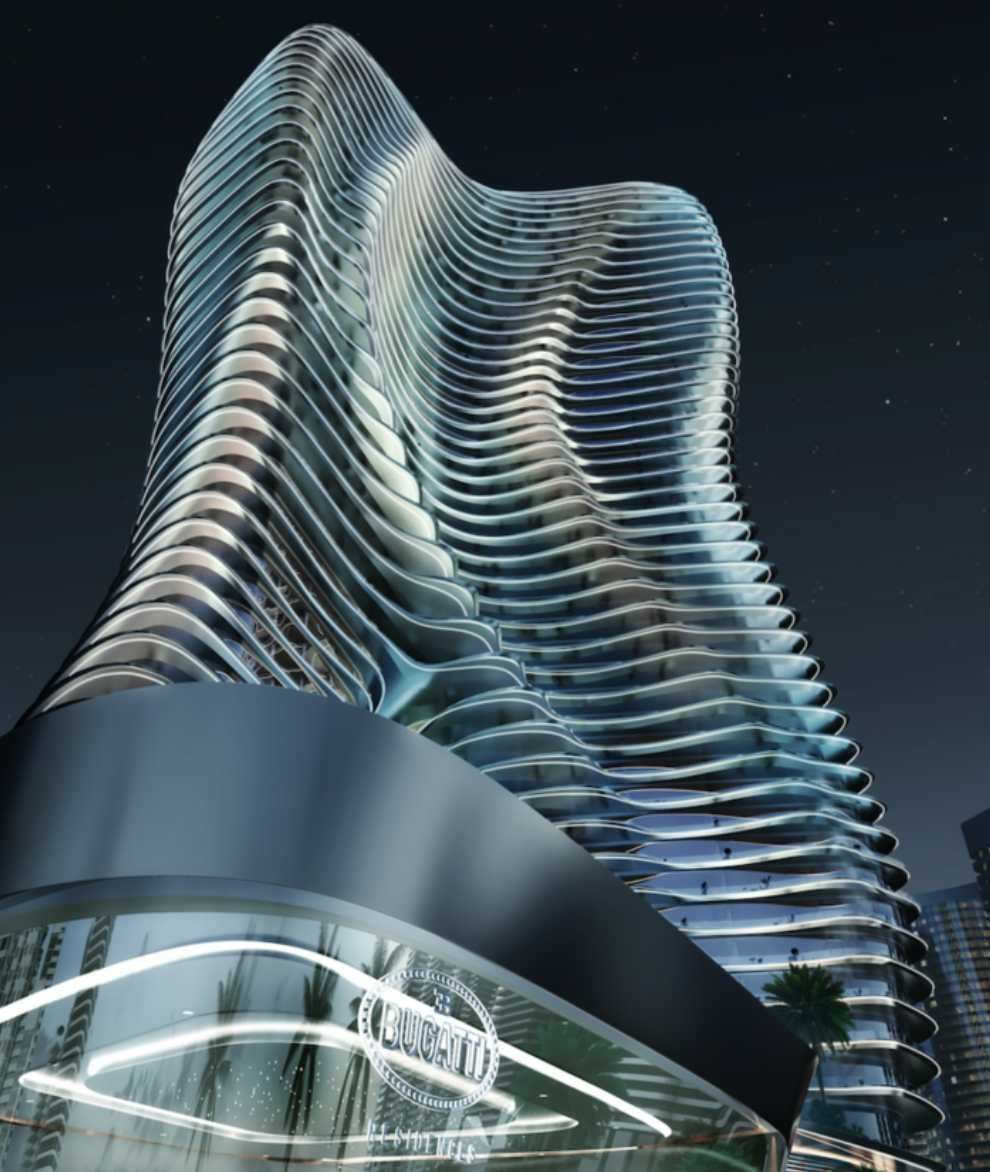

BUGATTI

Av.starting PRICE: 9'500 AED/sqft, Remaining SIZES from: 2'018 sqft in 2-Br, Handover: Q4 2025, PP: 70/30. Number of Units:182

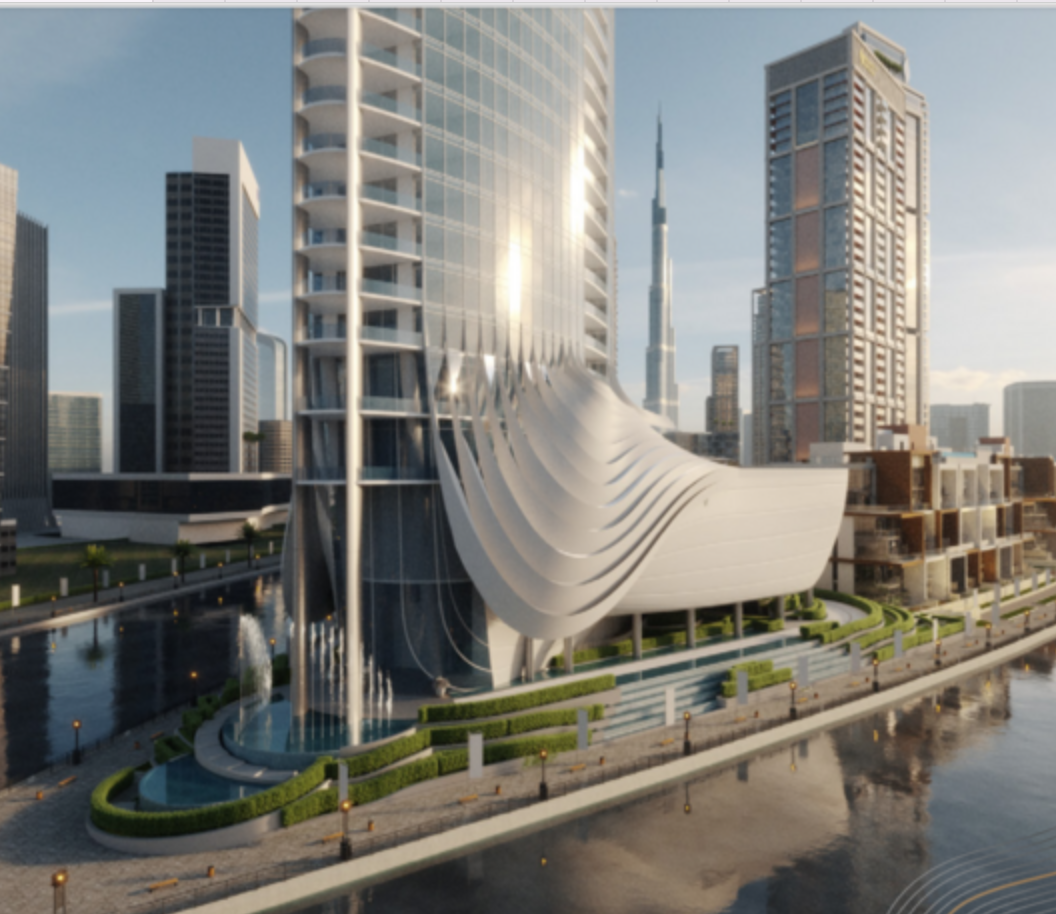

VELA & VELA VIENTO

Av.starting PRICE: 6'500 AED/sqft, Remaining SIZES from: 2'700 sqft in 2-Br, Handover: Q3 2026, PP: 60/40, Number of Units: 40 (Vela), 97 (Vela Vento)

REGENT Residences. SANKARI Place

Av.starting PRICE: 5'600 AED/sqft, SIZES from: 7'000 sqft in 3 -Br, Handover: Q4 2027, PP: 50/50, Number of Units: 63 in 2 towers

ENARA - commercial, AAA class

PREMIUM class OFFICES with private members club and a la carte services. Av.starting PRICE: 5'500 AED/sqft Handover: Q1 2028, PP: 70/30. Number of offices: 23.

OPUS by ZAHA HADID

Ready Project. 0nly 3 Residential floors. The rest: Retail, Offices, Hotel.

WALDORF ASTORIA RESIDENCES

Av.starting PRICE: 6'400 AED/sqft, SIZES from: 2'186 sqft in 2-Br, Expected Handover: Q4 2029, PP: 60/40. Configuration: 3B+G+4P+65. Number of Units: 146

DG1

Under construction. Available only on Secondary Market. Handover: Q2 2027, PP: 60/40, Number of Units: 224

JUMEIRAH LIVING, PENINSULA BB

-under construction. Available only on Secondary Market. Handover: Q2 2025, PP: 40/60, Number of Units: 82

EYWA

Av.starting PRICE: 3'000 AED/sqft, Remaining SIZES from: 4'200 sqft in 2-Br, Handover: Q2 2026, PP: 60/40, Number of Units: 51

CANAL CROWN & CANAL HEIGHTS

Av.starting PRICE: 2'700 AED/sqft, Remaining SIZES from: 1114 sqft in 1-Br, Handover: Q1 2027, PP: 60/40. Number of Units in 4 towers: 1191

SKYRISE

Av.starting PRICE: 3'000 AED/sqft, Remaining SIZES from: 762 sqft in 1-Br, Handover: Q4 2026, PP: 70/30, Number of Units in 3 Towers: 3'302

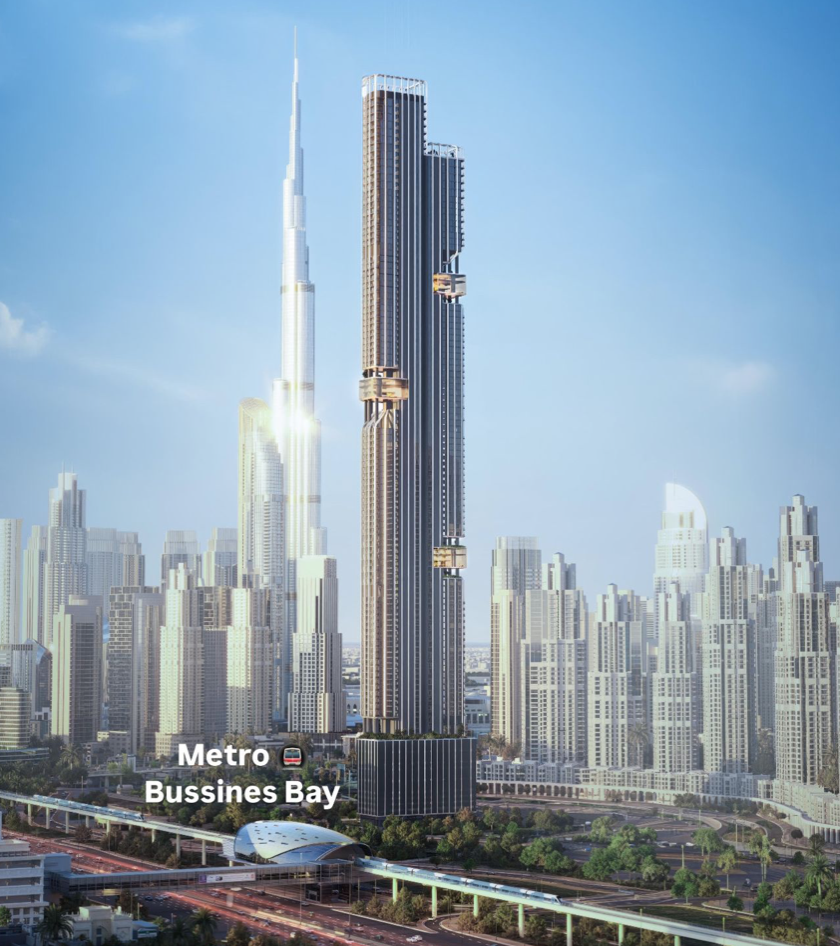

BURJ BINGHATTI BY JACOB &CO

Av.starting PRICE: 2'700 AED/sqft, Remaining SIZES from: 3'290 sqft in 2-Br, Handover: Q2 2026, PP: 60/40, Number of Units: 299

LUMENA - UltraLuxury Commercial Towers

Commercial Tower Grade AAA. Av.starting PRICE: 4'750 AED/sqft, SIZES from: 4'268 sqft. 91 offices (582'184 sqft) +44'605 sqft of Retail space +63'155 sqft of Amenities. 1'000+ parking slots. Next to Metro (!). HO:2030. PP:50/50

LUMENA ALTA - Commercial Towers

Commercial Tower Grade AAA. Av.starting PRICE: 5'000 AED/sqft, From 20M AED. Offices + Retail spaces + Amenities. 1'000+ parking slots. Close to Metro. HO: 2030. PP: 50/50

HQ by ROVE

commercial building - Offices with amenities. Av.starting PRICE: 4'250 AED/sqft. SIZES from:624 sqft. Handover: Q1 2029, PP: 50/50.

AVARRA Residences by PALACE

Av.starting PRICE: 3'400 AED/sqft, SIZES from: 789 sqft in 1-B. HO: Q2 2031. PP: 90/10. Number of Units: 687. Next to Metro station.

SkyParks

Av.starting PRICE: 3'900 AED/sqft, SIZES from: 720 sqft in 1-Br, HO: Q4 2031. PP: 70/30. Number of Units: 493. 92 Floors.

DWTN Residences

Av.starting PRICE: 2'430 AED/sqft, SIZES from: 764 sqft in 1-Br, HO: Q4 2029. PP: 50/50. Number of Units: 432. 110 Floors (445m height)

VELOR

Av.starting PRICE: 2'850 AED/sqft, SIZES from: 2'900 sqft in 4-Br, half-floor. HO: Q4 2027. PP: 60/40. Number of Units: 29 ON 26 Floors

ELIRE managed by LUX

Av.starting PRICE: 4'550 AED/sqft, SIZES from: 734 sqft in14-Br.. HO: Q4 2028. PP: 45/55. Number of Units: 153

BURJ CAPITAL

Commercial tower Grade A++. Premium Shell & Core offices. Av.starting PRICE: 4'000 AED/sqft, SIZES from: 754 sqft. HO: Q4 2028. PP: 50/50. 3B+G+3P+26+R

HOUSE of TENET

Commercial project: Offices Grade A+. Average PRICE: 5'370 AED/sqft. SIZEs from 596 sqft. Handover: Q2 2028. Payment Plan: 50/50

BUREAU LAMAR @ Peninsula Business Bay

7 buildings (6 commercial + 1 wellness). Average PRICE: 6'000 AED/sqft. SIZEs from 6'200 sqft. Handover: Q1 2029. Payment Plan: 60/40

.

Business Bay:

The Evolving Business Heart of Dubai’s Real Estate Market.

Business Bay has long been known as Dubai’s central business district, but today, it is transforming into a luxury residential hub with some of the city’s most high-end skyscrapers, waterfront properties, and branded residences. As we move into 2025, the district is seeing a shift from a purely commercial zone to a dynamic live-work-play environment, making it an attractive proposition for investors.

Market Analysis: Growth vs. Challenges

Price Appreciation & Market Trends

Business Bay has experienced a steady 10-12% increase in property values over the past year, fueled by demand for prime locations.

High-end projects like Bugatti Residences, Opus by Zaha Hadid, Dorchester Collections, Jumeirah Living and others have redefined Business Bay’s luxury real estate landscape.

However, the area still holds a mix of mid-tier and older developments, which create price disparities within the district.

Rental Yields & Investor Appeal

With rental yields averaging 6-8%, Business Bay remains one of Dubai’s most profitable areas for landlords.

Short-term rentals and serviced apartments benefit from Business Bay’s proximity to Downtown, DIFC, and Dubai Design District, attracting professionals and corporate tenants.

The challenge? Saturation of mid-range apartments, which could impact rental demand for non-luxury units as newer, more prestigious developments enter the market.

Infrastructure & Traffic Concerns

Connectivity is a double-edged sword: while Business Bay enjoys direct access to Sheikh Zayed Road, Al Khail Road, and the Dubai Metro, ongoing development and high population density contribute to traffic congestion in peak hours.

The Dubai Water Canal and planned urban enhancements aim to improve pedestrian access and public transport options, making it more attractive for residents.

Why Ultra-Luxury Investors Should Pay Attention

Business Bay is no longer just a corporate hub—it’s becoming as well a destination for ultra-luxury living. With limited waterfront plots and branded residences entering the market, high-net-worth individuals (HNWIs) are increasingly turning to Business Bay.

Ultra-Luxury Market Surge: Business Bay is home to some of the most exclusive new developments in Dubai. Projects like The Lana Residences by Dorchester Collection and SLS Dubai Residences cater to affluent buyers seeking world-class amenities and personalized services.

Limited Supply of Branded Residences: The demand for high-end, fully serviced apartments is growing, yet supply remains constrained—offering strong potential for capital appreciation.

Waterfront & Skyline Views: Luxury penthouses and duplexes with unobstructed Burj Khalifa and canal views continue to command premium pricing, making them a lucrative long-term asset.

Final Outlook: A Strategic Investment Zone

Business Bay is evolving into a high-value luxury district while maintaining its commercial and residential appeal. Investors looking for strong returns, high rental yields, and long-term capital growth should focus on premium waterfront developments and branded residences to maximize value in this competitive market.

Interested in securing a luxury property in Business Bay? Contact us for exclusive opportunities in Dubai’s most dynamic district.